Kroger 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-15

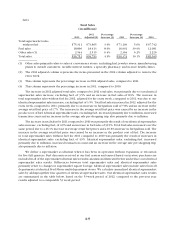

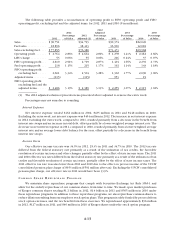

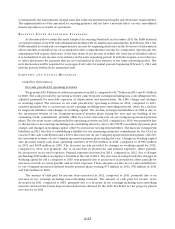

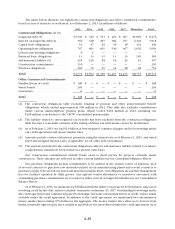

The following table provides a calculation of ROIC for 2012 and 2011 on a 52 week basis ($ in millions):

February 2,

2013

January 28,

2012

Return on Invested Capital

Numerator

Operating profit on a 53 week basis in fiscal year 2012.................. $ 2,764 $ 1,278

53rd week operating profit adjustment ............................... (100) —

LIFO charge.................................................... 55 216

Depreciation and amortization ..................................... 1,652 1,638

Rent on a 53 week basis in fiscal year 2012 ........................... 628 619

53rd week rent adjustment ........................................ (12) —

2011 adjusted item .............................................. — 953

2012 adjusted items ............................................. (115) —

Adjusted operating profit ......................................... $ 4,872 $ 4,704

Denominator

Average total assets ............................................. $24,064 $23,491

Average taxes receivable (1) ....................................... (22) (21)

Average LIFO reserve ............................................ 1,071 935

Average accumulated depreciation and amortization.................... 14,051 13,088

Average trade accounts payable .................................... (4,427) (4,278)

Average accrued salaries and wages ................................. (1,017) (972)

Average other current liabilities (2) ................................. (2,313) (2,151)

Rent x 8....................................................... 4,928 4,952

Average invested capital .......................................... $36,335 $35,044

Return on Invested Capital .......................................... 13.4% 13.4%

(1) Taxes receivable were $2 as of February 2, 2013 and $42 as of January 28, 2012. As of January 29, 2011,

the Company did not have any taxes receivable.

(2) Other current liabilities included accrued income taxes of $128 as of February 2, 2013 and $61 as of

January 29, 2011. As of January 28, 2012, other current liabilities did not include any accrued income

taxes. Accrued income taxes are removed from other current liabilities in the calculation of average

invested capital.

CR I T I C A L A C C O U N T I N G P O L I C I E S

We have chosen accounting policies that we believe are appropriate to report accurately and fairly our

operating results and financial position, and we apply those accounting policies in a consistent manner. Our

significant accounting policies are summarized in Note 1 to the Consolidated Financial Statements.

The preparation of financial statements in conformity with GAAP requires us to make estimates and

assumptions that affect the reported amounts of assets, liabilities, revenues, and expenses, and related

disclosures of contingent assets and liabilities. We base our estimates on historical experience and other

factors we believe to be reasonable under the circumstances, the results of which form the basis for making

judgments about the carrying values of assets and liabilities that are not readily apparent from other sources.

Actual results could differ from those estimates.

We believe that the following accounting policies are the most critical in the preparation of our financial

statements because they involve the most difficult, subjective or complex judgments about the effect of

matters that are inherently uncertain.