Kroger 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-47

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

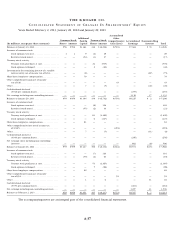

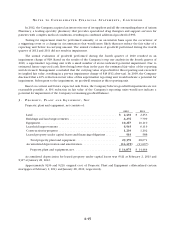

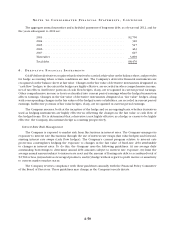

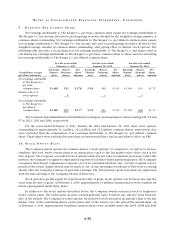

The tax effects of significant temporary differences that comprise tax balances were as follows:

2012 2011

Current deferred tax assets:

Net operating loss and credit carryforwards ................... $ 4 $ 1

Compensation related costs ................................ 79 171

Total current deferred tax assets .......................... 83 172

Current deferred tax liabilities:

Insurance related costs .................................... (116) (111)

Inventory related costs .................................... (234) (220)

Other.................................................. (17) (31)

Total current deferred tax liabilities ....................... (367) (362)

Current deferred taxes....................................... $ (284) $ (190)

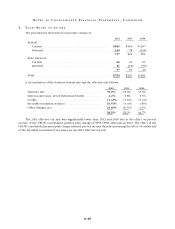

Long-term deferred tax assets:

Compensation related costs ................................ $ 564 $ 749

Lease accounting......................................... 87 93

Closed store reserves ..................................... 56 66

Insurance related costs .................................... 77 76

Net operating loss and credit carryforwards ................... 82 86

Other.................................................. 223

Subtotal .................................................. 868 1,093

Valuation allowance ...................................... (32) (42)

Total long-term deferred tax assets ........................ 836 1,051

Long-term deferred tax liabilities:

Depreciation ............................................ (1,636) (1,698)

Long-term deferred taxes..................................... $ (800) $ (647)

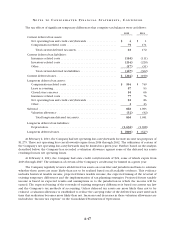

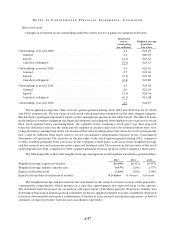

At February 2, 2013, the Company had net operating loss carryforwards for state income tax purposes of

$1,275. These net operating loss carryforwards expire from 2014 through 2032. The utilization of certain of

the Company’s net operating loss carryforwards may be limited in a given year. Further, based on the analysis

described below, the Company has recorded a valuation allowance against some of the deferred tax assets

resulting from its net operating losses.

At February 2, 2013, the Company had state credit carryforwards of $24, some of which expire from

2013 through 2027. The utilization of certain of the Company’s credits may be limited in a given year.

The Company regularly reviews all deferred tax assets on a tax filer and jurisdictional basis to estimate

whether these assets are more likely than not to be realized based on all available evidence. This evidence

includes historical taxable income, projected future taxable income, the expected timing of the reversal of

existing temporary differences and the implementation of tax planning strategies. Projected future taxable

income is based on expected results and assumptions as to the jurisdiction in which the income will be

earned. The expected timing of the reversals of existing temporary differences is based on current tax law

and the Company’s tax methods of accounting. Unless deferred tax assets are more likely than not to be

realized, a valuation allowance is established to reduce the carrying value of the deferred tax asset until such

time that realization becomes more likely than not. Increases and decreases in these valuation allowances are

included in “Income tax expense” in the Consolidated Statements of Operations.