Kraft 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

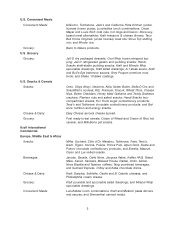

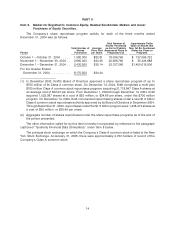

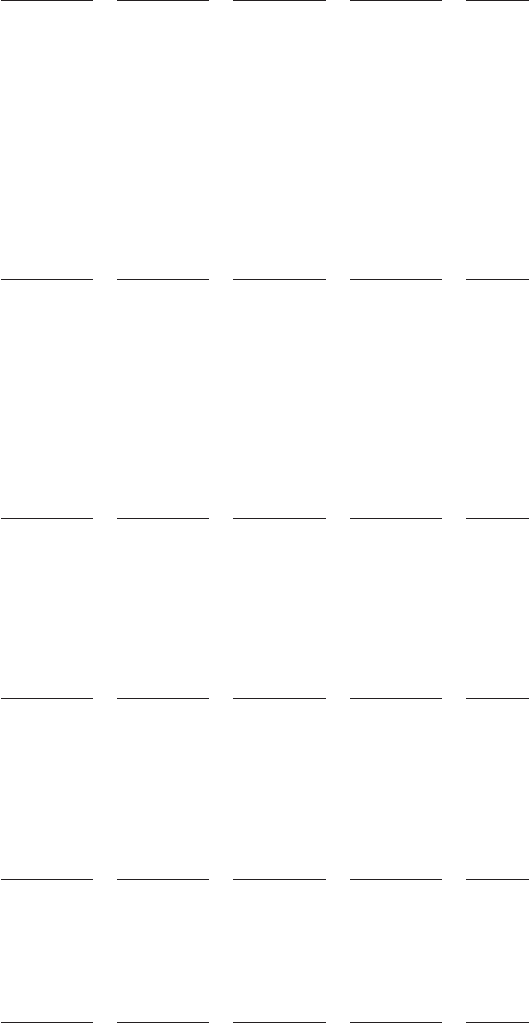

Item 6. Selected Financial Data.

KRAFT FOODS INC.

Selected Financial Data—Five Year Review (in millions of dollars, except per share data)

2004 2003 2002 2001 2000

Summary of Operations:

Net revenues ..................... $ 32,168 $ 30,498 $ 29,248 $ 28,731 $22,720

Cost of sales ..................... 20,281 18,531 17,463 17,310 13,872

Operating income .................. 4,612 5,860 5,961 4,717 3,933

Interest and other debt expense, net ...... 666 665 847 1,437 597

Earnings from continuing operations, before

income taxes and minority interest ...... 3,946 5,195 5,114 3,280 3,336

Pre-tax profit margin from continuing

operations ...................... 12.3% 17.0% 17.5% 11.4% 14.7%

Provision for income taxes ............ 1,274 1,812 1,813 1,484 1,380

Minority interest in earnings from continuing

operations, net ................... 3 4 4 — —

(Loss) earnings from discontinued

operations, net of income taxes ....... (4) 97 97 86 45

Net earnings ...................... 2,665 3,476 3,394 1,882 2,001

Basic EPS:

Continuing operations .............. 1.56 1.95 1.90 1.12 1.35

Discounted operations .............. — 0.06 0.06 0.05 0.03

Net earnings .................... 1.56 2.01 1.96 1.17 1.38

Diluted EPS:

Continuing operations .............. 1.55 1.95 1.90 1.12 1.35

Discontinued operations ............ — 0.06 0.06 0.05 0.03

Net earnings .................... 1.55 2.01 1.96 1.17 1.38

Dividends declared per share .......... 0.77 0.66 0.56 0.26 —

Weighted average shares (millions)—Basic . 1,709 1,727 1,734 1,610 1,455

Weighted average shares (millions)—Diluted 1,714 1,728 1,736 1,610 1,455

Capital expenditures ................ 1,006 1,085 1,184 1,101 906

Depreciation ...................... 868 804 709 680 499

Property, plant and equipment, net ....... 9,985 10,155 9,559 9,109 9,405

Inventories ....................... 3,447 3,343 3,382 3,026 3,041

Total assets ...................... 59,928 59,285 57,100 55,798 52,071

Long-term debt .................... 9,723 11,591 10,416 8,134 2,695

Notes payable to Altria Group, Inc. and

affiliates ....................... — — 2,560 5,000 21,407

Total debt ........................ 12,518 13,462 14,443 16,007 25,826

Total deferred income taxes ............ 5,101 5,175 4,917 4,565 942

Shareholders’ equity ................ 29,911 28,530 25,832 23,478 14,048

Common dividends declared as a % of

Basic EPS ...................... 49.4% 32.8% 28.6% 22.2% —

Common dividends declared as a % of

Diluted EPS ..................... 49.7% 32.8% 28.6% 22.2% —

Book value per common share outstanding . 17.54 16.57 14.92 13.53 9.65

Market price per Class A common share—

high/low ....................... 36.06-29.45 39.40-26.35 43.95-32.50 35.57-29.50 —

Closing price of Class A common share at

year end ....................... 35.61 32.22 38.93 34.03 —

Price/earnings ratio at year end—Basic .... 23 16 20 29 —

Price/earnings ratio at year end—Diluted . . . 23 16 20 29 —

Number of common shares outstanding at

year end (millions) ................ 1,705 1,722 1,731 1,735 1,455

Number of employees ............... 98,000 106,000 109,000 114,000 117,000

15