Kroger 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

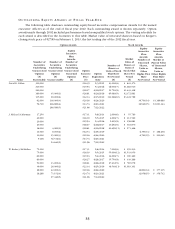

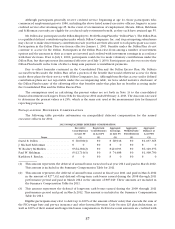

EX E C U T I V E C O M P E N S A T I O N

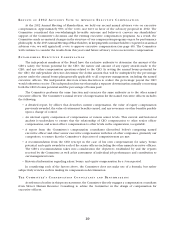

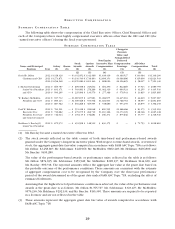

SU M M A R Y C O M P E N S A T I O N T A B L E

The following table shows the compensation of the Chief Executive Officer, Chief Financial Officer and

eachoftheCompany’sthreemosthighlycompensatedexecutiveofficersotherthantheCEOandCFO(the

“namedexecutiveofficers”)duringthefiscalyearspresented:

SU M M A R Y C O M P E N S A T I O N T A B L E

Name and Principal

Position Year

Salary

($)

Bonus

($)

Stock

Awards

($)

Option

Awards

($)

Non-Equity

Incentive Plan

Compensation

($)

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($)

All Other

Compensation

($)

Total

($)

(2) (3) (4) (5) (6)

David B. Dillon 2012 $1,328,320 — $3,332,852 $1,342,088 $1,619,419 $3,380,527 $143,084 $11,146,290

Chairman and CEO 2011 $1,273,871 — $3,130,540 $1,716,693 $2,699,153 $3,088,686 $115,600 $12,024,543

2010 $1,256,548 — $2,070,880 $1,201,240 $ 808,020 $2,156,625 $ 58,027 $ 7,551,340

J.MichaelSchlotman 2012 $ 669,787 — $ 609,908 $ 245,602 $ 604,250 $ 822,669 $ 37,543 $ 2,989,759

Senior Vice President 2011 $ 631,371 — $ 503,801 $ 276,269 $1,002,310 $ 990,524 $ 31,255 $ 3,435,530

and CFO 2010 $ 590,295 — $ 225,096 $ 130,570 $ 277,368 $ 578,541 $ 13,815 $ 1,815,685

W.RodneyMcMullen 2012 $ 937,732 — $1,087,655 $ 437,983 $1,084,975 $1,415,003 $ 44,619 $ 5,007,967

President and COO 2011 $ 899,113 — $1,009,368 $ 553,506 $1,821,903 $1,768,792 $ 38,957 $ 6,091,639

2010 $ 887,562 — $ 630,268 $ 365,595 $ 538,680 $ 953,159 $ 20,875 $ 3,396,139

Paul W. Heldman 2012 $ 761,501 — $ 551,418 $ 222,048 $ 650,595 $1,266,466 $ 83,175 $ 3,535,203

Executive Vice 2011 $ 730,682 — $ 479,075 $ 262,710 $1,110,126 $1,374,309 $ 68,346 $ 4,025,248

President, Secretary 2010 $ 716,044 — $ 270,115 $ 156,684 $ 296,274 $ 875,646 $ 33,777 $ 2,348,540

andGeneralCounsel

Kathleen S. Barclay(1) 2012 $ 675,972 — $ 491,998 $ 148,512 $ 630,375 $ — $ 71,753 $ 2,018,610

Senior Vice President

(1) Ms.Barclaybecameanamedexecutiveofficerin2012.

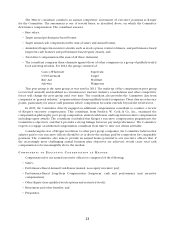

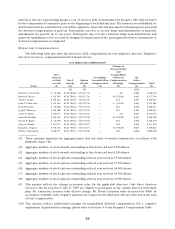

(2) The stock awards reflected in the table consist of both time-based and performance-based awards

granted under the Company’s long-term incentive plans. With respect to time-based awards, or restricted

stock,theaggregategrantdatefairvaluecomputedinaccordancewithFASBASCTopic718isasfollows:

Mr.Dillon:$2,458,817;Mr.Schlotman:$449,960;Mr.McMullen:$802,418;Mr.Heldman:$406,809,and

Ms.Barclay:$395,280.

Thevalueoftheperformance-basedawards,orperformanceunits,reflectedinthetableisasfollows:

Mr.Dillon:$874,035;Mr.Schlotman:$159,948;Mr.McMullen:$285,237;Mr.Heldman:$144,609;and

Ms.Barclay:$96,718.Thereportedamountsreflecttheaggregatefairvalueatthegrantdatebasedon

the probable outcome of the performance conditions. These amounts are consistent with the estimate

of aggregate compensation cost to be recognized by the Company over the three-year performance

period of the award determined as of the grant date under FASB ASC Topic 718, excluding the effect of

estimated forfeitures.

Assuming that the highest level of performance conditions is achieved, the value of the performance unit

awardsatthegrantdateisasfollows:Mr.Dillon$1,765,727;Mr.Schlotman:$323,127;Mr.McMullen:

$576,236;Mr.Heldman:$292,139,andMs.Barclay:$195,390.Theseamountsarerequiredtobereported

in a footnote and are not reflected in the table.

(3) Theseamountsrepresenttheaggregategrantdatefairvalueofawardscomputedinaccordancewith

FASB ASC Topic 718.