Kroger 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

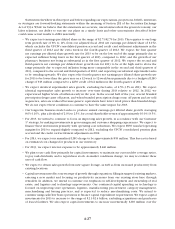

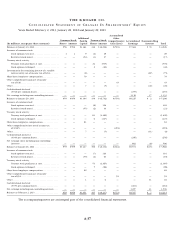

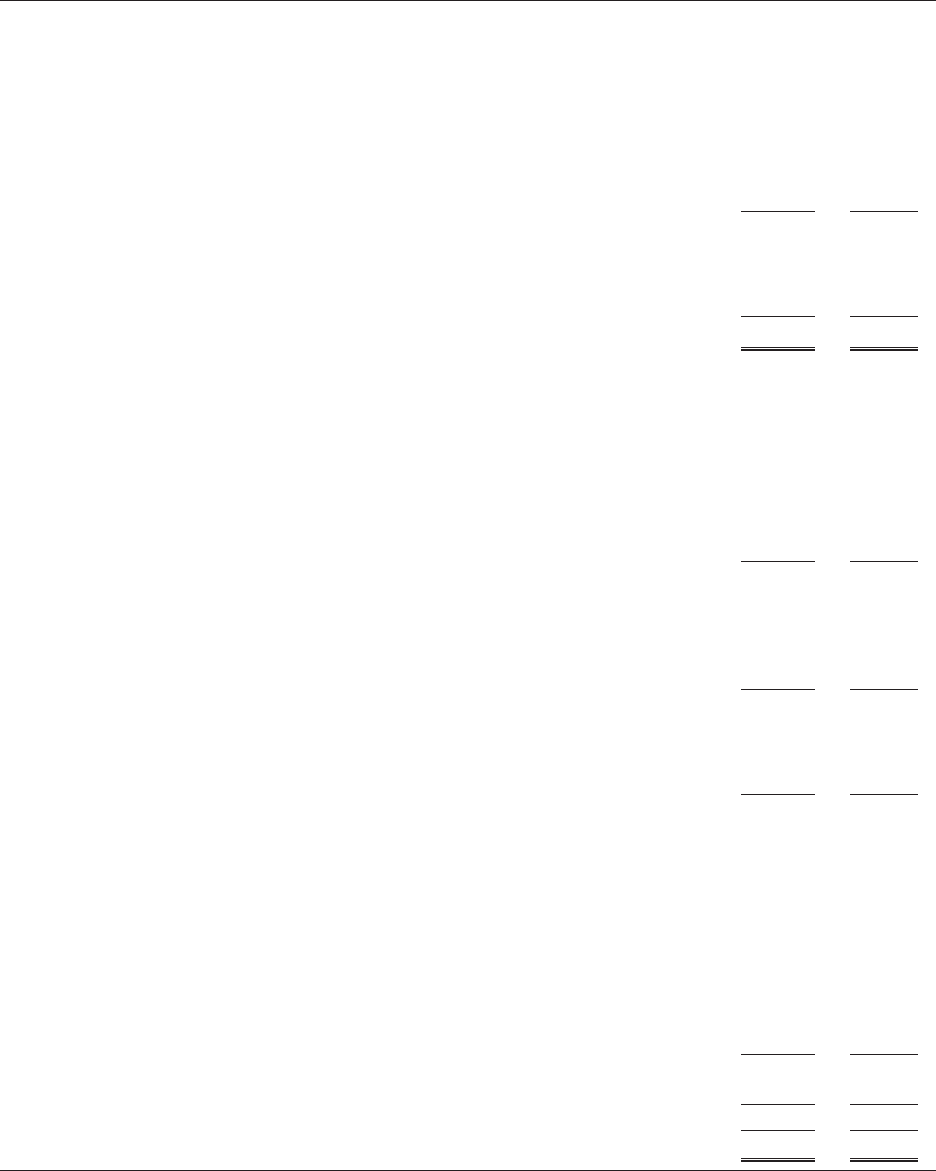

A-33

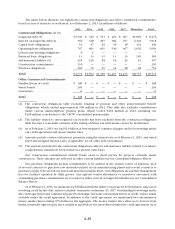

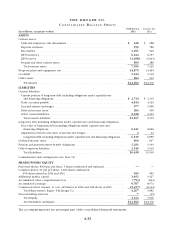

THE KROGER CO.

CO N S O L I D A T E D B A L A N C E S H E E T S

(In millions, except par values)

February 2,

2013

January 28,

2012

ASSETS

Current assets

Cash and temporary cash investments ....................................... $ 238 $ 188

Deposits in-transit ....................................................... 955 786

Receivables ............................................................ 1,051 949

FIFO inventory ......................................................... 6,244 6,157

LIFO reserve ........................................................... (1,098) (1,043)

Prepaid and other current assets ........................................... 569 288

Total current assets .................................................... 7,959 7,325

Property, plant and equipment, net .......................................... 14,875 14,464

Goodwill ............................................................... 1,234 1,138

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 584 549

Total Assets .......................................................... $ 24,652 $ 23,476

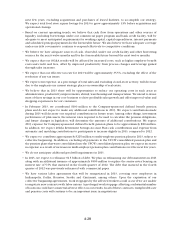

LIABILITIES

Current liabilities

Current portion of long-term debt including obligations under capital leases

and financing obligations ............................................... $ 2,734 $ 1,315

Trade accounts payable................................................... 4,524 4,329

Accrued salaries and wages ............................................... 977 1,056

Deferred income taxes ................................................... 284 190

Other current liabilities................................................... 2,538 2,215

Total current liabilities.................................................. 11,057 9,105

Long-term debt including obligations under capital leases and financing obligations

Face-value of long-term debt including obligations under capital leases and

financing obligations ................................................... 6,141 6,826

Adjustment related to fair-value of interest rate hedges .......................... 4 24

Long-term debt including obligations under capital leases and financing obligations... 6,145 6,850

Deferred income taxes..................................................... 800 647

Pension and postretirement benefit obligations ................................. 1,291 1,393

Other long-term liabilities .................................................. 1,145 1,515

Total Liabilities........................................................ 20,438 19,510

Commitments and contingencies (see Note 11)

SHAREOWNERS’ EQUITY

Preferred shares, $100 par per share, 5 shares authorized and unissued.............. — —

Common shares, $1 par per share, 1,000 shares authorized;

959 shares issued in 2012 and 2011 ........................................ 959 959

Additional paid-in capital................................................... 3,451 3,427

Accumulated other comprehensive loss ....................................... (753) (844)

Accumulated earnings ..................................................... 9,787 8,571

Common stock in treasury, at cost, 445 shares in 2012 and 398 shares in 2011 ........ (9,237) (8,132)

Total Shareowners’ Equity - The Kroger Co................................... 4,207 3,981

Noncontrolling interests ................................................... 7 (15)

Total Equity .......................................................... 4,214 3,966

Total Liabilities and Equity............................................... $ 24,652 $ 23,476

The accompanying notes are an integral part of the consolidated financial statements.