Kraft 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

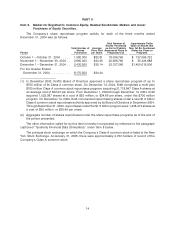

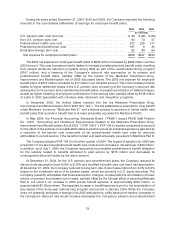

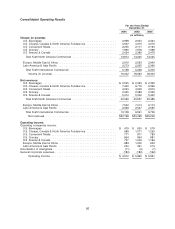

December 31, 2004 from the year ended December 31, 2003 were due primarily to the following (in

millions, except per share data):

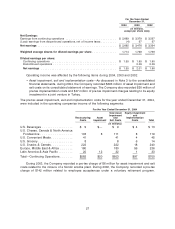

Earnings from Diluted EPS from

Continuing Operations Continuing Operations

For the year ended December 31, 2003 ............ $3,379 $1.95

Asset impairment, exit and implementation costs ...... (459) (0.27)

Lower effective income tax rate ................... 106 0.06

Currency ................................... 64 0.04

Gains on sales of businesses, net ................. (22) (0.01)

Shares outstanding ........................... 0.01

Operations ................................. (399) (0.23)

For the year ended December 31, 2004 ............ $2,669 $1.55

See discussion of events affecting the comparability of statement of earnings amounts in the

Consolidated Operating Results section of the following Discussion and Analysis.

The unfavorable impact of asset impairment, exit and implementation costs on net earnings and

diluted EPS is due primarily to the following:

Restructuring Program—In January 2004, the Company announced a three-year restructuring

program. As part of this program, the Company anticipates the closing or sale of up to twenty plants and

the elimination of approximately six thousand positions. From 2004 through 2006, the Company expects

to incur up to $1.2 billion in pre-tax charges, reflecting asset disposals, severance and other

implementation costs, including pre-tax charges of $641 million incurred in 2004. Included in the

$641 million are asset impairment and exit costs of $583 million for the restructuring program and

$58 million of implementation costs associated with the restructuring program, of which $8 million was

included in loss from discontinued operations on the consolidated statement of earnings.

In November 2004, the Company completed a valuation of its equity investment in a joint venture in

Turkey following the determination that a non-temporary decline in value had occurred. This valuation

resulted in a $47 million non-cash pre-tax charge.

For further details, see Note 3 to the Consolidated Financial Statements and the Business

Environment section of the following Discussion and Analysis.

Lower Effective Income Tax Rate—The Company’s reported effective income tax rate decreased by

2.6 percentage points to 32.3%, resulting from an $81 million favorable resolution of an outstanding tax

item, the majority of which occurred in the third quarter of 2004, and the reversal of $35 million of tax

accruals that are no longer required due to tax events that occurred during the first quarter of 2004.

Currency—The favorable currency impact on net earnings and diluted EPS is due primarily to the

weakness of the U.S. dollar versus the euro and the Canadian dollar.

Continuing Operations—The decrease in results from continuing operations was due primarily to

the following:

• Lower income at Kraft North America Commercial, reflecting higher commodity costs, increased

promotional programs and higher benefit costs, partially offset by higher pricing and favorable

volume/mix.

• Lower income at Kraft International Commercial, reflecting higher costs, including benefits,

promotional programs and commodity costs.

17