Kraft 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

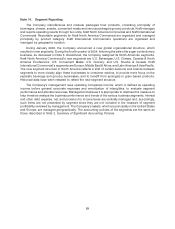

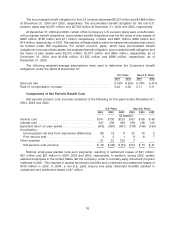

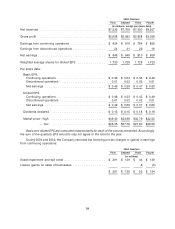

The following weighted-average assumptions were used to determine the Company’s net

postretirement cost for the years ended December 31:

U.S. Plans Canadian Plans

2004 2003 2002 2004 2003 2002

Discount rate .............. 6.25% 6.50% 7.00% 6.50% 6.75% 6.75%

Health care cost trend rate .... 10.00 8.00 6.20 8.00 7.00 8.00

In 2005, the discount rate used to determine the Company’s net postretirement cost will be 5.75%

and the health care cost trend rate will be 8.00% for its U.S. plans and 9.50% for its Canadian plans.

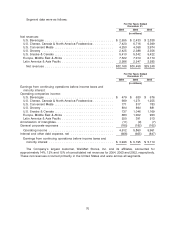

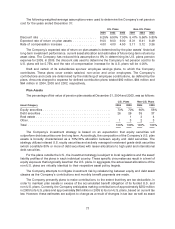

The Company’s postretirement health care plans are not funded. The changes in the accumulated

benefit obligation and net amount accrued at December 31, 2004 and 2003, were as follows:

2004 2003

(in millions)

Accumulated postretirement benefit obligation at January 1 ............... $2,955 $ 2,712

Service cost ................................................ 43 41

Interest cost ................................................ 173 173

Benefits paid ............................................... (239) (189)

Plan amendments ............................................ (28)

Medicare Prescription Drug, Improvement and Modernization Act of 2003 . . . (315)

Currency .................................................. 10 18

Assumption changes ......................................... 268 174

Actuarial losses ............................................. 36 54

Accumulated postretirement benefit obligation at December 31 ............. 2,931 2,955

Unrecognized actuarial losses ................................... (1,005) (1,064)

Unrecognized prior service cost .................................. 178 202

Accrued postretirement health care costs ............................ $2,104 $ 2,093

The current portion of the Company’s accrued postretirement health care costs of $217 million and

$199 million at December 31, 2004 and 2003, respectively, are included in other accrued liabilities on the

consolidated balance sheets.

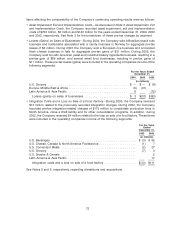

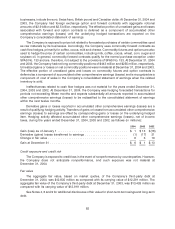

The following weighted-average assumptions were used to determine the Company’s

postretirement benefit obligations at December 31:

U.S. Plans Canadian Plans

2004 2003 2004 2003

Discount rate .................................... 5.75% 6.25% 5.75% 6.50%

Health care cost trend rate assumed for next year ......... 8.00 10.00 9.50 8.00

Ultimate trend rate .............................. 5.00 5.00 6.00 5.00

Year that the rate reaches the ultimate trend rate ......... 2008 2006 2012 2010

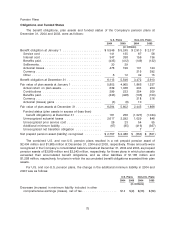

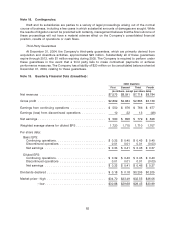

Assumed health care cost trend rates have a significant effect on the amounts reported for the

health care plans. A one-percentage-point change in assumed health care cost trend rates would have

the following effects as of December 31, 2004:

One-Percentage-Point One-Percentage-Point

Increase Decrease

Effect on total of service and interest cost ............ 12.5% (10.2)%

Effect on postretirement benefit obligation ............ 9.6 (8.1)

79