Kroger 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-58

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

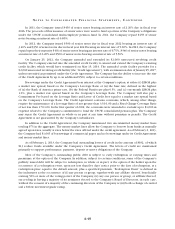

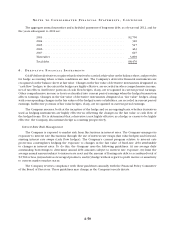

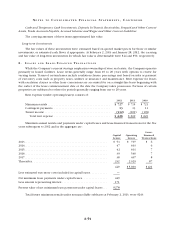

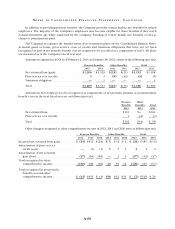

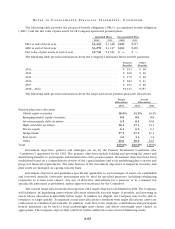

Total stock compensation recognized in 2012, 2011 and 2010 was $82, $81 and $79, respectively. Stock

option compensation recognized in 2012, 2011 and 2010 was $22, $22 and $25, respectively. Restricted shares

compensation recognized in 2012, 2011 and 2010 was $60, $59 and $54 respectively.

The total intrinsic value of options exercised was $44, $24 and $11 in 2012, 2011 and 2010, respectively.

The total amount of cash received in 2012 by the Company from the exercise of options granted under

share-based payment arrangements was $110. As of February 2, 2013, there was $96 of total unrecognized

compensation expense remaining related to non-vested share-based compensation arrangements granted

under the Company’s equity award plans. This cost is expected to be recognized over a weighted-average

period of approximately two years. The total fair value of options that vested was $23, $33 and $37 in 2012,

2011 and 2010, respectively.

Shares issued as a result of stock option exercises may be newly issued shares or reissued treasury shares.

Proceeds received from the exercise of options, and the related tax benefit, may be utilized to repurchase the

Company’s common shares under a stock repurchase program adopted by the Company’s Board of Directors.

During 2012, the Company repurchased approximately four million common shares in such a manner.

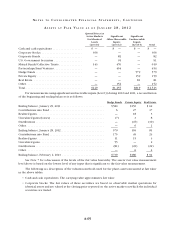

1 1 . C O M M I T M E N T S A N D C O N T I N G E N C I E S

The Company continuously evaluates contingencies based upon the best available evidence.

The Company believes that allowances for loss have been provided to the extent necessary and that its

assessment of contingencies is reasonable. To the extent that resolution of contingencies results in amounts

that vary from the Company’s estimates, future earnings will be charged or credited.

The principal contingencies are described below:

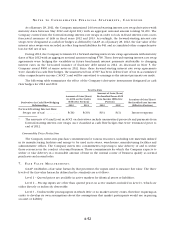

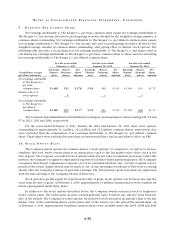

Insurance — The Company’s workers’ compensation risks are self-insured in most states. In addition,

other workers’ compensation risks and certain levels of insured general liability risks are based on retrospective

premium plans, deductible plans, and self-insured retention plans. The liability for workers’ compensation

risks is accounted for on a present value basis. Actual claim settlements and expenses incident thereto may

differ from the provisions for loss. Property risks have been underwritten by a subsidiary and are all reinsured

with unrelated insurance companies. Operating divisions and subsidiaries have paid premiums, and the

insurance subsidiary has provided loss allowances, based upon actuarially determined estimates.

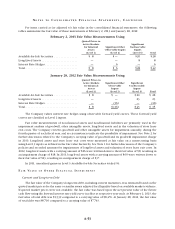

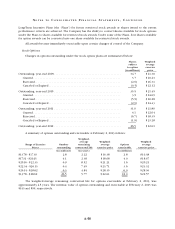

Litigation — On October 6, 2006, the Company petitioned the Tax Court (Ralphs Grocery Company

and Subsidiaries, formerly known as Ralphs Supermarkets, Inc. v. Commissioner of Internal Revenue,

Docket No. 20364-06) for a redetermination of deficiencies asserted by the Commissioner of Internal

Revenue. The dispute at issue involved a 1992 transaction in which Ralphs Holding Company acquired the

stock of Ralphs Grocery Company and made an election under Section 338(h)(10) of the Internal Revenue

Code. The Commissioner determined that the acquisition of the stock was not a purchase as defined by

Section 338(h)(3) of the Internal Revenue Code and that the acquisition therefore did not qualify for a Section

338(h)(10) election. On January 27, 2011, the Tax Court issued its opinion upholding the Company’s position

that the acquisition of the stock qualified as a purchase, granting the Company’s motion for partial summary

judgment and denying the Tax Commissioner’s motion. All remaining issues in the matter had been resolved

and the Tax Court entered its decision on May 2, 2012. On July 24, 2012, the Tax Commissioner filed a notice

with the United States Court of Appeals for the 9th Circuit to appeal the decision of the Tax Court.

Subsequent to the filing of the notice to appeal the government requested the dismissal of the case.

On November 14, 2012, the United States Court of Appeals for the 9th Circuit issued its dismissal order with

prejudice, finally resolving all issues in the matter.

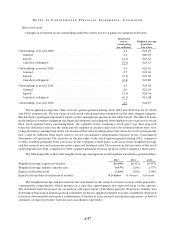

Various claims and lawsuits arising in the normal course of business, including suits charging violations

of certain antitrust, wage and hour, or civil rights laws, are pending against the Company. Some of these suits

purport or have been determined to be class actions and/or seek substantial damages. Any damages that may

be awarded in antitrust cases will be automatically trebled. Although it is not possible at this time to evaluate