Kraft 2004 Annual Report Download - page 38

Download and view the complete annual report

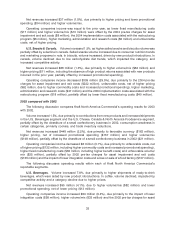

Please find page 38 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Volume decreased 1.1%, due to the divestiture of a Latin American bakery ingredients business in

2002 and a rice business and a branded fresh cheese business in Europe in 2003, the impact of price

competition, particularly in Germany and France, and the adverse impact of a summer heat wave across

Europe on the chocolate and coffee businesses. These declines were partially offset by growth in

developing markets, including Russia, Brazil, Mexico and China, and the acquisitions of a snacks

business in Turkey and a biscuits business in Egypt.

Net revenues increased $802 million (9.2%), due primarily to favorable currency ($564 million),

higher pricing ($320 million, reflecting higher commodity and currency devaluation-driven cost

increases in Latin America) and the impact of acquisitions ($57 million), partially offset by lower

volume/mix ($73 million) and the impact of divestitures ($66 million).

Operating companies income decreased $73 million (5.0%), due primarily to higher marketing,

administration and research costs ($90 million, including higher benefit costs and infrastructure

investment in developing markets), the net impact of lower gains on sales of businesses ($41 million),

lower volume/mix ($39 million) and the impact of divestitures ($13 million), partially offset by favorable

currency ($61 million), higher pricing, net of cost increases ($24 million, including fixed manufacturing

costs), the 2002 pre-tax charges for integration costs ($17 million) and the impact of acquisitions

($7 million).

The following discusses operating results within each of Kraft International Commercial’s reportable

segments.

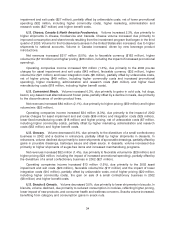

Europe, Middle East & Africa. Volume increased 0.3%, due to growth in the Central and Eastern

Europe, Middle East & Africa region, which benefited from the acquisition of a biscuits business in Egypt

in 2003, as well as a snacks business acquisition in Turkey during the third quarter of 2002, and new

product introductions. These gains were partially offset by the impact of the summer heat wave across

Europe on the chocolate and coffee businesses, price competition in Germany and France, and the

divestiture of a rice business and a branded fresh cheese business in Europe in 2003. In snacks, volume

increased in biscuits and salted snacks, benefiting from acquisitions, partially offset by lower

confectionery volume due to the summer heat wave across Europe and price competition. In beverages,

volume declined, due primarily to the summer heat wave across Europe (which had an adverse impact

on coffee shipments) and price competition. These declines were partially offset by increased coffee

shipments in Russia, benefiting from expanded distribution, and Poland, aided by new product

introductions. Convenient meals volume also declined, due to the divestiture of a rice business in

Europe, partially offset by higher shipments of canned meats in Italy. Cheese volume declined, due

primarily to the impact of price competition in Germany and Spain, partially offset by gains in cream

cheese in Italy.

Net revenues increased $840 million (13.6%), due primarily to favorable currency ($804 million), the

impact of acquisitions ($57 million) and higher pricing ($18 million), partially offset by unfavorable

volume/mix ($41 million).

Operating companies income increased $49 million (5.1%), due primarily to favorable currency

($100 million) and the gain on the sale of a rice business and a branded fresh cheese business in Europe

($31 million), partially offset by unfavorable costs, net of higher pricing ($40 million, including higher

commodity costs and increased promotional spending), unfavorable volume/mix ($26 million) and

higher marketing, administration and research costs ($19 million, including higher benefit costs and

infrastructure investment in eastern Europe).

Latin America & Asia Pacific. Volume decreased 3.0%, due to the divestiture of a Latin American

bakery ingredients business in 2002, partially offset by growth in Brazil, Mexico, Argentina, Australia and

China. In grocery, volume declined in Latin America, due primarily to the sale of a bakery ingredients

business in the fourth quarter of 2002. In beverages, volume increased due primarily to growth in Brazil,

37