Kraft 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

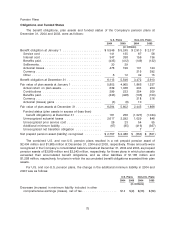

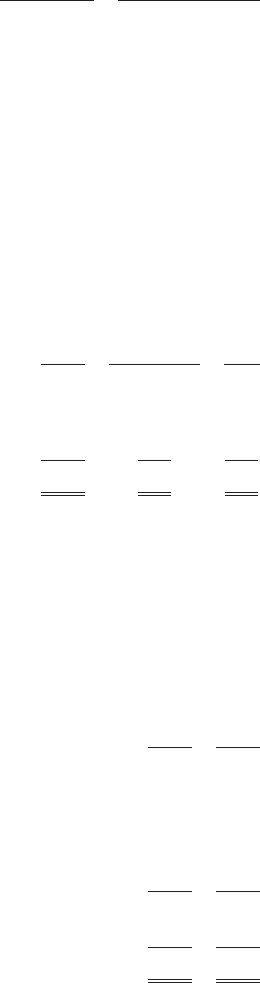

The Company’s estimated future benefit payments for its postretirement health care plans at

December 31, 2004, were as follows:

U.S. Plans Canadian Plans

(in millions)

2005 ............................................... $210 $ 7

2006 ............................................... 190 7

2007 ............................................... 189 7

2008 ............................................... 186 8

2009 ............................................... 184 8

2010-2014 ........................................... 924 46

Postemployment Benefit Plans

Kraft and certain of its affiliates sponsor postemployment benefit plans covering substantially all

salaried and certain hourly employees. The cost of these plans is charged to expense over the working

life of the covered employees. Net postemployment costs consisted of the following for the years ended

December 31, 2004, 2003 and 2002:

2004 2003 2002

(in millions)

Service cost ............................................. $ 7 $10 $19

Amortization of unrecognized net gains ......................... (7) (5) (7)

Other expense ........................................... 167 1 23

Net postemployment costs ................................ $167 $ 6 $35

As previously discussed in Note 3. Asset Impairment, Exit and Implementation Costs, the Company

announced several workforce reduction programs during 2004 as part of the overall restructuring

program. The cost of these programs, $167 million, is included in other expense above. During 2002,

certain salaried employees in the United States left the Company under voluntary early retirement and

integration programs. These programs resulted in incremental postemployment costs of $23 million,

which are included in other expense above.

The Company’s postemployment plans are not funded. The changes in the benefit obligations of

the plans at December 31, 2004 and 2003, were as follows:

2004 2003

(in millions)

Accumulated benefit obligation at January 1 .............................. $241 $295

Service cost .................................................... 7 10

Restructuring program ............................................ 167

Benefits paid ................................................... (135) (106)

Actuarial (gains) losses ............................................ (28) 42

Accumulated benefit obligation at December 31 ........................... 252 241

Unrecognized experience gains ..................................... 74 56

Accrued postemployment costs ....................................... $326 $297

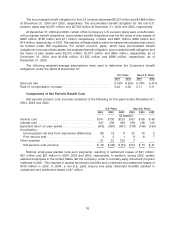

The accumulated benefit obligation was determined using an assumed ultimate annual turnover

rate of 0.3% in 2004 and 2003, assumed compensation cost increases of 4.0% in 2004 and 2003, and

assumed benefits as defined in the respective plans. Postemployment costs arising from actions that

offer employees benefits in excess of those specified in the respective plans are charged to expense

when incurred.

80