Kroger 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-61

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

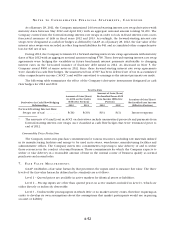

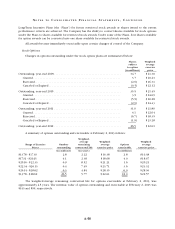

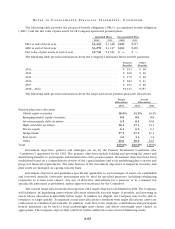

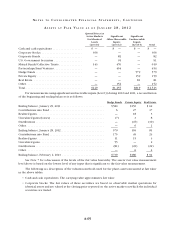

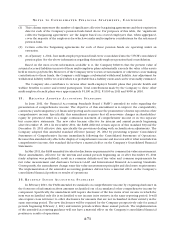

Information with respect to change in benefit obligation, change in plan assets, the funded status of

the plans recorded in the Consolidated Balance Sheets, net amounts recognized at the end of fiscal years,

weighted average assumptions and components of net periodic benefit cost follow:

Pension Benefits

Qualified Plans Non-Qualified Plan Other Benefits

2012 2011 2012 2011 2012 2011

Change in benefit obligation:

Benefit obligation at beginning of

fiscal year ................................ $3,348 $2,923 $ 217 $ 192 $ 378 $ 330

Service cost .............................. 44 41 3 3 16 13

Interest cost .............................. 146 158 9 10 16 17

Plan participants’ contributions ............... — — — — 9 9

Actuarial loss ............................. 33 344 3 21 6 32

Benefits paid ............................. (131) (122) (11) (9) (23) (23)

Other ................................... 34————

Benefit obligation at end of fiscal year ............ $3,443 $3,348 $ 221 $ 217 $ 402 $ 378

Change in plan assets:

Fair value of plan assets at beginning of

fiscal year ................................ $2,523 $2,472 $ — $ — $ — $ —

Actual return on plan assets .................. 278 117 — — — —

Employer contributions ..................... 71 52 11 9 14 14

Plan participants’ contributions ............... — — — — 9 9

Benefits paid ............................. (131) (122) (11) (9) (23) (23)

Other ................................... 54————

Fair value of plan assets at end of fiscal year ....... $2,746 $2,523 $ — $ — $ — $ —

Funded status at end of fiscal year ............... $ (697) $ (825) $ (221) $(217) $(402) $(378)

Net liability recognized at end of fiscal year ....... $ (697) $ (825) $ (221) $(217) $(402) $(378)

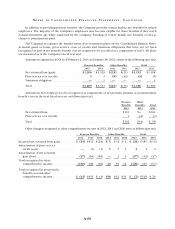

As of February 2, 2013 and January 28, 2012, other current liabilities include $29 and $27, respectively,

of net liability recognized for the above benefit plans.

As of February 2, 2013 and January 28, 2012, pension plan assets do not include common shares of The

Kroger Co.

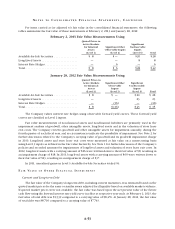

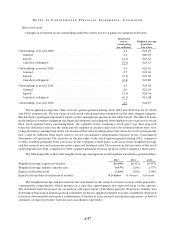

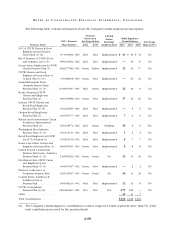

Pension Benefits Other Benefits

Weighted average assumptions 2012 2011 2010 2012 2011 2010

Discount rate – Benefit obligation ............... 4.29% 4.55% 5.60% 4.11% 4.40% 5.40%

Discount rate – Net periodic benefit cost ......... 4.55% 5.60% 6.00% 4.40% 5.40% 5.80%

Expected return on plan assets ................. 8.50% 8.50% 8.50%

Rate of compensation increase –

Net periodic benefit cost .................... 2.82% 2.88% 2.92%

Rate of compensation increase –

Benefit Obligation ......................... 2.77% 2.82% 2.88%

The Company’s discount rate assumptions were intended to reflect the rates at which the pension benefits

could be effectively settled. They take into account the timing and amount of benefits that would be available

under the plans. The Company’s policy for selecting the discount rates as of year-end 2012 changed from the

policy as of year-end 2011 and 2010. In 2012, the Company’s policy was to match the plan’s cash flows to that

of a hypothetical bond portfolio whose cash flow from coupons and maturities match the plan’s projected