Kroger 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-71

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

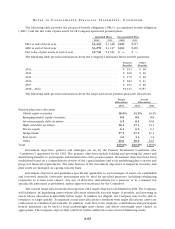

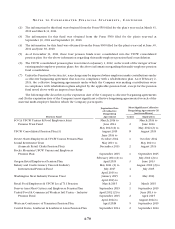

(1) This column represents the number of significant collective bargaining agreements and their expiration

date for each of the Company’s pension funds listed above. For purposes of this table, the “significant

collective bargaining agreements” are the largest based on covered employees that, when aggregated,

cover the majority of the employees for which we make multi-employer contributions for the referenced

pension fund.

(2) Certain collective bargaining agreements for each of these pension funds are operating under an

extension.

(3) As of January 1, 2012, four multi-employer pension funds were consolidated into the UFCW consolidated

pension plan. See the above information regarding this multi-employer pension fund consolidation.

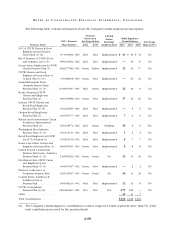

Based on the most recent information available to it, the Company believes that the present value of

actuarial accrued liabilities in most of these multi-employer plans substantially exceeds the value of the assets

held in trust to pay benefits. Moreover, if the Company were to exit certain markets or otherwise cease making

contributions to these funds, the Company could trigger a substantial withdrawal liability. Any adjustment for

withdrawal liability will be recorded when it is probable that a liability exists and can be reasonably estimated.

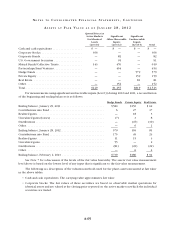

The Company also contributes to various other multi-employer benefit plans that provide health and

welfare benefits to active and retired participants. Total contributions made by the Company to these other

multi-employer benefit plans were approximately $1,100 in 2012, $1,000 in 2011 and $900 in 2010.

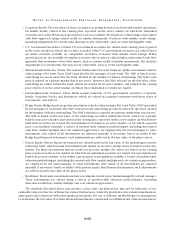

15 . R E C E N T L Y A D O P T E D A C C O U N T I N G S T A N D A R D S

In June 2011, the Financial Accounting Standards Board (“FASB”) amended its rules regarding the

presentation of comprehensive income. The objective of this amendment is to improve the comparability,

consistency and transparency of financial reporting and to increase the prominence of items reported in other

comprehensive income. Specifically, this amendment requires that all non-owner changes in shareholders’

equity be presented either in a single continuous statement of comprehensive income or in two separate

but consecutive statements. The new rules became effective for interim and annual periods beginning

after December 15, 2011. In December 2011, the FASB deferred certain aspects of this standard beyond the

December 15, 2011 effective date, specifically the provisions dealing with reclassification adjustments. The

Company adopted this amended standard effective January 29, 2012 by presenting separate Consolidated

Statements of Comprehensive Income immediately following the Consolidated Statements of Operations.

Because this standard only affects the display of comprehensive income and does not affect what is included in

comprehensive income, this standard did not have a material effect on the Company’s Consolidated Financial

Statements.

In May 2011, the FASB amended its rules for disclosure requirements for common fair value measurement.

These amendments, effective for the interim and annual periods beginning on or after December 15, 2011

(early adoption was prohibited), result in a common definition of fair value and common requirements for

fair value measurement and disclosure between GAAP and International Financial Accounting Standards.

Consequently, the amendments change some fair value measurement principles and disclosure requirements.

The implementation of the amended accounting guidance did not have a material effect on the Company’s

consolidated financial position or results of operations.

1 6 . R E C E N T L Y I S S U E D A C C O U N T I N G S T A N D A R D S

In February 2013, the FASB amended its standards on comprehensive income by requiring disclosure in

the footnotes of information about amounts reclassified out of accumulated other comprehensive income by

component. Specifically, the amendment will require disclosure of the line items of net income in which the

item was reclassified only if it is reclassified to net income in its entirety in the same reporting period. It will

also require cross reference to other disclosures for amounts that are not reclassified in their entirety in the

same reporting period. The new disclosures will be required for the Company prospectively only for annual

periods beginning February 3, 2013 and interim periods within those annual periods. The implementation

of the amended accounting guidance will not have a material effect on the Company’s consolidated financial

position or results of operations.