Kraft 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The (loss) earnings from discontinued operations for the year ended December 31, 2004 included a

deferred income tax benefit of $43 million. The Company also anticipates additional tax expense of

approximately $270 million in 2005, once the sale of its sugar confectionery business has been

consummated.

At December 31, 2004, applicable United States federal income taxes and foreign withholding taxes

have not been provided on approximately $3.8 billion of accumulated earnings of foreign subsidiaries

that are expected to be permanently reinvested.

On October 22, 2004, the American Jobs Creation Act (‘‘the Jobs Act’’) was signed into law. The

Jobs Act includes a deduction for 85% of certain foreign earnings that are repatriated. The Company

may elect to apply this provision to qualifying earnings repatriations in 2005 and is conducting analyses

of its effects. The U.S. Treasury Department recently provided additional clarifying language on key

elements of the provision, which is under consideration as part of the Company’s evaluation. The

Company expects to complete its evaluation of the effects of the repatriation provision within a

reasonable period of time. The Company does not expect the repatriation provisions of the Jobs Act to

have a significant impact on its consolidated results of operations or its consolidated cash flows.

The Jobs Act also provides tax relief to U.S. domestic manufacturers by providing a tax deduction

up to 9% of the lesser of ‘‘qualified production activities income’’ or taxable income. In December 2004,

the FASB issued FASB Staff Position 109-1, ‘‘Application of FASB Statement No. 109, ‘‘Accounting for

Income Taxes,’ to the Tax Deduction on Qualified Production Activities Provided by the American Jobs

Creation Act of 2004’’ (‘‘FSP 109-1’’). FSP 109-1 requires companies to account for this deduction as a

‘‘special deduction’’ rather than a rate reduction, in accordance with SFAS No. 109, and therefore, the

Company will recognize these benefits, which are not expected to be significant, in the year earned.

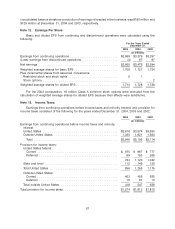

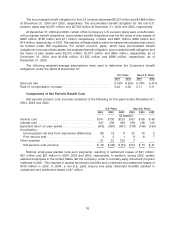

The effective income tax rate on pre-tax earnings differed from the U.S. federal statutory rate for the

following reasons for the years ended December 31, 2004, 2003 and 2002:

2004 2003 2002

U.S. federal statutory rate .................................... 35.0% 35.0% 35.0%

Increase (decrease) resulting from:

State and local income taxes, net of federal tax benefit ............. 1.8 1.8 1.7

Reversal of taxes no longer required .......................... (2.9)

Other ................................................ (1.6) (1.9) (1.2)

Effective tax rate .......................................... 32.3% 34.9% 35.5%

The tax provision in 2004 includes an $81 million favorable resolution of an outstanding tax item, the

majority of which occurred in the third quarter of 2004, and the reversal of $35 million of tax accruals that

are no longer required due to tax events that occurred during the first quarter of 2004.

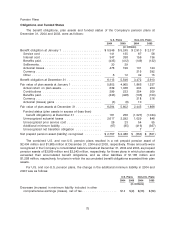

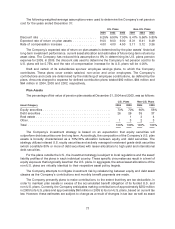

The tax effects of temporary differences that gave rise to deferred income tax assets and liabilities

consisted of the following at December 31, 2004 and 2003:

2004 2003

(in millions)

Deferred income tax assets:

Accrued postretirement and postemployment benefits .................. $ 823 $ 809

Other ..................................................... 390 392

Total deferred income tax assets ............................... 1,213 1,201

Deferred income tax liabilities:

Trade names ............................................... (3,545) (3,839)

Property, plant and equipment ................................... (1,751) (1,636)

Prepaid pension costs ........................................ (1,018) (901)

Total deferred income tax liabilities .............................. (6,314) (6,376)

Net deferred income tax liabilities .................................. $(5,101) $(5,175)

68