Kroger 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-44

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

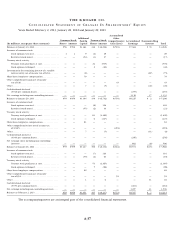

Segments

The Company operates retail food and drug stores, multi-department stores, jewelry stores, and

convenience stores throughout the United States. The Company’s retail operations, which represent over

99% of the Company’s consolidated sales and EBITDA, are its only reportable segment. The Company’s retail

operating divisions have been aggregated into one reportable segment due to the operating divisions having

similar economic characteristics with similar long-term financial performance. In addition, the Company’s

operating divisions offer to its customers similar products, have similar distribution methods, operate in

similar regulatory environments, purchase the majority of the Company’s merchandise for retail sale from

similar (and in many cases identical) vendors on a coordinated basis from a centralized location, serve similar

types of customers, and are allocated capital from a centralized location. The Company’s operating divisions

reflect the manner in which the business is managed and how the Company’s Chief Executive Officer and

Chief Operating Officer, who act as the Company’s chief operating decision makers, assess performance

internally. All of the Company’s operations are domestic.

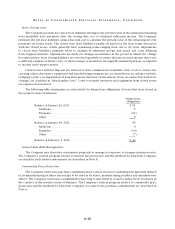

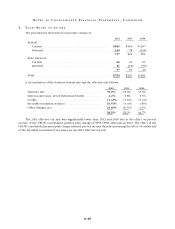

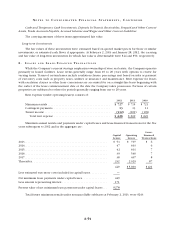

The following table presents sales revenue by type of product for 2012, 2011 and 2010.

2012 2011 2010

Amount % of total Amount % of total Amount % of total

Non Perishable (1) ............ $48,663 50.3% $46,494 51.4% $44,615 54.4%

Perishable (2) ............... 19,893 20.6% 18,693 20.7% 17,532 21.4%

Fuel ....................... 18,896 19.5% 16,901 18.7% 12,081 14.7%

Pharmacy .................. 8,018 8.3% 7,322 8.1% 6,929 8.4%

Other (3) ................... 1,281 1.3% 964 1.1% 892 1.1%

Total Sales and other revenue ... $96,751 100.0% $90,374 100.0% $82,049 100.0%

(1) Consists primarily of grocery, general merchandise, health and beauty care and natural foods.

(2) Consists primarily of produce, floral, meat, seafood, deli and bakery.

(3) Consists primarily of jewelry store sales, outside manufacturing sales and sales from entities not

controlled by the Company.

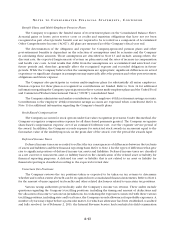

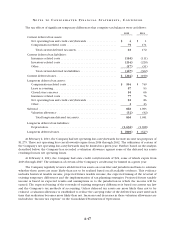

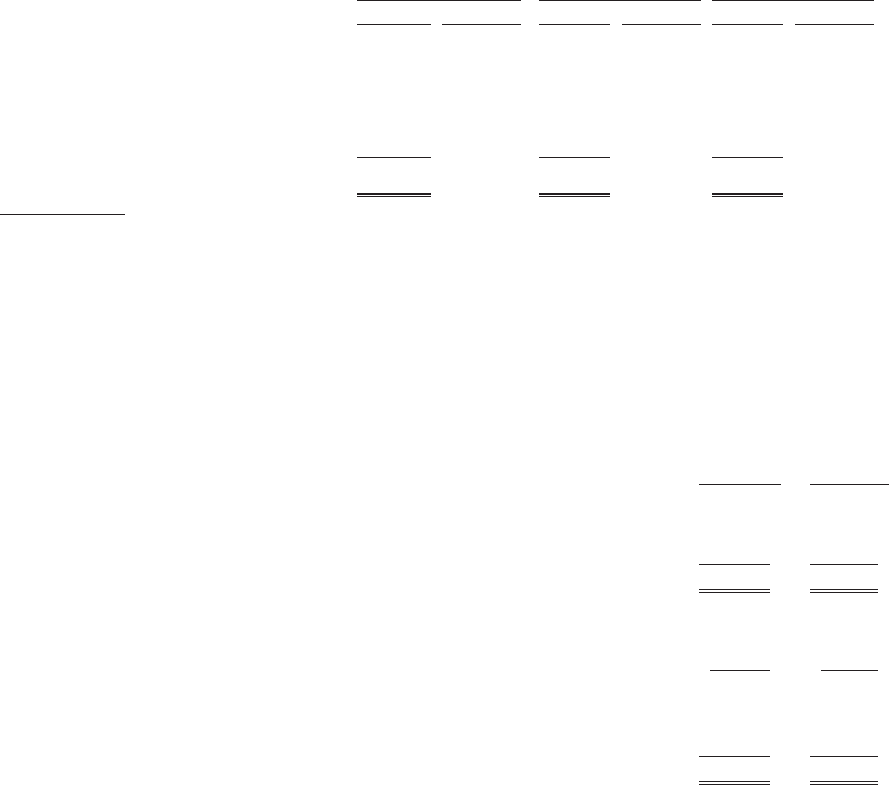

2 . G O O D W I L L

The following table summarizes the changes in the Company’s net goodwill balance through

February 2, 2013.

2012 2011

Balance beginning of year

Goodwill ................................................ $ 3,670 $ 3,672

Accumulated impairment losses .............................. (2,532) (2,532)

1,138 1,140

Activity during the year

Acquisitions .............................................. 96 —

Disposition ............................................... —(2)

Balance end of year

Goodwill ................................................ 3,766 3,670

Accumulated impairment losses .............................. (2,532) (2,532)

$ 1,234 $ 1,138