Kraft 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

consolidated balance sheets as a reduction of earnings reinvested in the business, was $190 million and

$129 million at December 31, 2004 and 2003, respectively.

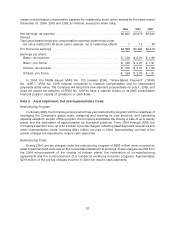

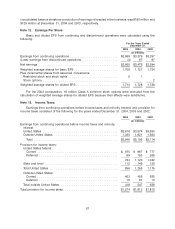

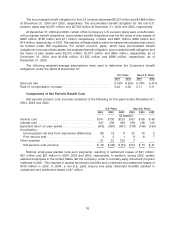

Note 12. Earnings Per Share:

Basic and diluted EPS from continuing and discontinued operations were calculated using the

following:

For the Years Ended

December 31,

2004 2003 2002

(in millions)

Earnings from continuing operations .......................... $2,669 $3,379 $3,297

(Loss) earnings from discontinued operations .................... (4) 97 97

Net earnings ........................................... $2,665 $3,476 $3,394

Weighted average shares for basic EPS ........................ 1,709 1,727 1,734

Plus incremental shares from assumed conversions:

Restricted stock and stock rights ........................... 5 1

Stock options ......................................... 2

Weighted average shares for diluted EPS ....................... 1,714 1,728 1,736

For the 2003 computation, 18 million Class A common stock options were excluded from the

calculation of weighted average shares for diluted EPS because their effects were antidilutive.

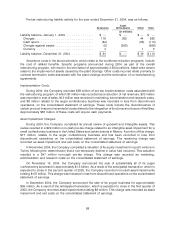

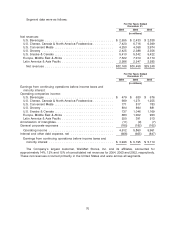

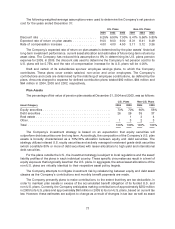

Note 13. Income Taxes:

Earnings from continuing operations before income taxes and minority interest, and provision for

income taxes consisted of the following for the years ended December 31, 2004, 2003 and 2002:

2004 2003 2002

(in millions)

Earnings from continuing operations before income taxes and minority

interest:

United States ......................................... $2,616 $3,574 $3,550

Outside United States ................................... 1,330 1,621 1,564

Total .............................................. $3,946 $5,195 $5,114

Provision for income taxes:

United States federal:

Current ............................................ $ 675 $ 967 $ 777

Deferred ........................................... 69 153 265

744 1,120 1,042

State and local ........................................ 112 145 133

Total United States ..................................... 856 1,265 1,175

Outside United States:

Current ............................................ 403 456 625

Deferred ........................................... 15 91 13

Total outside United States ................................ 418 547 638

Total provision for income taxes .............................. $1,274 $1,812 $1,813

67