Kroger 2012 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

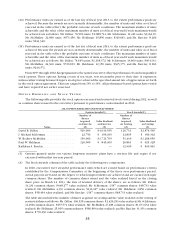

EX E C U T I V E C O M P E N S A T I O N R E C O U P M E N T P O L I C Y

IfamaterialerroroffactsresultsinthepaymenttoanexecutiveofficeratthelevelofGroupVicePresident

or higher of an annual bonus or a long-term bonus in an amount higher than otherwise would have been paid,

as determined by the Committee, then the officer, upon demand from the Committee, will reimburse Kroger

for the amounts that would not have been paid if the error had not occurred. This recoupment policy applies

to those amounts paid by Kroger within 36 months prior to the detection and public disclosure of the error.

In enforcing the policy, the Committee will take into consideration all factors that it deems appropriate,

including:

• Thematerialityoftheamountofpaymentinvolved;

• The extent to which other benefits were reduced in other years as a result of the achievement of

performance levels based on the error;

• Individualofficerculpability,ifany;and

• Otherfactorsthatshouldoffsettheamountofoverpayment.

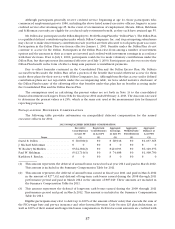

SE C T I O N 1 6 2 ( M ) O F T H E I N T E R N A L R E V E N U E C O D E

Tax laws place a limit of $1,000,000 on the amount of some types of compensation for the CEO and the

next four most highly compensated officers reported in this proxy by virtue of being among the four highest

compensatedofficers(“coveredemployees”)thatistaxdeductiblebyKroger.Compensationthatisdeemed

to be “performance-based” is excluded for purposes of the calculation and is tax deductible. Awards under

Kroger’s long-term incentive plans, when payable upon achievement of stated performance criteria, should

be considered performance-based and the compensation paid under those plans should be tax deductible.

Generally,compensationexpenserelatedtostockoptionsawardedtotheCEOandthenextfourmosthighly

compensatedofficersshouldbedeductible.Ontheotherhand,Kroger’sawardsofrestrictedstockthatvest

solely upon the passage of time are not performance-based. As a result, compensation expense for those

awards to the covered employees is not deductible, to the extent that the related compensation expense, plus

any other expense for compensation that is not performance-based, exceeds $1,000,000.

Kroger’s bonus plans rely on performance criteria, and have been approved by shareholders. As a result,

bonuses paid under the plans to the covered employees will be deductible by Kroger. In Kroger’s case, this

group of individuals is not identical to the group of named executive officers.

Kroger’s policy is, primarily, to design and administer compensation plans that support the achievement

of long-term strategic objectives and enhance shareholder value. Where it is material and supports Kroger’s

compensation philosophy, the Committee also will attempt to maximize the amount of compensation expense

that is deductible by Kroger.

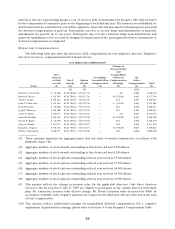

CO M P E N S A T I O N C O M M I T T E E R E P O R T

The Compensation Committee has reviewed and discussed with management of the Company the

Compensation Discussion and Analysis contained in this proxy statement. Based on its review and discussions

with management, the Compensation Committee has recommended to the Company’s Board of Directors that

the Compensation Discussion and Analysis be included in the Company’s proxy statement and incorporated

by reference into its annual report on Form 10-K.

CompensationCommittee:

ClydeR.Moore,Chair

JohnT.LaMacchia

JorgeP.Montoya

SusanM.Phillips

James A. Runde