Kraft 2004 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 18. Contingencies:

Kraft and its subsidiaries are parties to a variety of legal proceedings arising out of the normal

course of business, including a few cases in which substantial amounts of damages are sought. While

the results of litigation cannot be predicted with certainty, management believes that the final outcome of

these proceedings will not have a material adverse effect on the Company’s consolidated financial

position, results of operations or cash flows.

Third-Party Guarantees

At December 31, 2004, the Company’s third-party guarantees, which are primarily derived from

acquisition and divestiture activities, approximated $25 million. Substantially all of these guarantees

expire through 2013, with $1 million expiring during 2005. The Company is required to perform under

these guarantees in the event that a third party fails to make contractual payments or achieve

performance measures. The Company has a liability of $20 million on its consolidated balance sheet at

December 31, 2004, relating to these guarantees.

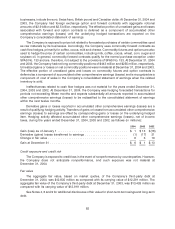

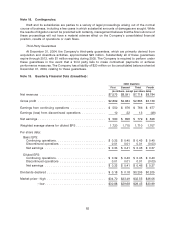

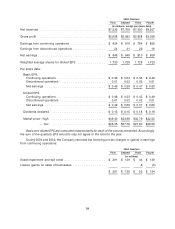

Note 19. Quarterly Financial Data (Unaudited):

2004 Quarters

First Second Third Fourth

(in millions, except per share data)

Net revenues .................................... $7,575 $8,091 $7,718 $8,784

Gross profit ..................................... $2,899 $2,984 $2,865 $3,139

Earnings from continuing operations ................... $ 550 $ 676 $ 766 $ 677

Earnings (loss) from discontinued operations ............. 10 22 13 (49)

Net earnings ..................................... $ 560 $ 698 $ 779 $ 628

Weighted average shares for diluted EPS ................ 1,720 1,715 1,710 1,707

Per share data:

Basic EPS:

Continuing operations ........................... $ 0.32 $ 0.40 $ 0.45 $ 0.40

Discontinued operations ......................... 0.01 0.01 0.01 (0.03)

Net earnings ................................. $ 0.33 $ 0.41 $ 0.46 $ 0.37

Diluted EPS:

Continuing operations ........................... $ 0.32 $ 0.40 $ 0.45 $ 0.40

Discontinued operations ......................... 0.01 0.01 0.01 (0.03)

Net earnings ................................. $ 0.33 $ 0.41 $ 0.46 $ 0.37

Dividends declared ................................ $ 0.18 $ 0.18 $0.205 $0.205

Market price—high ................................ $34.70 $33.49 $32.55 $36.06

—low................................. $30.88 $29.68 $29.45 $30.99

83