Kroger 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-60

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

In addition to providing pension benefits, the Company provides certain health care benefits for retired

employees. The majority of the Company’s employees may become eligible for these benefits if they reach

normal retirement age while employed by the Company. Funding of retiree health care benefits occurs as

claims or premiums are paid.

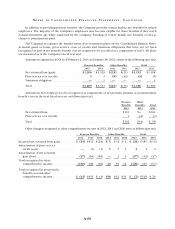

The Company recognizes the funded status of its retirement plans on the Consolidated Balance Sheet.

Actuarial gains or losses, prior service costs or credits and transition obligations that have not yet been

recognized as part of net periodic benefit cost are required to be recorded as a component of AOCI. All plans

are measured as of the Company’s fiscal year end.

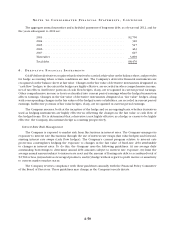

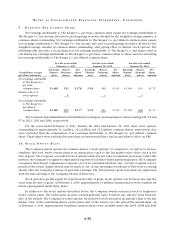

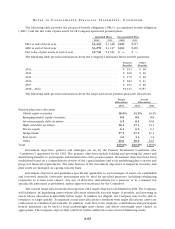

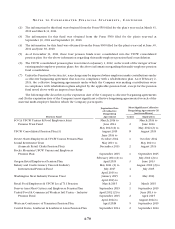

Amounts recognized in AOCI as of February 2, 2013 and January 28, 2012 consist of the following (pre-tax):

Pension Benefits Other Benefits Total

2012 2011 2012 2011 2012 2011

Net actuarial loss (gain) . . . . . . . . . . . . . . $1,206 $1,329 $(15) $(21) $1,191 $1,308

Prior service cost (credit) . . . . . . . . . . . . . 33(8) (12) (5) (9)

Transition obligation . . . . . . . . . . . . . . . . . —1———1

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,209 $1,333 $(23) $(33) $1,186 $1,300

Amounts in AOCI expected to be recognized as components of net periodic pension or postretirement

benefit costs in the next fiscal year are as follows (pre-tax):

Pension

Benefits

Other

Benefits Total

2013 2013 2013

Net actuarial loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $101 $— $101

Prior service cost (credit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 (4) (3)

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $102 $(4) $ 98

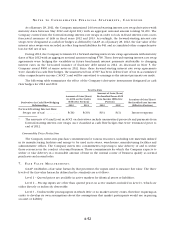

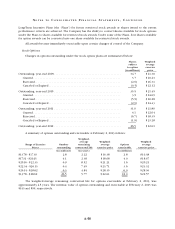

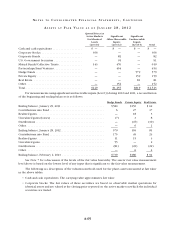

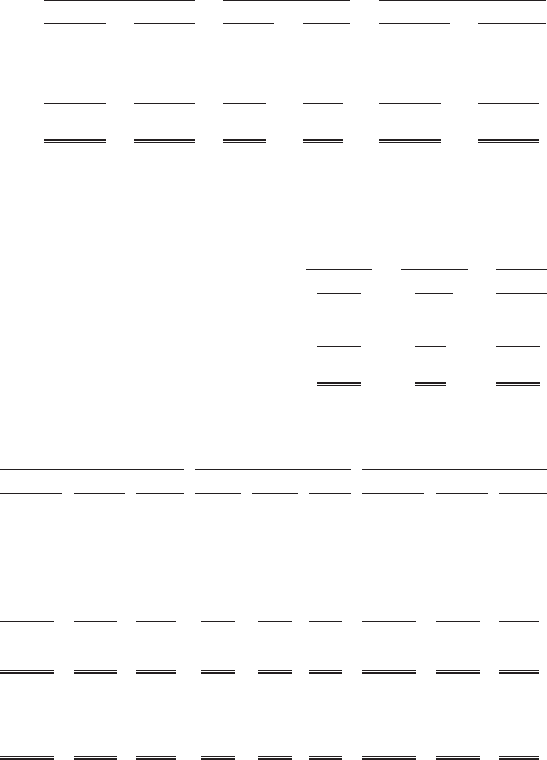

Other changes recognized in other comprehensive income in 2012, 2011, and 2010 were as follows (pre-tax):

Pension Benefits Other Benefits Total

2012 2011 2010 2012 2011 2010 2012 2011 2010

Incurred net actuarial loss (gain) . . . . . . . . . $ (33) $451 $(18) $ 5 $32 $ 4 $ (28) $483 $(14)

Amortization of prior service

credit (cost) . . . . . . . . . . . . . . . . . . . . . . . —(1) (1) 55 5 54 4

Amortization of net actuarial

gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . (97) (64) (50) —2 3 (97) (62) (47)

Total recognized in other

comprehensive income . . . . . . . . . . . . . . (130) 386 (69) 10 39 12 (120) 425 (57)

Total recognized in net periodic

benefit cost and other

comprehensive income . . . . . . . . . . . . . . $ (41) $456 $ (4) $38 $62 $33 $ (3) $518 $ 29