Kraft 2004 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Acquisitions and Divestitures

During 2004, the Company acquired a U.S.-based beverage business for a total cost of $137 million.

During 2003, the Company acquired a biscuits business in Egypt and trademarks associated with a

small U.S.-based natural foods business. The total cost of these and other smaller acquisitions was

$98 million. During 2002, the Company acquired a snacks business in Turkey and a biscuits business in

Australia. The total cost of these and other smaller acquisitions was $122 million.

On November 15, 2004, the Company announced the sale of substantially all of its sugar

confectionery business for approximately $1.5 billion. The proposed sale includes the Life Savers,

Creme Savers, Altoids, Trolli and Sugus brands. The transaction, which is subject to regulatory approval,

is expected to be completed in the second quarter of 2005. The Company has reflected the results of its

sugar confectionery business as discontinued operations on the consolidated statements of earnings

for all years presented. Pursuant to the sugar confectionery sale agreement, the Company has agreed to

provide certain transition and supply services to the buyer. These service arrangements are primarily for

terms of one year or less, with the exception of one supply arrangement with a term of not more than

three years. The expected cash flow from this supply arrangement is not significant.

During 2004, the Company sold a Brazilian snack nuts business and trademarks associated with a

candy business in Norway. The aggregate proceeds received from the sale of these businesses were

$18 million, on which pre-tax losses of $3 million were recorded. In December 2004, the Company

announced the sale of its U.K. desserts business for approximately $135 million, which is expected to

result in an estimated gain of $0.04 per share. The transaction closed in the first quarter of 2005. The

Company also announced in December 2004, the sale of its yogurt business for approximately

$59 million, which is expected to result in an after-tax loss of approximately $12 million ($5 million in

2004, with the remainder at closing). The transaction, which is also subject to regulatory approval, is

expected to be completed in the first quarter of 2005. During 2003, the Company sold a European rice

business and a branded fresh cheese business in Italy. The aggregate proceeds received from sales of

businesses during 2003 were $96 million, on which the Company recorded pre-tax gains of $31 million.

During 2002, the Company sold several small North American food businesses, some of which had been

previously classified as businesses held for sale arising from the acquisition of Nabisco. In addition, the

Company sold its Latin American yeast and industrial bakery ingredients business for approximately

$110 million and recorded a pre-tax gain of $69 million. The aggregate proceeds received from sales of

businesses during 2002 were $219 million, on which the Company recorded pre-tax gains of $80 million.

The operating results of the acquisitions and divestitures, except for the sale of the sugar

confectionery business, were not material to the Company’s consolidated financial position, results of

operations or cash flows in any of the periods presented.

Other Matters

Customers

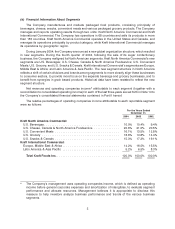

For each of the years ended December 31, 2004 and 2003, the Company’s five largest customers

accounted for approximately 28% of its net revenues, and the Company’s ten largest customers

accounted for approximately 38% of its net revenues. One of the Company’s customers, Wal-Mart

Stores, Inc., accounted for approximately 14% of net revenues for 2004 and approximately 12% of net

revenues for 2003.

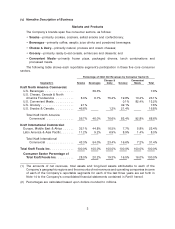

Employees

At December 31, 2004, the Company employed approximately 98,000 people worldwide.

Approximately 30% of the Company’s 45,000 employees in the United States are represented by labor

unions. Most of the unionized workers at the Company’s domestic locations are represented under

8