Kraft 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

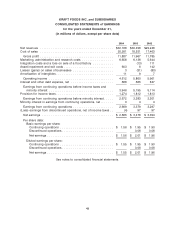

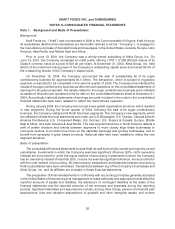

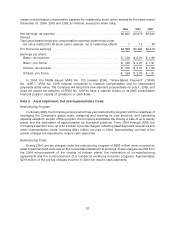

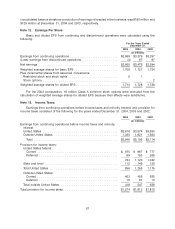

measure stock-based compensation expense for outstanding stock option awards for the years ended

December 31, 2004, 2003 and 2002 (in millions, except per share data):

2004 2003 2002

Net earnings, as reported .................................. $2,665 $3,476 $3,394

Deduct:

Total stock-based employee compensation expense determined under

fair value method for all stock option awards, net of related tax effects 7 12 78

Pro forma net earnings .................................... $2,658 $3,464 $3,316

Earnings per share:

Basic—as reported ..................................... $ 1.56 $ 2.01 $ 1.96

Basic—pro forma ...................................... $ 1.56 $ 2.01 $ 1.91

Diluted—as reported .................................... $ 1.55 $ 2.01 $ 1.96

Diluted—pro forma ..................................... $ 1.55 $ 2.00 $ 1.91

In 2004, the FASB issued SFAS No. 123 (revised 2004), ‘‘Share-Based Payment’’ (‘‘SFAS

No. 123R’’). SFAS No. 123R requires companies to measure compensation cost for share-based

payments at fair value. The Company will adopt this new standard prospectively on July 1, 2005, and

does not expect the adoption of SFAS No. 123R to have a material impact on its 2005 consolidated

financial position, results of operations or cash flows.

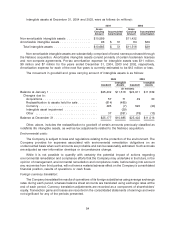

Note 3. Asset Impairment, Exit and Implementation Costs:

Restructuring Program:

In January 2004, the Company announced a three-year restructuring program with the objectives of

leveraging the Company’s global scale, realigning and lowering its cost structure, and optimizing

capacity utilization. As part of this program, the Company anticipates the closing or sale of up to twenty

plants and the elimination of approximately six thousand positions. From 2004 through 2006, the

Company expects to incur up to $1.2 billion in pre-tax charges, reflecting asset disposals, severance and

other implementation costs, including $641 million incurred in 2004. Approximately one-half of the

pre-tax charges are expected to require cash payments.

Restructuring Costs:

During 2004, pre-tax charges under the restructuring program of $583 million were recorded as

asset impairment and exit costs on the consolidated statement of earnings. These charges resulted from

the 2004 announcement of the closing of thirteen plants, the termination of co-manufacturing

agreements and the commencement of a number of workforce reduction programs. Approximately

$216 million of the pre-tax charges incurred in 2004 will require cash payments.

57