Kraft 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 11. Stock Plans:

Under the 2001 Kraft Performance Incentive Plan (the ‘‘2001 Plan’’), the Company may grant stock

options, stock appreciation rights, restricted stock, reload options and other awards based on the

Company’s Class A common stock, as well as performance-based annual and long-term incentive

awards. A maximum of 75 million shares of the Company’s Class A common stock may be issued under

the 2001 Plan. In addition, the Company may grant up to 500,000 shares of Class A common stock to

members of the Board of Directors who are not full-time employees of the Company or Altria Group, Inc.,

or their subsidiaries, under the Kraft Directors Plan (the ‘‘2001 Directors Plan’’). Shares available to be

granted under the 2001 Plan and the 2001 Directors Plan at December 31, 2004, were 46,707,241 and

458,633, respectively.

The Company applies the intrinsic value-based methodology in accounting for the various stock

plans. Accordingly, no compensation expense has been recognized other than for restricted stock

awards. In December 2004, the FASB issued SFAS No. 123R, which requires companies to measure

compensation cost for share-based payments at fair value. The Company will adopt this new standard

prospectively on July 1, 2005.

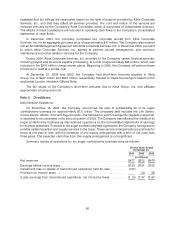

Stock option activity was as follows for the years ended December 31, 2002, 2003 and 2004:

Weighted

Shares Subject Average Options

to Option Exercise Price Exercisable

Balance at January 1, 2002 ..................... 20,770,302 31.00 —

Options granted ............................ 14,030 37.10

Options exercised .......................... (2,000) 31.00

Options canceled ........................... (1,490,660) 31.00

Balance at December 31, 2002 ................... 19,291,672 31.00 696,615

Options exercised .......................... (346,868) 31.00

Options canceled ........................... (663,027) 31.00

Balance at December 31, 2003 ................... 18,281,777 31.00 17,032,740

Options exercised .......................... (1,405,312) 31.00

Options canceled ........................... (687,601) 31.00

Balance at December 31, 2004 ................... 16,188,864 31.00 15,190,716

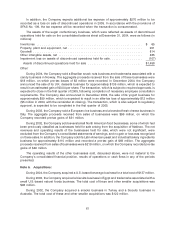

The following table summarizes the status of the Company’s stock options outstanding and

exercisable as of December 31, 2004:

Options Outstanding Options Exercisable

Average Weighted Weighted

Remaining Average Average

Number Contractual Exercise Number Exercise

Range of Exercise Prices Outstanding Life Price Exercisable Price

$30.54—$39.51 .................. 16,188,864 6 years $31.00 15,190,716 $31.00

Prior to the IPO, certain employees of the Company participated in Altria Group, Inc.’s stock

compensation plans. Altria Group, Inc. does not intend to issue additional Altria Group, Inc. stock

compensation to the Company’s employees, except for reloads of previously issued options. Altria

Group, Inc. accounts for its plans in accordance with the intrinsic value-based method permitted by

SFAS No. 123, ‘‘Accounting for Stock-Based Compensation,’’ which did not result in compensation cost

for stock options.

65