Kraft 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The effects of these acquisitions were not material to the Company’s consolidated financial position,

results of operations or cash flows in any of the periods presented.

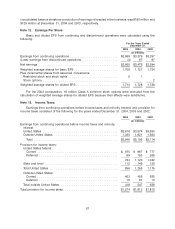

Note 7. Inventories:

The cost of approximately 37% and 39% of inventories in 2004 and 2003, respectively, was

determined using the LIFO method. The stated LIFO amounts of inventories were approximately

$81 million and $155 million higher than the current cost of inventories at December 31, 2004 and 2003,

respectively.

Note 8. Short-Term Borrowings and Borrowing Arrangements:

At December 31, 2004 and 2003, the Company had short-term borrowings of $1,818 million and

$2,453 million, respectively, consisting principally of commercial paper borrowings with an average

year-end interest rate of 2.4% and 1.4%, respectively. Of these amounts, the Company reclassified

$1,900 million at December 31, 2003, of the commercial paper borrowings to long-term debt based

upon its intent and ability to refinance these borrowings on a long-term basis.

The fair values of the Company’s short-term borrowings at December 31, 2004 and 2003, based

upon current market interest rates, approximate the amounts disclosed above.

Following a $10.1 billion judgment on March 21, 2003, against Altria Group, Inc.’s domestic tobacco

subsidiary, Philip Morris USA Inc., the three major credit rating agencies took a series of ratings actions

resulting in the lowering of the Company’s short-term and long-term debt ratings, despite the fact the

Company is neither a party to, nor has exposure to, this litigation. The Company’s credit ratings by

Moody’s at December 31, 2004, were ‘‘P-2’’ for short-term debt and ‘‘A3’’ for long-term-debt, with stable

outlook. The Company’s credit ratings by Standard & Poor’s at December 31, 2004 were ‘‘A-2’’ for

short-term debt and ‘‘BBB+’’ for long-term debt, with stable outlook. The Company’s credit ratings by

Fitch Rating Services at December 31, 2004 were ‘‘F-2’’ for short-term debt and ‘‘BBB+’’ for long-term

debt, with stable outlook. None of the Company’s debt agreements requires accelerated repayment in

the event of a decrease in credit ratings.

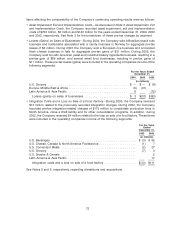

The Company maintains revolving credit facilities that have historically been used to support the

issuance of commercial paper. The 364-day revolving credit facility expires in July 2005, although it

contains a provision allowing the Company to extend the maturity of outstanding borrowings for up to

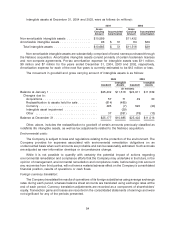

one additional year. At December 31, 2004, credit lines for the Company and the related activity were as

follows (in billions of dollars):

Commercial

Credit Amount Paper

Type Lines Drawn Outstanding

364-day (expires July 2005) ............................... $2.5 $— $—

Multi-year (expires July 2006) .............................. 2.0 1.7

$4.5 $ — $1.7

The Company’s revolving credit facilities, which are for its sole use, require the maintenance of a

minimum net worth of $18.2 billion. At December 31, 2004, the Company’s net worth was $29.9 billion.

The Company expects to continue to meet this covenant. The foregoing revolving credit facilities do not

include any other financial tests, any credit rating triggers or any provisions that could require the

posting of collateral.

In addition to the above, certain international subsidiaries of Kraft maintain uncommitted credit lines

to meet the short-term working capital needs of the international businesses. These credit lines, which

amounted to approximately $600 million as of December 31, 2004, are for the sole use of the Company’s

62