Kraft 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

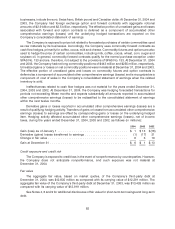

Note 16. Additional Information:

The amounts shown below are for continuing operations.

For the Years Ended

December 31,

2004 2003 2002

(in millions)

Research and development expense ........................ $ 388 $ 374 $ 354

Advertising expense .................................... $1,258 $1,142 $1,111

Interest and other debt expense, net:

Interest (income) expense, Altria Group, Inc. and affiliates ....... $ (2) $ 31 $ 243

Interest expense, external debt .......................... 679 647 611

Interest income ..................................... (11) (13) (7)

$ 666 $ 665 $ 847

Rent expense ........................................ $ 448 $ 450 $ 436

Minimum rental commitments under non-cancelable operating leases in effect at December 31,

2004, were as follows (in millions):

2005 ............................................................... $ 283

2006 ............................................................... 221

2007 ............................................................... 182

2008 ............................................................... 132

2009 ............................................................... 99

Thereafter ........................................................... 193

$1,110

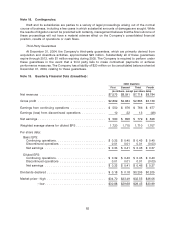

Note 17. Financial Instruments:

Derivative financial instruments

The Company operates globally, with manufacturing and sales facilities in various locations around

the world, and utilizes certain financial instruments to manage its foreign currency and commodity

exposures. Derivative financial instruments are used by the Company, principally to reduce exposures to

market risks resulting from fluctuations in foreign exchange rates and commodity prices by creating

offsetting exposures. The Company is not a party to leveraged derivatives and, by policy, does not use

financial instruments for speculative purposes. Financial instruments qualifying for hedge accounting

must maintain a specified level of effectiveness between the hedging instrument and the item being

hedged, both at inception and throughout the hedged period. The Company formally documents the

nature of and relationships between the hedging instruments and hedged items, as well as its

risk-management objectives, strategies for undertaking the various hedge transactions and method of

assessing hedge effectiveness. Additionally, for hedges of forecasted transactions, the significant

characteristics and expected terms of the forecasted transaction must be specifically identified, and it

must be probable that each forecasted transaction will occur. If it were deemed probable that the

forecasted transaction will not occur, the gain or loss would be recognized in earnings currently.

The Company uses forward foreign exchange contracts and foreign currency options to mitigate its

exposure to changes in exchange rates from third-party and intercompany actual and forecasted

transactions. Substantially all of the Company’s derivative financial instruments are effective as hedges.

The primary currencies to which the Company is exposed, based on the size and location of its

81