Kroger 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-25

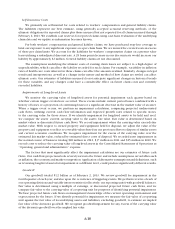

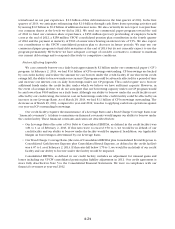

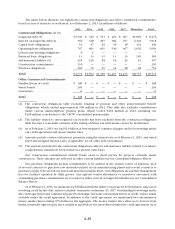

The tables below illustrate our significant contractual obligations and other commercial commitments,

based on year of maturity or settlement, as of February 2, 2013 (in millions of dollars):

2013 2014 2015 2016 2017 Thereafter Total

Contractual Obligations (1) (2)

Long-term debt (3) ................. $2,700 $ 320 $ 517 $ 463 $ 607 $3,869 $ 8,476

Interest on long-term debt (4). . . . . . . . . 360 318 297 284 257 2,422 3,938

Capital lease obligations ............. 51 47 42 39 38 232 449

Operating lease obligations .......... 707 663 601 540 467 2,025 5,003

Low-income housing obligations ...... 6 1 — — — — 7

Financed lease obligations ........... 13 13 13 13 13 116 181

Self-insurance liability (5) ............ 205 126 84 54 25 43 537

Construction commitments .......... 230 — — — — — 230

Purchase obligations ................ 500 76 45 34 28 68 751

Total ............................ $4,772 $1,564 $1,599 $1,427 $1,435 $8,775 $19,572

Other Commercial Commitments

Standby letters of credit ............. $ 148 $ — $ — $ — $ — $ — $ 148

Surety bonds ...................... 294 — — — — — 294

Guarantees ....................... 6 — — — — — 6

Total ............................ $ 448 $ — $ — $ — $ — $ — $ 448

(1) The contractual obligations table excludes funding of pension and other postretirement benefit

obligations, which totaled approximately $98 million in 2012. This table also excludes contributions

under various multi-employer pension plans, which totaled $492 million in 2012, including our

$258 million contribution to the UFCW consolidated pension plan.

(2) The liability related to unrecognized tax benefits has been excluded from the contractual obligations

table because a reasonable estimate of the timing of future tax settlements cannot be determined.

(3) As of February 2, 2013, we had $1.6 billion of borrowings of commercial paper and no borrowings under

our credit agreement and money market lines.

(4) Amounts include contractual interest payments using the interest rate as of February 2, 2013, and stated

fixed and swapped interest rates, if applicable, for all other debt instruments.

(5) The amounts included in the contractual obligations table for self-insurance liability related to workers’

compensation claims have been stated on a present value basis.

Our construction commitments include funds owed to third parties for projects currently under

construction. These amounts are reflected in other current liabilities in our Consolidated Balance Sheets.

Our purchase obligations include commitments to be utilized in the normal course of business, such

as several contracts to purchase raw materials utilized in our manufacturing plants and several contracts to

purchase energy to be used in our stores and manufacturing facilities. Our obligations also include management

fees for facilities operated by third parties. Any upfront vendor allowances or incentives associated with

outstanding purchase commitments are recorded as either current or long-term liabilities in our Consolidated

Balance Sheets.

As of February 2, 2013, we maintained a $2 billion (with the ability to increase by $500 million), unsecured

revolving credit facility that, unless extended, terminates on January 25, 2017. Outstanding borrowings under

the credit agreement and commercial paper borrowings, and some outstanding letters of credit, reduce funds

available under the credit agreement. In addition to the credit agreement, we maintained two uncommitted

money market lines totaling $75 million in the aggregate. The money market lines allow us to borrow from

banks at mutually agreed upon rates, usually at rates below the rates offered under the credit agreement. As of