Kraft 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Mexico, Venezuela, and China, aided by new product introductions. Snacks volume also increased, as

biscuits volume growth in Brazil, Argentina, China and Australia, aided by new product introductions,

was partially offset by a decline in confectionery, which was impacted by economic weakness, trade

inventory reductions and price competition in Brazil. In cheese, volume increased, due to higher

shipments in Asia Pacific, benefiting from new products in Australia and promotional programs in the

Philippines, partially offset by declines in Latin America. In convenient meals, volume grew, benefiting

from gains in Argentina.

Net revenues decreased $38 million (1.5%), due primarily to unfavorable currency ($240 million),

the divestiture of a Latin American bakery ingredients business in 2002 ($68 million) and lower

volume/mix ($32 million), partially offset by higher pricing ($302 million, reflecting higher commodity and

currency devaluation-driven costs).

Operating companies income decreased $122 million (23.8%), due primarily to gains on sales of

businesses in 2002 ($72 million), higher marketing, administration and research costs ($71 million),

unfavorable currency ($39 million), lower volume/mix ($13 million) and the divestiture of a Latin

American bakery ingredients business in 2002 ($10 million), partially offset by higher pricing, net of cost

increases ($64 million) and the 2002 pre-tax charges for integration costs ($17 million).

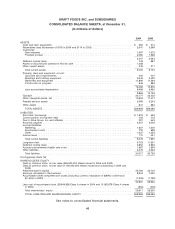

Financial Review

Net Cash Provided by Operating Activities

Net cash provided by operating activities was $4.0 billion in 2004, $4.1 billion in 2003 and

$3.7 billion in 2002. The decrease in 2004 operating cash flows from 2003 was due primarily to lower net

earnings, cash payments associated with the restructuring program and higher pension contributions,

partially offset by a lower use of cash to fund working capital. The increase in 2003 operating cash flows

over 2002 was due primarily to a lower use of cash to fund working capital, partially offset by increased

pension contributions.

Net Cash Used in Investing Activities

One element of the growth strategy of the Company is to strengthen its brand portfolios through

disciplined programs of selective acquisitions and divestitures. The Company is constantly reviewing

potential acquisition candidates and from time to time sells businesses to accelerate the shift in its

portfolio toward businesses—whether global, regional or local—that offer the Company a sustainable

competitive advantage. The impact of any future acquisition or divestiture could have a material impact

on the Company’s cash flows.

During 2004, 2003 and 2002, net cash used in investing activities was $1.1 billion, $1.0 billion and

$1.1 billion, respectively. The increase in 2004 primarily reflected higher uses of cash for the purchase of

businesses and the reduction of cash received from the sales of businesses, partially offset by lower

capital expenditures. The decrease in 2003 primarily reflected lower capital expenditures and lower

purchases of businesses, partially offset by the reduction in the cash received from the sales of

businesses.

Capital expenditures, which were funded by operating activities, were $1.0 billion, $1.1 billion and

$1.2 billion in 2004, 2003 and 2002, respectively. The 2004 capital expenditures were primarily to

modernize manufacturing facilities, implement the restructuring program and expand production

capacity for growing product lines. In 2005, capital expenditures are currently expected to be at or

slightly above 2004 expenditures, including capital expenditures required for the restructuring program.

These expenditures are expected to be funded from operations.

As previously discussed, during the fourth quarter of 2004, the Company announced the sale of its

sugar confectionery, U.K. desserts and yogurt businesses for approximately $1.5 billion, $135 million

38