Kroger 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-12

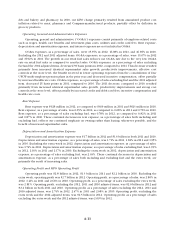

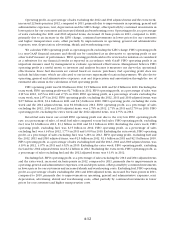

Operating profit, as a percentage of sales excluding the 2012 and 2011 adjusted items and the extra week,

increased 22 basis points in 2012, compared to 2011, primarily due to improvements in operating, general and

administrative expenses, rent, depreciation and the LIFO charge, offset partially by continued investments in

lower prices for our customers and increased shrink and warehousing costs. Operating profit, as a percentage

of sales excluding the 2011 and 2010 adjusted items, decreased 21 basis points in 2011, compared to 2010,

primarily due to an increase in the LIFO charge, continued investments in lower prices for our customers

and higher transportation costs, offset partially by improvements in operating, general and administrative

expenses, rent, depreciation, advertising, shrink and warehousing costs.

We calculate FIFO operating profit as operating profit excluding the LIFO charge. FIFO operating profit

is a non-GAAP financial measure and should not be considered as an alternative to operating profit or any

other GAAP measure of performance. FIFO operating profit should not be reviewed in isolation or considered

as a substitute for our financial results as reported in accordance with GAAP. FIFO operating profit is an

important measure used by management to evaluate operational effectiveness. Management believes FIFO

operating profit is a useful metric to investors and analysts because it measures our day-to-day operational

effectiveness. Since fuel discounts are earned based on in-store purchases, fuel operating profit does not

include fuel discounts, which are allocated to our in-store supermarket location departments. We also derive

operating, general and administrative expenses, rent and depreciation and amortization through the use of

estimated allocations in the calculation of fuel operating profit.

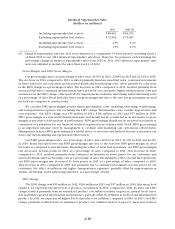

FIFO operating profit was $2.8 billion in 2012, $1.5 billion in 2011 and $2.2 billion in 2010. Excluding the

extra week, FIFO operating profit was $2.7 billion in 2012. FIFO operating profit, as a percentage of sales, was

2.91% in 2012, 1.65% in 2011 and 2.73% in 2010. FIFO operating profit, as a percentage of sales excluding the

extra week, was 2.87% in 2012. FIFO operating profit, excluding the 2012, 2011 and 2010 adjusted items, was

$2.7 billion in 2012, $2.4 billion in 2011 and $2.3 billion in 2010. FIFO operating profit, excluding the extra

week and the 2012 adjusted items, was $2.8 billion in 2012. FIFO operating profit, as a percentage of sales

excluding the 2012, 2011 and 2010 adjusted items, was 2.79% in 2012, 2.71% in 2011 and 2.75% in 2010. FIFO

operating profit, excluding the extra week and the 2012 adjusted items, was 2.75% in 2012.

Retail fuel sales lower our overall FIFO operating profit rate due to the very low FIFO operating profit

rate, as a percentage of sales, of retail fuel sales compared to non-fuel sales. FIFO operating profit, excluding

fuel, was $2.6 billion in 2012, $1.3 billion in 2011 and $2.1 billion in 2010. Excluding the extra week, FIFO

operating profit, excluding fuel, was $2.5 billion in 2012. FIFO operating profit, as a percentage of sales

excluding fuel, was 3.34% in 2012, 1.77% in 2011 and 3.00% in 2010. Excluding the extra week, FIFO operating

profit, as a percentage of sales excluding fuel, was 3.28% in 2012. FIFO operating profit, excluding fuel and

the 2012, 2011 and 2010 adjusted items, was $2.5 billion in 2012, $2.3 billion in 2011 and $2.1 billion in 2010.

FIFO operating profit, as a percentage of sales excluding fuel and the 2012, 2011 and 2010 adjusted items, was

3.19% in 2012, 3.07% in 2011 and 3.02% in 2010. Excluding the extra week, FIFO operating profit, excluding

fuel and the 2012 adjusted items was $2.4 billion in 2012. Excluding the extra week, FIFO operating profit, as

a percentage of sales excluding fuel and the 2012 adjusted items, was 3.13% in 2012.

Excluding fuel, FIFO operating profit, as a percentage of sales excluding the 2012 and 2011 adjusted items

and the extra week, increased six basis points in 2012, compared to 2011, primarily due to improvements in

operating, general and administrative expenses, rent and depreciation, offset partially by continued investments

in lower prices for our customers and increased shrink and warehousing costs. Excluding fuel, FIFO operating

profit, as a percentage of sales excluding the 2011 and 2010 adjusted items, increased five basis points in 2011,

compared to 2010, primarily due to improvements in operating, general and administrative expenses, rent,

depreciation, advertising, shrink and warehousing costs, offset partially by continued investments in lower

prices for our customers and higher transportation costs.