Kraft 2004 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

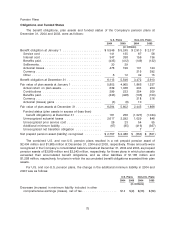

The accumulated benefit obligation for the U.S. pension plans was $5,327 million and $4,898 million

at December 31, 2004 and 2003, respectively. The accumulated benefit obligation for the non-U.S.

pension plans was $3,251 million and $2,708 million at December 31, 2004 and 2003, respectively.

At December 31, 2004 and 2003, certain of the Company’s U.S. pension plans were underfunded,

with projected benefit obligations, accumulated benefit obligations and the fair value of plan assets of

$260 million, $188 million and $11 million, respectively, in 2004, and $261 million, $208 million and

$14 million, respectively, in 2003. The majority of these relate to plans for salaried employees that cannot

be funded under IRS regulations. For certain non-U.S. plans, which have accumulated benefit

obligations in excess of plan assets, the projected benefit obligation, accumulated benefit obligation and

fair value of plan assets were $2,012 million, $1,877 million and $950 million, respectively, as of

December 31, 2004, and $1,648 million, $1,532 million and $588 million, respectively, as of

December 31, 2003.

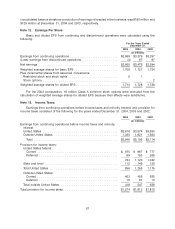

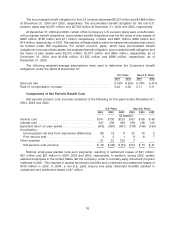

The following weighted-average assumptions were used to determine the Company’s benefit

obligations under the plans at December 31:

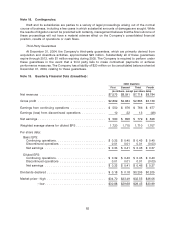

U.S. Plans Non-U.S. Plans

2004 2003 2004 2003

Discount rate ...................................... 5.75% 6.25% 5.18% 5.41%

Rate of compensation increase ......................... 4.00 4.00 3.11 3.11

Components of Net Periodic Benefit Cost

Net periodic pension cost (income) consisted of the following for the years ended December 31,

2004, 2003 and 2002:

U.S. Plans Non-U.S. Plans

2004 2003 2002 2004 2003 2002

(in millions)

Service cost .............................. $141 $135 $120 $67 $58 $49

Interest cost .............................. 347 338 339 156 136 120

Expected return on plan assets ................. (575) (587) (631) (178) (146) (134)

Amortization:

Unrecognized net loss from experience differences . 89 15 8 32 18 5

Prior service cost ......................... 3 2 1987

Other expense ............................. 41 51 130 7

Net pension cost (income) .................. $ 46 $(46) $ (33) $ 93 $ 74 $ 47

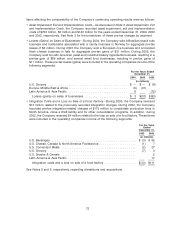

Retiring employees elected lump-sum payments, resulting in settlement losses of $41 million,

$51 million and $21 million in 2004, 2003 and 2002, respectively. In addition, during 2002, certain

salaried employees in the United States left the Company under a voluntary early retirement program

instituted in 2001. This resulted in special termination benefits and curtailment and settlement losses of

$109 million in 2002. In 2004, a non-U.S. plant closure and early retirement benefits resulted in

curtailment and settlement losses of $7 million.

76