Kraft 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. Management’s Discussion and Analysis of Financial Condition and Results of

Operation.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Description of the Company

The Company manufactures and markets packaged food products, consisting principally of

beverages, cheese, snacks, convenient meals and various packaged grocery products. Kraft manages

and reports operating results through two units, Kraft North America Commercial and Kraft International

Commercial. Reportable segments for Kraft North America Commercial are organized and managed

principally by product category. Kraft International Commercial’s operations are organized and

managed by geographic location. At December 31, 2004, Altria Group, Inc. held 98.0% of the combined

voting power of Kraft’s outstanding capital stock and owned 85.4% of the outstanding shares of Kraft’s

capital stock.

On November 15, 2004, the Company announced the sale of substantially all of its sugar

confectionery business for approximately $1.5 billion. The transaction, which is subject to regulatory

approval, is expected to be completed in the second quarter of 2005. The Company has reflected the

results of its sugar confectionery business as discontinued operations on the consolidated statements of

earnings for all years presented. Accordingly, historical statements of earnings amounts included in

Management’s Discussion and Analysis of Financial Condition and Results of Operations have been

restated to reflect the discontinued operation. The assets related to the sugar confectionery business

were reflected as assets of discontinued operations held for sale on the consolidated balance sheet at

December 31, 2004.

During January 2004, the Company announced a new global organization structure, which resulted

in new segments. During the fourth quarter of 2004, following the sale of its sugar confectionery

business, the Company realigned its North American segments. Kraft North America Commercial’s new

segments, which are reflected in this Management’s Discussion and Analysis, are U.S. Beverages;

U.S. Cheese, Canada & North America Foodservice; U.S. Convenient Meals; U.S. Grocery; and

U.S. Snacks & Cereals. Kraft International Commercial’s segments are Europe, Middle East & Africa; and

Latin America & Asia Pacific. The new segment structure in North America reflects a shift of certain

divisions and brands between segments to more closely align these businesses to consumer sectors, to

provide more focus on the separate beverage and grocery businesses, and to benefit from synergies in

grain based products. Historical data have been restated to reflect the new segment structure.

Executive Summary

The following executive summary is intended to provide significant highlights of the Discussion and

Analysis that follows.

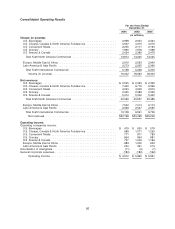

Consolidated Operating Results—The changes in the Company’s earnings from continuing

operations and diluted earnings per share (‘‘EPS’’) from continuing operations for the year ended

16