Kroger 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-23

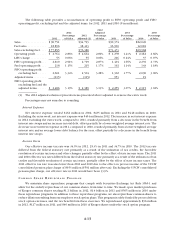

Net cash used by investing activities

Cash used by investing activities was $2.2 billion in 2012, compared to $1.9 billion in 2011 and $2.0 billion

in 2010. The amount of cash used by investing activities increased in 2012, compared to 2011, due to increased

payments for capital investments and acquisitions. The amount of cash used by investing activities decreased in

2011, compared to 2010, due to decreased payments for other investing activities, offset partially by increased

payments for acquisitions. Capital investments, including changes in construction-in-progress payables and

excluding acquisitions, were $2.1 billion in 2012, $2.0 billion in 2011 and $1.9 billion in 2010. Refer to the

Capital Investment section for an overview of our supermarket storing activity during the last three years.

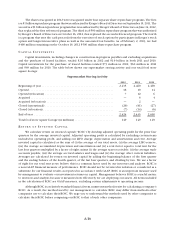

Net cash used by financing activities

Financing activities used $600 million of cash in 2012, compared to $1.4 billion in 2011 and $1.0 billion

in 2010. The decrease in the amount of cash used for financing activities in 2012, compared to 2011, was

primarily related to increased proceeds from the issuance of long-term debt and net borrowings from our

commercial paper program, offset partially by payments on long-term debt. The increase in the amount of

cash used for financing activities in 2011, compared to 2010, was primarily related to increased payments for

treasury stock purchases, partially offset by increased borrowings under our commercial paper program. We

repurchased $1.3 billion of Kroger common shares in 2012, compared to $1.5 billion in 2011 and $545 million

in 2010. We paid dividends totaling $267 million in 2012, $257 million in 2011 and $250 million in 2010.

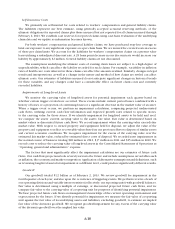

Debt Management

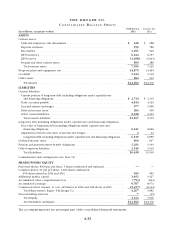

Total debt, including both the current and long-term portions of capital leases and lease-financing

obligations increased $714 million to $8.9 billion as of year-end 2012, compared to 2011. The increase in

2012, compared to 2011, resulted from increased borrowings of $1.3 billion of commercial paper supported

by our credit facility and the issuance of (i) $500 million of senior notes bearing an interest rate of 3.4% and

(ii) $350 million of senior notes bearing an interest rate of 5.0%, offset partially by payments at maturity of

(i) $491 million of senior notes bearing an interest rate of 6.75%, (ii) $346 million of senior notes bearing an

interest rate of 6.2% and (iii) $500 million of senior notes bearing an interest rate of 5.5%. This increase was

primarily due to our $258 million UFCW consolidated pension plan contribution in the fourth quarter of 2012,

prefunding $250 million of employee benefit costs at the end of 2012, our common share repurchase activity

during the year, the payment at maturity of $500 million of senior notes bearing an interest rate of 5.5% and

the purchase of a specialty pharmacy. Total debt increased $273 million to $8.2 billion as of year-end 2011,

compared to year-end 2010. The increase in 2011, compared to 2010, resulted from increased net borrowings

of commercial paper of $370 million and the issuance of $450 million of senior notes bearing an interest rate

of 2.20%, offset by the payment at maturity of our $478 million of senior notes bearing an interest rate of

6.80%.

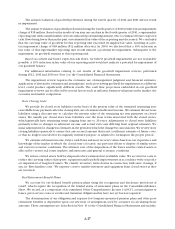

In 2013, we expect to refinance $1.5 billion of debt. We plan on refinancing our debt maturities in

2013 along with an additional issuance of approximately $500 million to replace the senior notes bearing an

interest rate of 5.5% that matured in the fourth quarter of 2012. The debt that matured in the fourth quarter of

2012 was previously refinanced with commercial paper. We have entered into $850 million notional amount

of forward starting interest rate swaps to effectively hedge the changes in future benchmark interest rates on

a portion of our expected issuances of fixed rate debt.

Liquidity Needs

We estimate our liquidity needs over the next twelve-month period to be approximately $5 billion, which

includes anticipated requirements for working capital, capital expenditures, interest payments and scheduled

principal payments of debt and commercial paper, offset by cash and temporary cash investments on hand

at the end of 2012. Based on current operating trends, we believe that cash flows from operating activities

and other sources of liquidity, including borrowings under our commercial paper program and bank credit

facility, will be adequate to meet our liquidity needs for the next twelve months and for the foreseeable future

beyond the next twelve months. We have approximately $1.6 billion of commercial paper and $1.0 billion of

senior notes maturing in the next twelve months, which is included in the $5 billion in estimated liquidity

needs. We expect to refinance this debt by issuing additional senior notes or commercial paper on favorable