Kraft 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.KRAFT FOODS INC. and SUBSIDIARIES

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

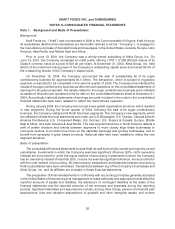

Note 1. Background and Basis of Presentation:

Background:

Kraft Foods Inc. (‘‘Kraft’’) was incorporated in 2000 in the Commonwealth of Virginia. Kraft, through

its subsidiaries (Kraft and its subsidiaries are hereinafter referred to as the ‘‘Company’’), is engaged in

the manufacture and sale of branded foods and beverages in the United States, Canada, Europe, Latin

America, Asia Pacific and Middle East and Africa.

Prior to June 13, 2001, the Company was a wholly-owned subsidiary of Altria Group, Inc. On

June 13, 2001, the Company completed an initial public offering (‘‘IPO’’) of 280,000,000 shares of its

Class A common stock at a price of $31.00 per share. At December 31, 2004, Altria Group, Inc. held

98.0% of the combined voting power of the Company’s outstanding capital stock and owned 85.4% of

the outstanding shares of the Company’s capital stock.

On November 15, 2004, the Company announced the sale of substantially all of its sugar

confectionery business for approximately $1.5 billion. The transaction, which is subject to regulatory

approval, is expected to be completed in the second quarter of 2005. The Company has reflected the

results of its sugar confectionery business as discontinued operations on the consolidated statements of

earnings for all years presented. The assets related to the sugar confectionery business were reflected

as assets of discontinued operations held for sale on the consolidated balance sheet at December 31,

2004. Accordingly, historical statements of earnings amounts included in the notes to the consolidated

financial statements have been restated to reflect the discontinued operation.

During January 2004, the Company announced a new global organization structure, which resulted

in new segments. During the fourth quarter of 2004, following the sale of its sugar confectionery

business, the Company realigned its North American segments. The Company’s new segments, which

are reflected in these financial statements and notes, are U.S. Beverages; U.S. Cheese, Canada & North

America Foodservice; U.S. Convenient Meals; U.S. Grocery; U.S. Snacks & Cereals; Europe, Middle

East & Africa; and Latin America & Asia Pacific. The new segment structure in North America reflects a

shift of certain divisions and brands between segments to more closely align these businesses to

consumer sectors, to provide more focus on the separate beverage and grocery businesses, and to

benefit from synergies in grain based products. Historical data have been restated to reflect the new

segment structure.

Basis of presentation:

The consolidated financial statements include Kraft, as well as its wholly-owned and majority-owned

subsidiaries. Investments in which the Company exercises significant influence (20%—50% ownership

interest) are accounted for under the equity method of accounting. Investments in which the Company

has an ownership interest of less than 20%, or does not exercise significant influence, are accounted for

with the cost method of accounting. All intercompany transactions and balances between and among

Kraft’s subsidiaries have been eliminated. Transactions between any of the Company’s businesses and

Altria Group, Inc. and its affiliates are included in these financial statements.

The preparation of financial statements in conformity with accounting principles generally accepted

in the United States of America requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities, the disclosure of contingent liabilities at the dates of the

financial statements and the reported amounts of net revenues and expenses during the reporting

periods. Significant estimates and assumptions include, among other things, pension and benefit plan

assumptions, lives and valuation assumptions of goodwill and other intangible assets, and income

52