Kroger 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-52

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

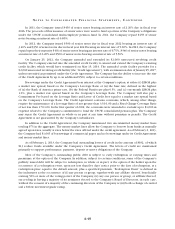

As of January 28, 2012, the Company maintained 24 forward-starting interest rate swap derivatives with

maturity dates between May 2012 and April 2013 with an aggregate notional amount totaling $1,200. The

Company entered into the forward-starting interest rate swaps in order to lock in fixed interest rates on its

forecasted issuances of debt in fiscal years 2012 and 2013. Accordingly, the forward-starting interest rate

swaps were designated as cash-flow hedges as defined by GAAP. As of January 28, 2012, the fair value of the

interest rates swaps was recorded in other long-term liabilities for $41 and accumulated other comprehensive

loss for $26 net of tax.

During 2012, the Company terminated 14 forward-starting interest rate swap agreements with maturity

dates of May 2012 with an aggregate notional amount totaling $700. These forward-starting interest rate swap

agreements were hedging the variability in future benchmark interest payments attributable to changing

interest rates on the forecasted issuance of fixed-rate debt issued in 2012. As discussed in Note 5, the

Company issued $850 of senior notes in 2012. Since these forward-starting interest rate swap agreements

were classified as cash flow hedges, the unamortized loss of $27 has been deferred net of tax in accumulated

other comprehensive income (“AOCI”) and will be amortized to earnings as the interest payments are made.

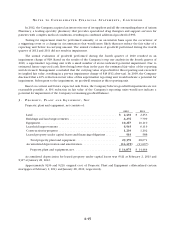

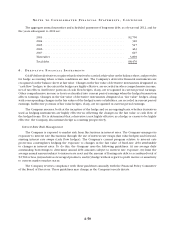

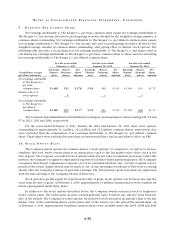

The following table summarizes the effect of the Company’s derivative instruments designated as cash

flow hedges for 2012 and 2011:

Year-To-Date

Derivatives in Cash Flow Hedging

Relationships

Amount of Gain/(Loss)

in AOCI on Derivative

(Effective Portion)

Amount of Gain/(Loss)

Reclassified from AOCI

into Income (Effective

Portion) Location of Gain/(Loss)

Reclassified into Income

(Effective Portion)2012 2011 2012 2011

Forward-Starting Interest Rate

Swaps, net of tax* . . . . . . . . . $(14) $(30) $(3) $(1) Interest expense

* The amounts of Gain/(Loss) in AOCI on derivatives include unamortized proceeds and payments from

forward-starting interest rate swaps once classified as cash flow hedges that were terminated prior to

end of 2012.

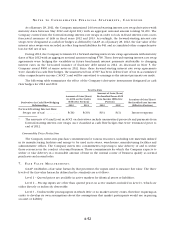

Commodity Price Protection

The Company enters into purchase commitments for various resources, including raw materials utilized

in its manufacturing facilities and energy to be used in its stores, warehouses, manufacturing facilities and

administrative offices. The Company enters into commitments expecting to take delivery of and to utilize

those resources in the conduct of normal business. Those commitments for which the Company expects to

utilize or take delivery in a reasonable amount of time in the normal course of business qualify as normal

purchases and normal sales.

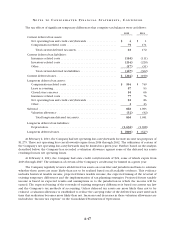

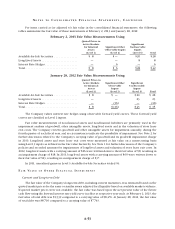

7. F A I R VA L U E M E A S U R E M E N T S

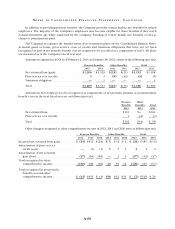

GAAP establishes a fair value hierarchy that prioritizes the inputs used to measure fair value. The three

levels of the fair value hierarchy defined in the standards are as follows:

Level 1 – Quoted prices are available in active markets for identical assets or liabilities;

Level 2 – Pricing inputs are other than quoted prices in active markets included in Level 1, which are

either directly or indirectly observable;

Level 3 – Unobservable pricing inputs in which little or no market activity exists, therefore requiring an

entity to develop its own assumptions about the assumptions that market participants would use in pricing

an asset or liability.