Kroger 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-28

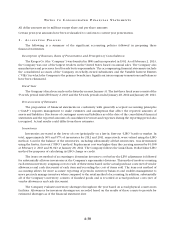

next few years, excluding acquisitions and purchases of leased facilities, to accomplish our strategy.

We expect total food store square footage for 2013 to grow approximately 1.5% before acquisitions and

operational closings.

• Based on current operating trends, we believe that cash flow from operations and other sources of

liquidity, including borrowings under our commercial paper program and bank credit facility, will be

adequate to meet anticipated requirements for working capital, capital expenditures, interest payments

and scheduled principal payments for the foreseeable future. We also believe we have adequate coverage

under our debt covenants to continue to respond effectively to competitive conditions.

• Webelievewehaveadequatesourcesofcash,ifneeded,underourcreditfacilityandotherborrowing

sources for the next twelve months and for the foreseeable future beyond the next twelve months.

• WeexpectthatourOG&Aresultswillbeaffectedbyincreasedcosts,suchashigheremployeebenefit

costs and credit card fees, offset by improved productivity from process changes and leverage gained

through sales increases.

• Weexpectthatoureffectivetaxratefor2013willbeapproximately35.5%,excludingtheeffectofthe

resolution of any tax issues.

• Weexpectrentexpense,asapercentageoftotalsalesandexcludingclosed-storeactivity,willdecrease

due to the emphasis our current strategy places on ownership of real estate.

• We believe that in 2013 there will be opportunities to reduce our operating costs in such areas as

administration, productivity improvements, shrink, warehousing and transportation. We intend to invest

most of these savings in our core business to drive profitable sales growth and offer improved value and

shopping experiences for our customers.

• In February 2013, we contributed $100 million to the Company-sponsored defined benefit pension

plans and do not expect to make any additional contributions in 2013. We expect contributions made

during 2013 will decrease our required contributions in future years. Among other things, investment

performance of plan assets, the interest rates required to be used to calculate the pension obligations,

and future changes in legislation, will determine the amounts of additional contributions. We expect

2013 expense for Company-sponsored defined benefit pension plans to be approximately $80 million.

In addition, we expect 401(k) Retirement Savings Account Plan cash contributions and expense from

automatic and matching contributions to participants to increase slightly in 2013, compared to 2012.

• Weexpecttocontributeapproximately$225milliontomulti-employerpensionplansin2013,subjectto

collective bargaining. In addition, excluding all payments to the UFCW consolidated pension plan and

the pension plans that were consolidated into the UFCW consolidated pension plan, we expect increases

in expense as a result of increases in multi-employer pension plan contributions over the next few years.

• Wedonotanticipateadditionalgoodwillimpairmentsin2013.

• In2013,weexpecttorefinance$1.5billionofdebt.Weplanonrefinancingourdebtmaturitiesin2013

along with an additional issuance of approximately $500 million to replace the senior notes bearing an

interest rate of 5.5% that matured in the fourth quarter of 2012. The debt that matured in the fourth

quarter of 2012 was previously refinanced with commercial paper.

• We have various labor agreements that will be renegotiated in 2013, covering store employees in

Indianapolis, Dallas, Houston, Seattle and Cincinnati, among others. Upon the expiration of our

collective bargaining agreements, work stoppages by the affected workers could occur if we are unable

to negotiate new contracts with labor unions. A prolonged work stoppage affecting a substantial number

of locations could have a material adverse effect on our results. In all of these contracts, rising health care

and pension costs will continue to be an important issue in negotiations.