Kroger 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-45

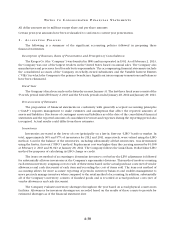

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

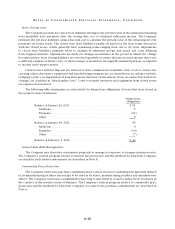

In 2012, the Company acquired an interest in one of its suppliers and all the outstanding shares of Axium

Pharmacy, a leading specialty pharmacy that provides specialized drug therapies and support services for

patients with complex medical conditions, resulting in combined additional goodwill of $96.

Testing for impairment must be performed annually, or on an interim basis upon the occurrence of

a triggering event or a change in circumstances that would more likely than not reduce the fair value of a

reporting unit below its carrying amount. The annual evaluation of goodwill performed during the fourth

quarter of 2012 and 2011 did not result in impairment.

The annual evaluation of goodwill performed during the fourth quarter of 2010 resulted in an

impairment charge of $18. Based on the results of the Company’s step one analysis in the fourth quarter of

2010, a supermarket reporting unit with a small number of stores indicated potential impairment. Due to

estimated future expected cash flows being lower than in the past, the estimated fair value of the reporting

unit decreased. Management concluded that the carrying value of goodwill for this reporting unit exceeded

its implied fair value, resulting in a pre-tax impairment charge of $18 ($12 after-tax). In 2009, the Company

disclosed that a 10% reduction in fair value of this supermarket reporting unit would indicate a potential for

impairment. Subsequent to the impairment, no goodwill remains at this reporting unit.

Based on current and future expected cash flows, the Company believes goodwill impairments are not

reasonably possible. A 10% reduction in fair value of the Company’s reporting units would not indicate a

potential for impairment of the Company’s remaining goodwill balance.

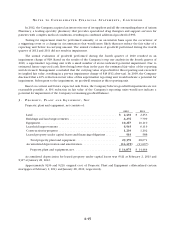

3 . P R O P E R T Y , PL A N T A N D E Q U I P M E N T , NE T

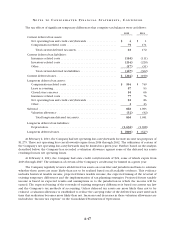

Property, plant and equipment, net consists of:

2012 2011

Land ...................................................... $ 2,450 $ 2,253

Buildings and land improvements .............................. 8,276 7,799

Equipment ................................................. 10,267 10,110

Leasehold improvements ..................................... 6,545 6,119

Construction-in-progress ..................................... 1,239 1,202

Leased property under capital leases and financing obligations ....... 593 588

Total property, plant and equipment .......................... 29,370 28,071

Accumulated depreciation and amortization ...................... (14,495) (13,607)

Property, plant and equipment, net ........................... $ 14,875 $ 14,464

Accumulated depreciation for leased property under capital leases was $321 at February 2, 2013 and

$327 at January 28, 2012.

Approximately $236 and $220, original cost, of Property, Plant and Equipment collateralized certain

mortgages at February 2, 2013 and January 28, 2012, respectively.