Kraft 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

assessed that the billings are reasonable based on the level of support provided by Altria Corporate

Services, Inc., and that they reflect all services provided. The cost and nature of the services are

reviewed annually by the Company’s Audit Committee, which is comprised of independent directors.

The effects of these transactions are included in operating cash flows in the Company’s consolidated

statements of cash flows.

In December 2004, the Company purchased two corporate aircraft from Altria Corporate

Services, Inc. for an aggregate purchase price of approximately $47 million. The Company also entered

into an Aircraft Management Agreement with Altria Corporate Services, Inc. in December 2004, pursuant

to which Altria Corporate Services, Inc. agreed to perform aircraft management, pilot services,

maintenance and other aviation services for the Company.

During 2004, Altria Corporate Services, Inc. provided to the Company certain financial services,

including payroll and accounts payable processing, at a cost of approximately $25 million, which was

included in the $310 million charge shown above. Beginning in 2005, the Company will perform these

functions for itself at a similar cost.

At December 31, 2004 and 2003, the Company had short-term amounts payable to Altria

Group, Inc. of $227 million and $543 million, respectively. Interest on these borrowings is based on the

applicable London Interbank Offered Rate.

The fair values of the Company’s short-term amounts due to Altria Group, Inc. and affiliates

approximate carrying amounts.

Note 5. Divestitures:

Discontinued Operations:

On November 15, 2004, the Company announced the sale of substantially all of its sugar

confectionery business for approximately $1.5 billion. The proposed sale includes the Life Savers,

Creme Savers, Altoids, Trolli and Sugus brands. The transaction, which is subject to regulatory approval,

is expected to be completed in the second quarter of 2005. The Company has reflected the results of its

sugar confectionery business as discontinued operations on the consolidated statements of earnings

for all years presented. Pursuant to the sugar confectionery sale agreement, the Company has agreed to

provide certain transition and supply services to the buyer. These service arrangements are primarily for

terms of one year or less, with the exception of one supply arrangement with a term of not more than

three years. The expected cash flow from this supply arrangement is not significant.

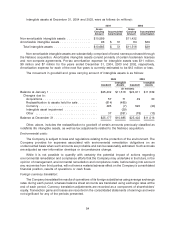

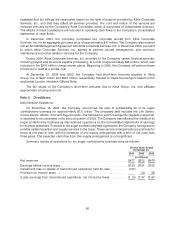

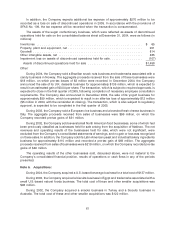

Summary results of operations for the sugar confectionery business were as follows:

For the Years Ended

December 31,

2004 2003 2002

(in millions)

Net revenues ............................................... $477 $512 $475

Earnings before income taxes ................................... $103 $151 $153

Impairment loss on assets of discontinued operations held for sale ........ (107)

Provision for income taxes ..................................... 54 56

(Loss) earnings from discontinued operations, net of income taxes ........ $ (4) $ 97 $ 97

60