Kroger 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-4

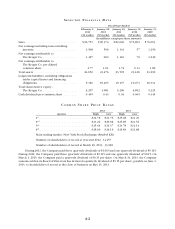

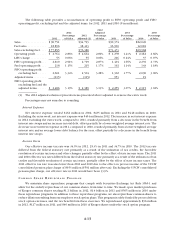

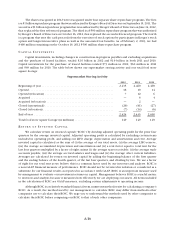

IS S U E R P U R C H A S E S O F E Q U I T Y S E C U R I T I E S

Period (1)

Total Number

of Shares

Purchased

Average

Price Paid

Per Share

Total Number of

Shares

Purchased as

Part of Publicly

Announced

Plans or

Programs (2)

Maximum Dollar

Value of Shares

that May Yet Be

Purchased Under

the Plans or

Programs (3)

(in millions)

First period - four weeks . . . . . . . . . . . . . . . . . . .

November 4, 2012 to December 1, 2012 . . . . . . 950,000 $24.80 950,000 $483

Second period - four weeks . . . . . . . . . . . . . . . .

December 2, 2012 to December 29, 2012 . . . . . 608,832 $26.43 608,832 $475

Third period – five weeks . . . . . . . . . . . . . . . . . .

December 30, 2012 to February 2, 2013 . . . . . . 690,343 $25.95 690,343 $466

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,249,175 $25.59 2,249,175 $466

(1) The fourth quarter of 2012 contained two 28-day periods and one 35-day period.

(2) Shares were repurchased under (i) a $500 million share repurchase program, authorized by the Board

of Directors and announced on October 16, 2012 and (ii) a program announced on December 6, 1999 to

repurchase common shares to reduce dilution resulting from our employee stock option and long-term

incentive plans, which program is limited to proceeds received from exercises of stock options and

the tax benefits associated therewith. The programs have no expiration date but may be terminated by

the Board of Directors at any time. Total shares purchased include shares that were surrendered to the

Company by participants under the Company’s long-term incentive plans to pay for taxes on restricted

stock awards.

(3) The amounts shown in this column reflect amounts remaining under the $500 million share repurchase

program referenced in clause (i) of Note 2 above. Amounts to be invested under the program utilizing

option exercise proceeds are dependent upon option exercise activity.

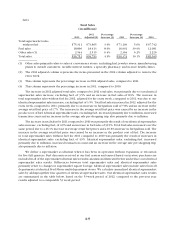

BU S I N E S S

The Kroger Co. (the “Company”) was founded in 1883 and incorporated in 1902. As of February 2, 2013,

the Company was one of the largest retailers in the world based on annual sales. The Company also

manufactures and processes some of the food for sale in its supermarkets. The Company’s principal executive

offices are located at 1014 Vine Street, Cincinnati, Ohio 45202, and its telephone number is (513) 762-4000.

The Company maintains a web site (www.thekrogerco.com) that includes additional information about the

Company. The Company makes available through its web site, free of charge, its annual reports on Form 10-K,

its quarterly reports on Form 10-Q, its current reports on Form 8-K and its interactive data files, including

amendments. These forms are available as soon as reasonably practicable after the Company has filed them

with, or furnished them electronically to, the SEC.

The Company’s revenues are earned and cash is generated as consumer products are sold to customers in

its stores. The Company earns income predominantly by selling products at price levels that produce revenues

in excess of its costs to make these products available to its customers. Such costs include procurement and

distribution costs, facility occupancy and operational costs, and overhead expenses. The Company’s fiscal

year ends on the Saturday closest to January 31.

EM P L O Y E E S

As of February 2, 2013, the Company employed approximately 343,000 full- and part-time employees.

A majority of the Company’s employees are covered by collective bargaining agreements negotiated with

local unions affiliated with one of several different international unions. There are approximately 300 such

agreements, usually with terms of three to five years.