Kraft 2004 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

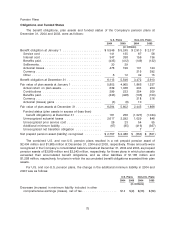

performance significantly above or below the assumed long-term rate of return on pension assets, or

significant changes in interest rates.

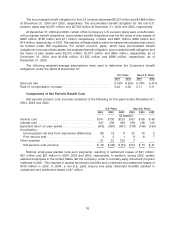

The estimated future benefit payments from the Company’s pension plans at December 31, 2004,

were as follows:

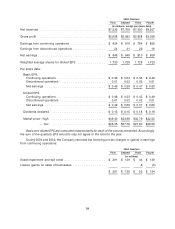

U.S. Plans Non-U.S. Plans

(in millions)

2005 ............................................... $390 $160

2006 ............................................... 385 162

2007 ............................................... 380 166

2008 ............................................... 377 170

2009 ............................................... 387 175

2010-2014 ........................................... 2,355 941

Postretirement Benefit Plans

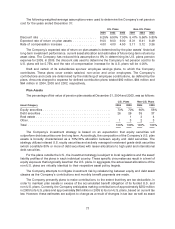

Net postretirement health care costs consisted of the following for the years ended December 31,

2004, 2003 and 2002:

2004 2003 2002

(in millions)

Service cost ................................................ $ 43 $ 41 $ 32

Interest cost ................................................ 173 173 168

Amortization:

Unrecognized net loss from experience differences .................. 46 40 21

Unrecognized prior service cost ................................ (25) (25) (20)

Other expense .............................................. 16

Net postretirement health care costs ............................. $237 $229 $217

During 2002, certain salaried employees in the United States left the Company under a voluntary

early retirement program instituted in 2001. This resulted in curtailment losses of $16 million in 2002,

which are included in other expense above.

In December 2003, the United States enacted into law the Medicare Prescription Drug,

Improvement and Modernization Act of 2003 (the ‘‘Act’’). The Act establishes a prescription drug benefit

under Medicare, known as ‘‘Medicare Part D,’’ and a federal subsidy to sponsors of retiree health care

benefit plans that provide a benefit that is at least actuarially equivalent to Medicare Part D.

In May 2004, the FASB issued FASB Staff Position No. 106-2, ‘‘Accounting and Disclosure

Requirements Related to the Medicare Prescription Drug, Improvement and Modernization Act of 2003’’

(‘‘FSP 106-2’’). FSP 106-2 requires companies to account for the effect of the subsidy on benefits

attributable to past service as an actuarial experience gain and as a reduction of the service cost

component of net postretirement health care costs for amounts attributable to current service, if the

benefit provided is at least actuarially equivalent to Medicare Part D.

The Company adopted FSP 106-2 in the third quarter of 2004. The impact of adoption for 2004 was

a reduction of pre-tax net postretirement health care costs and an increase in net earnings of $24 million,

which is included above as a reduction of $3 million in service cost, $10 million in interest cost and

$11 million in amortization of unrecognized net loss from experience differences. In addition, as of July 1,

2004, the Company reduced its accumulated postretirement benefit obligation for the subsidy related to

benefits attributed to past service by $315 million and decreased its unrecognized actuarial losses by the

same amount.

78