Kroger 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

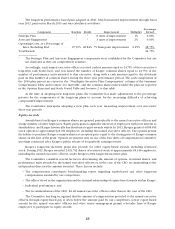

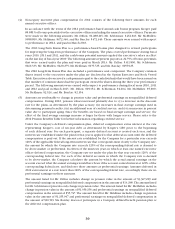

The long-term performance based plan adopted in 2010, which measured improvements through fiscal

year2012,paidoutinMarch2013andwascalculatedasfollows:

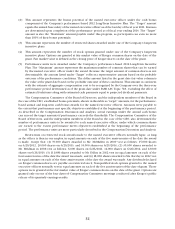

Component Baseline Result Improvement Multiplier

Percentage

Earned

Strategic Plan ..................... * * 0 units of improvement 1% 0.00%

Associate Engagement .............. * * 3 units of improvement 2% 6.00%

Operating Costs, as a Percentage of

Sales, Excluding Fuel ............ 27.59 % 26.84% 75 basis point improvement 0.25% 18.75%

Total Earned ...................... 24.75%

* The Strategic Plan and Associate Engagement components were established by the Committee but are

not disclosed as they are competitively sensitive.

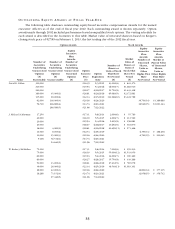

Accordingly, each named executive officer received cash in amount equal to 24.75% of that executive’s

long-term cash bonus base, and was issued the number of Kroger common shares equal to 24.75% of the

number of performance units awarded to that executive, along with a cash amount equal to the dividends

paid on that number of common shares during the three year performance period. The cash components of

the 2010 plan payout are report in the “Non-Equity Incentive Plan Compensation” column of the Summary

Compensation Table and footnote 4 to that table, and the common shares issued under the plan are reported

intheOptionsExercisedandStockVestedTableandfootnote2tothattable.

At the time of adopting new long-term plans, the Committee has made adjustments to the percentage

payouts for the components of the long-term plans to account for the increasing difficulty of achieving

compounded improvement.

The Committee anticipates adopting a new plan each year, measuring improvement over successive

three-year periods.

Equity Awards

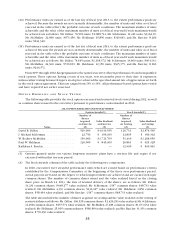

Awards based on Kroger’s common shares are granted periodically to the named executive officers and

a large number of other employees. Equity participation aligns the interests of employees with your interest as

shareholders, and Kroger historically has distributed equity awards widely. In 2012, Kroger granted 4,068,815

stockoptionstoapproximately8,031employees,includingthenamedexecutiveofficers.Theoptionspermit

the holder to purchase Kroger common shares at an option price equal to the closing price of Kroger common

shares on the date of the grant. Options are granted only on one of the four dates of Compensation Committee

meetings conducted after Kroger’s public release of its quarterly earnings results.

Kroger’s long-term incentive plans also provide for other equity-based awards, including restricted

stock.During2012,Krogerawarded2,623,742sharesofrestrictedstocktoapproximately18,346employees,

including the named executive officers, under Kroger’s 2012 long-term incentive plan.

The Committee considers several factors in determining the amount of options, restricted shares, and

performance units awarded to the named executive officers or, in the case of the CEO, recommending to the

independentdirectorstheamountawarded.Thesefactorsinclude:

• The compensation consultant’s benchmarking report regarding equity-based and other long-term

compensation awarded by our competitors;

• Theofficer’slevelintheorganizationandtheinternalrelationshipofequity-basedawardswithinKroger;

• Individualperformance;and

• TherecommendationoftheCEO,forallnamedexecutiveofficersotherthaninthecaseoftheCEO.

The Committee has long recognized that the amount of compensation provided to the named executive

officers through equity-based pay is often below the amount paid by our competitors. Lower equity-based

awards for the named executive officers and other senior management permit a broader base of Kroger

employees to participate in equity awards.