Kraft 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

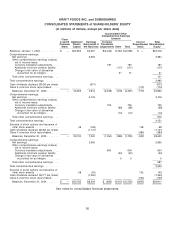

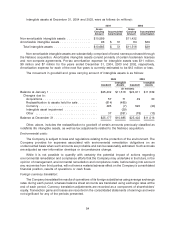

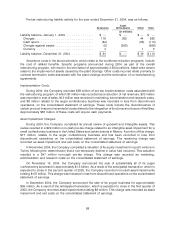

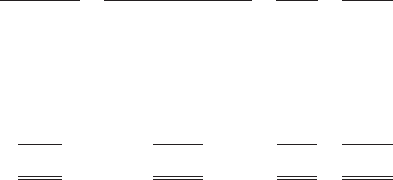

Pre-tax restructuring liability activity for the year ended December 31, 2004, was as follows:

Asset

Severance Write-downs Other Total

(in millions)

Liability balance, January 1, 2004 ............... $ — $ — $— $ —

Charges ................................ 176 363 44 583

Cash spent .............................. (84) (26) (110)

Charges against assets ..................... (5) (363) (368)

Currency ............................... 4 1 5

Liability balance, December 31, 2004 ............. $ 91 $ — $19 $110

Severance costs in the above schedule, which relate to the workforce reduction programs, include

the cost of related benefits. Specific programs announced during 2004, as part of the overall

restructuring program, will result in the elimination of approximately 3,500 positions. Asset write-downs

relate to the impairment of assets caused by the plant closings. Other costs incurred relate primarily to

contract termination costs associated with the plant closings and the termination of co-manufacturing

agreements.

Implementation Costs:

During 2004, the Company recorded $58 million of pre-tax implementation costs associated with

the restructuring program, of which $7 million was recorded as a reduction of net revenues, $30 million

was recorded in cost of sales, $13 million was recorded in marketing, administration and research costs,

and $8 million related to the sugar confectionery business was recorded in loss from discontinued

operations, on the consolidated statement of earnings. These costs include the discontinuance of

certain product lines and incremental costs related to the integration of functions and closure of facilities.

Approximately $36 million of these costs will require cash payments.

Asset Impairment Charges:

During 2004, the Company completed its annual review of goodwill and intangible assets. This

review resulted in a $29 million non-cash pre-tax charge related to an intangible asset impairment for a

small confectionery business in the United States and certain brands in Mexico. A portion of this charge,

$17 million, relates to the sugar confectionery business and has been recorded in loss from

discontinued operations on the consolidated statement of earnings. The remaining charge was

recorded as asset impairment and exit costs on the consolidated statement of earnings.

In November 2004, the Company completed a valuation of its equity investment in a joint venture in

Turkey following the determination that a non-temporary decline in value had occurred. This valuation

resulted in a $47 million non-cash pre-tax charge. This charge was recorded as marketing,

administration and research costs on the consolidated statement of earnings.

On November 15, 2004, the Company announced the sale of substantially all of its sugar

confectionery business for approximately $1.5 billion. As a result of the anticipated transaction, which is

expected to close in the second quarter of 2005, the Company recorded non-cash asset impairments

totaling $107 million. This charge was included in loss from discontinued operations on the consolidated

statement of earnings.

In December 2004, the Company announced the sale of its yogurt business for approximately

$59 million. As a result of the anticipated transaction, which is expected to close in the first quarter of

2005, the Company recorded asset impairments totaling $8 million. This charge was recorded as asset

impairment and exit costs on the consolidated statement of earnings.

58