Kraft 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

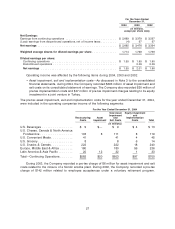

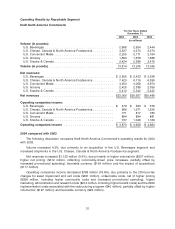

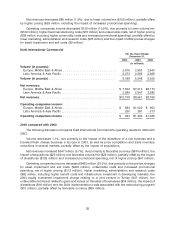

Approximately 700 employees elected to retire or terminate employment under the program. These

charges were included in the operating companies income of the following segments:

For the Years Ended

December 31,

2003 2002

(in millions)

U.S. Beverages .......................................... $ 27

U.S. Cheese, Canada & North America Foodservice ................ 43

U.S. Convenient Meals ..................................... 36

U.S. Grocery ............................................ 20

U.S. Snacks & Cereals ..................................... 9

Europe, Middle East & Africa ................................. $6 5

Latin America & Asia Pacific ................................. 2

Asset impairment and exit costs ............................. $6 $142

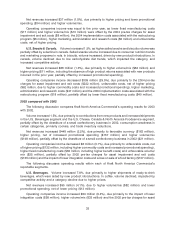

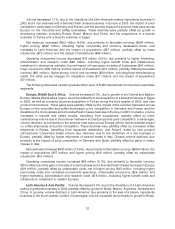

•Losses (Gains) on Sales of Businesses—During 2004, the Company sold a Brazilian snack nuts

business and trademarks associated with a candy business in Norway for aggregate pre-tax

losses of $3 million. During 2003, the Company sold a European rice business and a branded

fresh cheese business in Italy for aggregate pre-tax gains of $31 million. During 2002, the

Company sold its Latin American yeast and industrial bakery ingredients business, resulting in a

pre-tax gain of $69 million, and several small food businesses, resulting in pre-tax gains of

$11 million. These pre-tax losses (gains) were included in the operating companies income of the

following segments:

For the Years Ended

December 31,

2004 2003 2002

(in millions)

U.S. Grocery ........................................... $— $— $ (8)

Europe, Middle East & Africa ................................ (5) (31)

Latin America & Asia Pacific ................................ 8 (72)

Losses (gains) on sales of businesses ......................... $ 3 $(31) $(80)

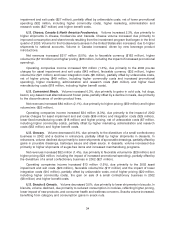

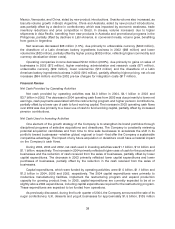

•Integration Costs and a Loss on Sale of a Food Factory—During 2003, the Company reversed

$13 million related to integration charges recorded in 2002 and 2001. During 2002, the Company

recorded pre-tax integration-related charges of $115 million to consolidate production lines in

North America, close a Kraft facility and for other consolidation programs. In addition, during

2002, the Company reversed $4 million related to the loss on sale of a food factory. These items

were included in the operating companies income of the following segments:

For the Years Ended

December 31,

2003 2002

(in millions)

U.S. Beverages .......................................... $ (3) $ 55

U.S. Cheese, Canada & North America Foodservice ................ (1) 7

U.S. Convenient Meals ..................................... (2) 27

U.S. Grocery ............................................ (7) 3

U.S. Snacks & Cereals ..................................... 2

Latin America & Asia Pacific ................................. 17

Integration costs and a loss on sale of a food factory ............. $(13) $111

28