Kraft 2004 Annual Report Download - page 23

Download and view the complete annual report

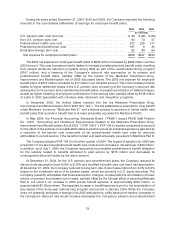

Please find page 23 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company expects to complete its evaluation of the effects of the repatriation provision within a

reasonable period of time. The Company does not expect the repatriation provisions of the Jobs Act to

have a significant impact on its consolidated results of operations or its consolidated cash flows.

The Jobs Act also provides tax relief to U.S. domestic manufacturers by providing a tax deduction of

up to 9% of the lesser of ‘‘qualified production activities income’’ or taxable income. In December 2004,

the FASB issued FASB Staff Position 109-1, ‘‘Application of FASB Statement No. 109, ‘Accounting for

Income Taxes,’ to the Tax Deduction on Qualified Production Activities Provided by the American Jobs

Creation Act of 2004’’ (‘‘FSP 109-1’’). FSP 109-1 requires companies to account for this deduction as a

‘‘special deduction’’ rather than a rate reduction, in accordance with SFAS No. 109, and therefore, the

Company will recognize these benefits, which are not expected to be significant, in the year earned.

Consolidation. The consolidated financial statements include Kraft Foods Inc., as well as its

wholly-owned and majority-owned subsidiaries. Investments in which Kraft Foods Inc. exercises

significant influence (20%—50% ownership interest), are accounted for under the equity method of

accounting. Investments in which Kraft Foods Inc. has an ownership interest of less than 20%, or does

not exercise significant influence, are accounted for with the cost method of accounting. All

intercompany transactions and balances have been eliminated.

Business Environment

The Company is subject to a number of challenges that may adversely affect its businesses. These

challenges, which are discussed below and under the ‘‘Forward-Looking and Cautionary Statements’’

section in Part I, Item 1 of this Annual Report on Form 10-K, include:

• fluctuations in commodity prices;

• movements of foreign currencies;

• competitive challenges in various products and markets, including price gaps with competitor

products and the increasing price-consciousness of consumers;

• a rising cost environment;

• a trend toward increasing consolidation in the retail trade and consequent pricing pressure and

inventory reductions;

• a growing presence of hard discount retailers, primarily in Europe, with an emphasis on own-label

products;

• changing consumer preferences, including diet trends;

• competitors with different profit objectives and less susceptibility to currency exchange rates; and

• concerns and/or regulations regarding food safety, quality and health, including genetically

modified organisms, trans-fatty acids and obesity. Increased government regulation of the food

industry could result in increased costs to the Company.

Fluctuations in commodity prices can lead to retail price volatility and intense price competition, and

can influence consumer and trade buying patterns. During 2004, the Company’s commodity costs on

average have been higher than those incurred in 2003 (most notably dairy, coffee, meat, nuts, energy

and packaging), and have adversely affected earnings. Dairy costs rose to historical highs during the

first half of 2004, but have moderated during the second half of 2004. For 2004, the Company had a

negative pre-tax impact from all commodities of approximately $930 million as compared with 2003.

In the ordinary course of business, the Company is subject to many influences that can impact the

timing of sales to customers, including the timing of holidays and other annual or special events,

seasonality of certain products, significant weather conditions, timing of Company and customer

22