Kraft 2004 Annual Report Download - page 56

Download and view the complete annual report

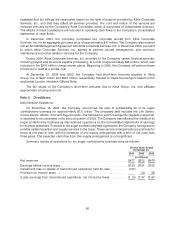

Please find page 56 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Guarantees:

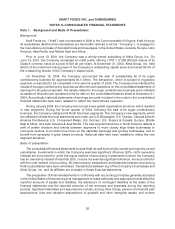

Effective January 1, 2003, the Company adopted Financial Accounting Standards Board (‘‘FASB’’)

Interpretation No. 45, ‘‘Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including

Indirect Guarantees of Indebtedness of Others.’’ Interpretation No. 45 required the disclosure of certain

guarantees existing at December 31, 2002. In addition, Interpretation No. 45 requires the recognition of a

liability for the fair value of the obligation of qualifying guarantee activities initiated or modified after

December 31, 2002. The Company has applied the recognition provisions of Interpretation No. 45 to

guarantee activity initiated after December 31, 2002. Adoption of Interpretation No. 45 as of January 1,

2003 did not have a material impact on the Company’s consolidated financial statements. See Note 18.

Contingencies for a further discussion of guarantees.

Hedging instruments:

Derivative financial instruments are recorded at fair value on the consolidated balance sheets as

either assets or liabilities. Changes in the fair value of derivatives are recorded each period either in

accumulated other comprehensive earnings (losses) or in earnings, depending on whether a derivative

is designated and effective as part of a hedge transaction and, if it is, the type of hedge transaction.

Gains and losses on derivative instruments reported in accumulated other comprehensive earnings

(losses) are reclassified to the consolidated statement of earnings in the periods in which operating

results are affected by the hedged item. Cash flows from hedging instruments are classified in the same

manner as the affected hedged item in the consolidated statements of cash flows.

Impairment of long-lived assets:

The Company reviews long-lived assets, including amortizable intangible assets, for impairment

whenever events or changes in business circumstances indicate that the carrying amount of the assets

may not be fully recoverable. The Company performs undiscounted operating cash flow analyses to

determine if an impairment exists. For purposes of recognition and measurement of an impairment for

assets held for use, the Company groups assets and liabilities at the lowest level for which cash flows are

separately identifiable. If an impairment is determined to exist, any related impairment loss is calculated

based on fair value. Impairment losses on assets to be disposed of, if any, are based on the estimated

proceeds to be received, less costs of disposal.

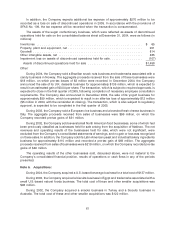

Income taxes:

The Company accounts for income taxes in accordance with Statement of Financial Accounting

Standards (‘‘SFAS’’) No. 109, ‘‘Accounting for Income Taxes.’’ The accounts of the Company are

included in the consolidated federal income tax return of Altria Group, Inc. Income taxes are generally

computed on a separate company basis. To the extent that foreign tax credits, capital losses and other

credits generated by the Company, which cannot currently be utilized on a separate company basis, are

utilized in Altria Group, Inc.’s consolidated federal income tax return, the benefit is recognized in the

calculation of the Company’s provision for income taxes. Based on the Company’s current estimate, this

benefit is calculated to be approximately $70 million, $100 million and $240 million for the years ended

December 31, 2004, 2003 and 2002, respectively. The Company makes payments to, or is reimbursed

by, Altria Group, Inc. for the tax effects resulting from its inclusion in Altria Group, Inc.’s consolidated

federal income tax return. Significant judgment is required in determining income tax provisions and in

evaluating tax positions. The Company establishes additional provisions for income taxes when, despite

the belief that their tax positions are fully supportable, there remain certain positions that are likely to be

challenged and that may not be sustained on review by tax authorities. The Company adjusts these

additional accruals in light of changing facts and circumstances. The consolidated tax provision

includes the impact of changes to accruals that are considered appropriate, as well as the related net

interest.

55