Kraft 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.dependent upon their continued ability to promote brand equity successfully, to anticipate and respond

to new consumer trends, to develop new products and markets, to broaden brand portfolios, to compete

effectively with lower priced products in a consolidating environment at the retail and manufacturing

levels and to improve productivity. The Company’s results are also dependent on its ability to

consummate and successfully integrate acquisitions and to realize the cost savings and improved asset

utilization contemplated by its restructuring program. The Company may, from time to time, divest

businesses that are less of a strategic fit within its portfolio, and its results may be impacted by either the

gains or losses, or lost operating income, from the sales of those businesses. In addition, the Company

is subject to the effects of foreign economies, currency movements, fluctuations in levels of customer

inventories and credit and other business risks related to its customers operating in a challenging

economic and competitive environment. The Company’s results are affected by its access to credit

markets, borrowing costs and credit ratings, which may in turn be influenced by the credit ratings of

Altria Group, Inc. The Company’s benefit expense is subject to the investment performance of pension

plan assets, interest rates and cost increases for medical benefits offered to employees and retirees. The

Company’s assessment of the fair value of its operations for purposes of assessing impairment of

goodwill and intangibles is based on discounting projections of future cash flows and is affected by the

interest rate market and general economic and market conditions. The food industry continues to be

subject to recalls if products become adulterated or misbranded, liability if product consumption causes

injury, ingredient disclosure and labeling laws and regulations and the possibility that consumers could

lose confidence in the safety and quality of certain food products. The food industry is also subject to

concerns and/or regulations regarding genetically modified organisms and the health implications of

obesity and trans-fatty acids. Increased government regulation of the food industry could result in

increased costs to the Company.

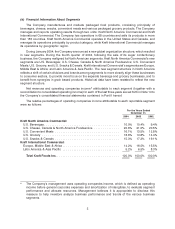

(d) Financial Information About Geographic Areas

The amounts of net revenues, total assets and long-lived assets attributable to each of the

Company’s geographic segments for each of the last three fiscal years are set forth in Note 14 to the

Company’s consolidated financial statements contained in Part II hereof.

Kraft’s subsidiaries export coffee products, grocery products, cheese and processed meats. In

2004, exports from the United States by these subsidiaries amounted to approximately $122 million.

In 2004, the Company had operations and plants or sold products to third-party distributors located

in 14 Middle East countries (as defined by the U.S. Department of State, Bureau of Near Eastern Affairs),

including a biscuit business acquired during 2003 in Egypt. In the region, the Company had operations

and plants in three countries (Egypt, Morocco, and through a majority owned joint venture, Saudi

Arabia). In addition, the Company sold products to third-party distributors located in 11 of these

countries (Algeria, Bahrain, Israel, Jordan, Kuwait, Lebanon, Oman, Qatar, Tunisia, United Arab Emirates

and Yemen). Revenue generated from operations or sales to the third-party distributors in the Middle

East was approximately $250 million in 2004, representing 3.3% of the net revenue of the Europe, Middle

East and Africa segment. In addition, in 2004, the Company entered into agreements with third parties

for the resale of the Company’s products into Iraq, Libya and Syria.

(e) Available Information

The Company is required to file annual, quarterly and special reports, proxy statements and other

information with the SEC. Investors may read and copy any document that the Company files, including

this Annual Report on Form 10-K, at the SEC’s Public Reference Room at 450 Fifth Street, N.W.,

Washington, D.C. 20549. Investors may obtain information on the operation of the Public Reference

Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site at

www.sec.gov that contains reports, proxy and information statements, and other information regarding

issuers that file electronically with the SEC, from which investors can electronically access the

Company’s SEC filings.

11