Kroger 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-21

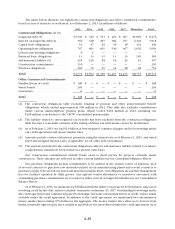

Share-Based Compensation Expense

We account for stock options under the fair value recognition provisions of GAAP. Under this method,

we recognize compensation expense for all share-based payments granted. We recognize share-based

compensation expense, net of an estimated forfeiture rate, over the requisite service period of the award. In

addition, we record expense for restricted stock awards in an amount equal to the fair market value of the

underlying stock on the grant date of the award, over the period the award restrictions lapse.

Inventories

Inventories are stated at the lower of cost (principally on a LIFO basis) or market. In total, approximately

96% of inventories in 2012 and 97% of inventories in 2011 were valued using the LIFO method. Cost for the

balance of the inventories was determined using the FIFO method. Replacement cost was higher than the

carrying amount by $1.1 billion at February 2, 2013, and by $1.0 billion at January 28, 2012. We follow the

Link-Chain, Dollar-Value LIFO method for purposes of calculating our LIFO charge or credit.

We follow the item-cost method of accounting to determine inventory cost before the LIFO adjustment

for substantially all store inventories at our supermarket divisions. This method involves counting each item in

inventory, assigning costs to each of these items based on the actual purchase costs (net of vendor allowances

and cash discounts) of each item and recording the cost of items sold. The item-cost method of accounting

allows for more accurate reporting of periodic inventory balances and enables management to more precisely

manage inventory when compared to the retail method of accounting. In addition, substantially all of our

inventory consists of finished goods and is recorded at actual purchase costs (net of vendor allowances and

cash discounts).

We evaluate inventory shortages throughout the year based on actual physical counts in our facilities.

We record allowances for inventory shortages based on the results of recent physical counts to provide for

estimated shortages from the last physical count to the financial statement date.

Vendor Allowances

We recognize all vendor allowances as a reduction in merchandise costs when the related product is

sold. In most cases, vendor allowances are applied to the related product cost by item, and therefore reduce

the carrying value of inventory by item. When it is not practicable to allocate vendor allowances to the

product by item, we recognize vendor allowances as a reduction in merchandise costs based on inventory

turns and as the product is sold. We recognized approximately $6.2 billion in 2012, $5.9 billion in 2011, and

$6.4 billion in 2010 of vendor allowances as a reduction in merchandise costs. We recognized approximately

95% of all vendor allowances in the item cost with the remainder being based on inventory turns.

RE C E N T L Y A D O P T E D A C C O U N T I N G S T A N D A R D S

In June 2011, the Financial Accounting Standards Board (“FASB”) amended its rules regarding the

presentation of comprehensive income. The objective of this amendment is to improve the comparability,

consistency and transparency of financial reporting and to increase the prominence of items reported in other

comprehensive income. Specifically, this amendment requires that all non-owner changes in shareholders’

equity be presented either in a single continuous statement of comprehensive income or in two separate

but consecutive statements. The new rules became effective for interim and annual periods beginning

after December 15, 2011. In December 2011, the FASB deferred certain aspects of this standard beyond the

December 15, 2011 effective date, specifically the provisions dealing with reclassification adjustments. We

adopted these amended standards effective January 29, 2012 by presenting separate Consolidated Statements

of Comprehensive Income immediately following the Consolidated Statements of Operations.

In May 2011, the FASB amended its rules for disclosure requirements for common fair value measurement.

These amendments, effective for the interim and annual periods beginning on or after December 15, 2011

(early adoption was prohibited), result in a common definition of fair value and common requirements for

fair value measurement and disclosure between GAAP and International Financial Accounting Standards.