Kraft 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

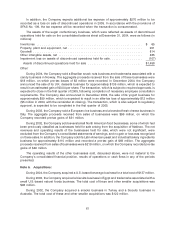

In addition, the Company expects additional tax expense of approximately $270 million to be

recorded as a loss on sale of discontinued operations in 2005. In accordance with the provisions of

SFAS No. 109, the tax expense will be recorded when the transaction is consummated.

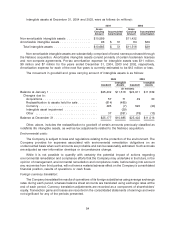

The assets of the sugar confectionery business, which were reflected as assets of discontinued

operations held for sale on the consolidated balance sheet at December 31, 2004, were as follows (in

millions):

Inventories .......................................................... $ 65

Property, plant and equipment, net ......................................... 201

Goodwill ............................................................ 814

Other intangible assets, net .............................................. 485

Impairment loss on assets of discontinued operations held for sale .................. (107)

Assets of discontinued operations held for sale .............................. $1,458

Other:

During 2004, the Company sold a Brazilian snack nuts business and trademarks associated with a

candy business in Norway. The aggregate proceeds received from the sale of these businesses were

$18 million, on which pre-tax losses of $3 million were recorded. In December 2004, the Company

announced the sale of its U.K. desserts business for approximately $135 million, which is expected to

result in an estimated gain of $0.04 per share. The transaction, which is subject to required approvals, is

expected to close in the first quarter of 2005, following completion of necessary employee consultation

requirements. The Company also announced in December 2004, the sale of its yogurt business for

approximately $59 million, which is expected to result in an after-tax loss of approximately $12 million

($5 million in 2004, with the remainder at closing). The transaction, which is also subject to regulatory

approval, is expected to be completed in the first quarter of 2005.

During 2003, the Company sold a European rice business and a branded fresh cheese business in

Italy. The aggregate proceeds received from sales of businesses were $96 million, on which the

Company recorded pre-tax gains of $31 million.

During 2002, the Company sold several small North American food businesses, some of which had

been previously classified as businesses held for sale arising from the acquisition of Nabisco. The net

revenues and operating results of the businesses held for sale, which were not significant, were

excluded from the Company’s consolidated statements of earnings, and no gain or loss was recognized

on these sales. In addition, the Company sold its Latin American yeast and industrial bakery ingredients

business for approximately $110 million and recorded a pre-tax gain of $69 million. The aggregate

proceeds received from sales of businesses were $219 million, on which the Company recorded pre-tax

gains of $80 million.

The operating results of the other businesses sold, discussed above, were not material to the

Company’s consolidated financial position, results of operations or cash flows in any of the periods

presented.

Note 6. Acquisitions:

During 2004, the Company acquired a U.S.-based beverage business for a total cost of $137 million.

During 2003, the Company acquired a biscuits business in Egypt and trademarks associated with a

small U.S.-based natural foods business. The total cost of these and other smaller acquisitions was

$98 million.

During 2002, the Company acquired a snacks business in Turkey and a biscuits business in

Australia. The total cost of these and other smaller acquisitions was $122 million.

61