Kroger 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-59

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

the merits of all of these claims and lawsuits, nor their likelihood of success, the Company is of the belief that

any resulting liability will not have a material adverse effect on the Company’s financial position, results of

operations, or cash flows.

The Company continually evaluates its exposure to loss contingencies arising from pending or threatened

litigation and believes it has made provisions where it is reasonably possible to estimate and where an adverse

outcome is probable. Nonetheless, assessing and predicting the outcomes of these matters involves substantial

uncertainties. Management currently believes that the aggregate range of loss for the Company’s exposure

is not material to the Company. It remains possible that despite management’s current belief, material

differences in actual outcomes or changes in management’s evaluation or predictions could arise that could

have a material adverse effect on the Company’s financial condition, results of operations, or cash flows.

Assignments — The Company is contingently liable for leases that have been assigned to various third

parties in connection with facility closings and dispositions. The Company could be required to satisfy the

obligations under the leases if any of the assignees is unable to fulfill its lease obligations. Due to the wide

distribution of the Company’s assignments among third parties, and various other remedies available, the

Company believes the likelihood that it will be required to assume a material amount of these obligations is

remote.

1 2 . S T O C K

Preferred Shares

The Company has authorized five million shares of voting cumulative preferred shares; two million

shares were available for issuance at February 2, 2013. The shares have a par value of $100 per share and are

issuable in series.

Common Shares

The Company has authorized one billion common shares, $1 par value per share. On May 20, 1999, the

shareholders authorized an amendment to the Amended Articles of Incorporation to increase the number of

authorized common shares from one billion to two billion when the Board of Directors determines it to be in

the best interest of the Company.

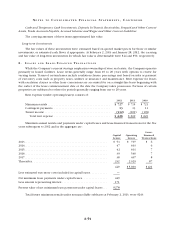

Common Stock Repurchase Program

The Company maintains stock repurchase programs that comply with Securities Exchange Act Rule

10b5-1 to allow for the orderly repurchase of The Kroger Co. common shares, from time to time. The Company

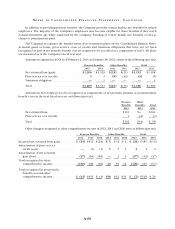

made open market purchases totaling $1,165, $1,420 and $505 under these repurchase programs in 2012, 2011

and 2010, respectively. In addition to these repurchase programs, in December 1999, the Company began a

program to repurchase common shares to reduce dilution resulting from its employee stock option plans. This

program is solely funded by proceeds from stock option exercises and the related tax benefit. The Company

repurchased approximately $96, $127 and $40 under the stock option program during 2012, 2011 and 2010,

respectively.

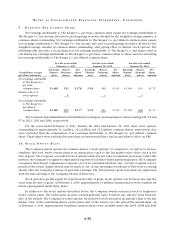

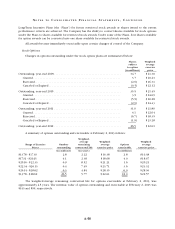

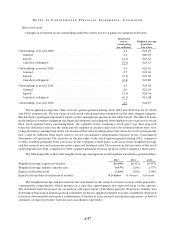

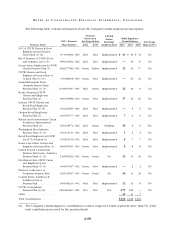

1 3 . C O M P A N Y - S P O N S O R E D B E N E F I T P L A N S

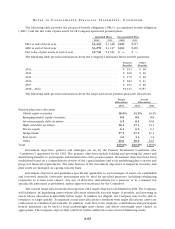

The Company administers non-contributory defined benefit retirement plans for substantially all non-

union employees and some union-represented employees as determined by the terms and conditions of

collective bargaining agreements. These include several qualified pension plans (the “Qualified Plans”) and

a non-qualified plan (the “Non-Qualified Plan”). The Non-Qualified Plan pays benefits to any employee that

earns in excess of the maximum allowed for the Qualified Plans by Section 415 of the Internal Revenue Code.

The Company only funds obligations under the Qualified Plans. Funding for the pension plans is based on a

review of the specific requirements and on evaluation of the assets and liabilities of each plan.