Kraft 2004 Annual Report Download - page 25

Download and view the complete annual report

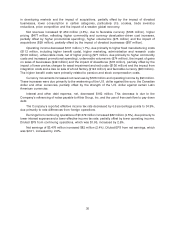

Please find page 25 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The sixth strategy—to strengthen employee and organizational excellence—reflects the need to

develop organizational capabilities and support employees in meeting the Company’s business

challenges, wherever they work. In this regard, during 2004 the Company completed a reorganization

and resource alignment for a new global structure. In addition, a new vision for the organization—to help

people around the world eat and live better—was introduced, while human resource policies, processes

and practices were harmonized across the Company.

The final strategy is to act responsibly. As the Company strives for sustainable growth, it seeks

business success in ways that honor ethical and legal standards and that respect people, communities

and the natural environment. This strategy includes a commitment to strong compliance and integrity

programs and sound corporate governance, as well as a number of health and wellness initiatives, such

as enhanced nutrition labeling, the development and funding of community-based programs and

voluntary limitations on advertising to younger children. It also includes taking steps to contribute to the

sustainability of the Company’s agricultural supply base through several programs with respected

international and local partners. The Company outlines its commitment to corporate responsibility in the

Kraft Code of Conduct for employees and at www.kraft.com/responsibility/home.aspx.

Acquisitions and Dispositions:

One element of the third strategy is to strengthen the Company’s brand portfolios through

disciplined programs of selective acquisitions and divestitures. The Company is constantly reviewing

potential acquisition candidates and from time to time sells businesses to accelerate the shift in its

portfolio toward businesses—whether global, regional or local—that offer the Company a sustainable

competitive advantage. The impact of any future acquisition or divestiture could have a material impact

on the Company’s consolidated financial position, results of operations or cash flows.

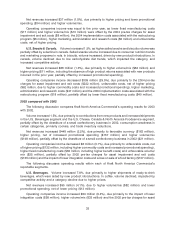

On November 15, 2004, the Company announced the sale of substantially all of its sugar

confectionery business for approximately $1.5 billion. The proposed sale includes the Life Savers,

Creme Savers, Altoids, Trolli and Sugus brands. The transaction, which is subject to regulatory approval,

is expected to be completed in the second quarter of 2005. The Company has reflected the results of its

sugar confectionery business as discontinued operations on the consolidated statements of earnings

for all years presented. The assets related to the sugar confectionery business were reflected as assets

of discontinued operations held for sale on the consolidated balance sheet at December 31, 2004. In

addition, the Company anticipates additional tax expense of approximately $270 million to be recorded

as a loss on sale of discontinued operations in 2005. In accordance with the provisions of SFAS No. 109,

the tax expense will be recorded when the transaction is consummated.

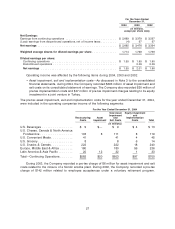

During 2004, the Company acquired a U.S.-based beverage business for a total cost of $137 million.

During 2003, the Company acquired a biscuits business in Egypt and trademarks associated with a

small U.S.-based natural foods business. The total cost of these and other smaller acquisitions was

$98 million. During 2002, the Company acquired a snacks business in Turkey and a biscuits business in

Australia. The total cost of these and other smaller acquisitions was $122 million.

During 2004, the Company sold a Brazilian snack nuts business and trademarks associated with a

candy business in Norway. The aggregate proceeds received from the sale of these businesses were

$18 million, on which pre-tax losses of $3 million were recorded. In December 2004, the Company

announced the sale of its U.K. desserts business for approximately $135 million, which is expected to

result in an estimated gain of $0.04 per share. The transaction closed in the first quarter of 2005. The

Company also announced in December 2004, the sale of its yogurt business for approximately

$59 million, which is expected to result in an after-tax loss of approximately $12 million ($5 million in

2004, with the remainder at closing). The transaction, which is also subject to regulatory approval, is

expected to be completed in the first quarter of 2005.

24