Kraft 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended December 31, 2004

COMMISSION FILE NUMBER 1-16483

KRAFT FOODS INC.

(Exact name of registrant as specified in its charter)

Virginia 52-2284372

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification No.)

Three Lakes Drive,

Northfield, Illinois 60093

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 847-646-2000

Securities registered pursuant to Section 12(b) of the Act:

Name of each exchange

Title of each class on which registered

Class A Common Stock, no par value New York Stock Exchange

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not

contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the

Act). Yes No

The aggregate market value of the shares of Class A Common Stock held by non-affiliates of the

registrant, computed by reference to the closing price of such stock on June 30, 2004, was

approximately $8 billion. At February 28, 2005, there were 526,741,988 shares of the registrant’s Class A

Common Stock outstanding, and 1,180,000,000 shares of the registrant’s Class B Common Stock

outstanding.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement for use in connection with its annual meeting of

shareholders to be held on April 26, 2005, filed with the Securities and Exchange Commission (the

‘‘SEC’’) on March 4, 2005, are incorporated in Part III hereof and made a part hereof.

Table of contents

-

Page 1

... FILE NUMBER 1-16483 KRAFT FOODS INC. (Exact name of registrant as specified in its charter) Virginia (State or other jurisdiction of incorporation or organization) 52-2284372 (I.R.S. Employer Identification No.) Three Lakes Drive, Northfield, Illinois (Address of principal executive offices... -

Page 2

... States, Canada, Europe, Latin America, Asia Pacific, the Middle East and Africa. Prior to June 13, 2001, Kraft was a wholly owned subsidiary of Altria Group, Inc. On June 13, 2001, Kraft completed an initial public offering (''IPO'') of 280,000,000 shares of its Class A common stock at a price... -

Page 3

... States and Canada, and manages its operations principally by product category, while Kraft International Commercial manages its operations by geographic region. During January 2004, the Company announced a new global organization structure, which resulted in new segments. During the fourth quarter... -

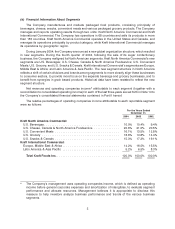

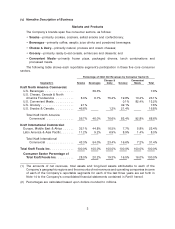

Page 4

... of Business Markets and Products The Company's brands span five consumer sectors, as follows: • Snacks-primarily cookies, crackers, salted snacks and confectionery; • Beverages-primarily coffee, aseptic juice drinks and powdered beverages; • Cheese & Dairy-primarily natural, process and cream... -

Page 5

... cream cheese; Kraft and Velveeta process cheeses; Kraft grated cheeses; Cheez Whiz process cheese sauce; and Knudsen and Breakstone's cottage cheese and sour cream. Kraft peanut butter in Canada; Del Monte and Aylmer canned fruits and vegetables in Canada; Miracle Whip spoonable dressing in Canada... -

Page 6

...; Kraft macaroni & cheese dinners; Taco Bell Home Originals (under license) meal kits; Stove Top stuffing mix; and Minute rice. Back to Nature products. Grocery: U.S. Grocery Grocery: Jell-O dry packaged desserts; Cool Whip frozen whipped topping; Jell-O refrigerated gelatin and pudding snacks... -

Page 7

... Cheez Whiz process cheese spread. Royal dry packaged desserts; Kraft spoonable and pourable salad dressings; Kraft and ETA peanut butters; and Vegemite yeast spread. Kraft macaroni & cheese dinners. Distribution, Competition and Raw Materials Kraft North America Commercial's products are generally... -

Page 8

... Kraft North America Commercial's United States businesses rely are subject to governmental agricultural programs. These programs have substantial effects on prices and supplies and are subject to Congressional and administrative review. Almost all of the activities of the Company's food operations... -

Page 9

... approximately $12 million ($5 million in 2004, with the remainder at closing). The transaction, which is also subject to regulatory approval, is expected to be completed in the first quarter of 2005. During 2003, the Company sold a European rice business and a branded fresh cheese business in Italy... -

Page 10

...the conduct of its business or operating results. Some of the Company's products are sold under brands that have been licensed from others on terms that are generally renewable at the Company's discretion. These licensed brands include Starbucks bagged coffee for sale in United States grocery stores... -

Page 11

... Response, Compensation and Liability Act of 1980 (commonly known as ''Superfund''), which imposes joint and several liability on each responsible party. In 2004, subsidiaries of the Company were involved in 93 active Superfund and other actions in the United States related to current operations and... -

Page 12

.... Kraft's subsidiaries export coffee products, grocery products, cheese and processed meats. In 2004, exports from the United States by these subsidiaries amounted to approximately $122 million. In 2004, the Company had operations and plants or sold products to third-party distributors located in... -

Page 13

...?t=kft&s=1901. The information on the Company's website is not, and shall not be deemed to be, a part of this Report or incorporated into any other filings the Company makes with the SEC. Item 2. Properties. The Company has 192 manufacturing and processing facilities worldwide. In North America... -

Page 14

... a material adverse effect on the Company's consolidated financial position, results of operations or cash flows. In October 2002, Mr. Mustapha Gaouar and five other family members (collectively ''the Gaouars'') filed suit in the Commercial Court of Casablanca against Kraft Foods Maroc and Mr. Omar... -

Page 15

... of Equity Securities. The Company's share repurchase program activity for each of the three months ended December 31, 2004 was as follows: Total Number of Approximate Dollar Shares Purchased Value of Shares that Total Number of Average as Part of Publicly May Yet Be Purchased Shares Price Paid... -

Page 16

Item 6. Selected Financial Data. KRAFT FOODS INC. Selected Financial Data-Five Year Review (in millions of dollars, except per share data) 2004 2003 2002 2001 2000 Summary of Operations: Net revenues ...Cost of sales ...Operating income ...Interest and other debt expense, net ...Earnings from ... -

Page 17

... Grocery; and U.S. Snacks & Cereals. Kraft International Commercial's segments are Europe, Middle East & Africa; and Latin America & Asia Pacific. The new segment structure in North America reflects a shift of certain divisions and brands between segments to more closely align these businesses to... -

Page 18

... Analysis. Lower Effective Income Tax Rate-The Company's reported effective income tax rate decreased by 2.6 percentage points to 32.3%, resulting from an $81 million favorable resolution of an outstanding tax item, the majority of which occurred in the third quarter of 2004, and the reversal of $35... -

Page 19

... and retired employees, including pensions, postretirement health care benefits and postemployment benefits (primarily severance). The Company records amounts relating to these plans based on calculations specified by U.S. GAAP , which include various actuarial assumptions, such as discount rates... -

Page 20

... current service, if the benefit provided is at least actuarially equivalent to Medicare Part D. The Company adopted FSP 106-2 in the third quarter of 2004. The impact of adoption for 2004 was a reduction of pre-tax net postretirement health care costs and an increase in net earnings of $24 million... -

Page 21

..., Altria Corporate Services, Inc., provides the Company with various services, including planning, legal, treasury, accounting, auditing, insurance, human resources, office of the secretary, corporate affairs, information technology, aviation and tax services. Billings for these services, 20 -

Page 22

... similar cost. At December 31, 2004 and 2003, the Company had short-term amounts payable to Altria Group, Inc. of $227 million and $543 million, respectively. Interest on these borrowings is based on the applicable London Interbank Offered Rate. Income Taxes. The Company accounts for income taxes in... -

Page 23

... as a ''special deduction'' rather than a rate reduction, in accordance with SFAS No. 109, and therefore, the Company will recognize these benefits, which are not expected to be significant, in the year earned. Consolidation. The consolidated financial statements include Kraft Foods Inc., as well as... -

Page 24

... using more value-added packaging, developing innovative new products and managing price gaps effectively. During 2004, the Company increased marketing spending by approximately $460 million versus 2003 to manage price gaps, to increase media presence, to drive growth, to enhance brand equity and to... -

Page 25

... corporate governance, as well as a number of health and wellness initiatives, such as enhanced nutrition labeling, the development and funding of community-based programs and voluntary limitations on advertising to younger children. It also includes taking steps to contribute to the sustainability... -

Page 26

..., the Company sold a European rice business and a branded fresh cheese business in Italy. The aggregate proceeds received from sales of businesses were $96 million, on which the Company recorded pre-tax gains of $31 million. During 2002, the Company sold several small North American food businesses... -

Page 27

... Commercial ...Europe, Middle East & Africa ...Latin America & Asia Pacific ...Total Kraft International Commercial ...Net revenues ...Operating income: Operating companies income: U.S. Beverages ...U.S. Cheese, Canada & North America Foodservice U.S. Convenient Meals ...U.S. Grocery ...U.S. Snacks... -

Page 28

...included in the operating companies income of the following segments: For the Year Ended December 31, 2004 Total Asset Equity Impairment Impairment and Restructuring Asset and Implementation Costs Impairment Exit Costs Costs (in millions) Total U.S. Beverages ...U.S. Cheese, Canada & North America... -

Page 29

... food factory. These items were included in the operating companies income of the following segments: For the Years Ended December 31, 2003 2002 (in millions) U.S. Beverages ...U.S. Cheese, Canada & North U.S. Convenient Meals ...U.S. Grocery ...U.S. Snacks & Cereals ...Latin America & Asia Pacific... -

Page 30

... against the euro and the Canadian dollar. The Company's reported effective income tax rate decreased by 2.6 percentage points to 32.3%, resulting from an $81 million favorable resolution of an outstanding tax item, the majority of which occurred in the third quarter of 2004, and the reversal of $35... -

Page 31

... dollar against certain Latin American currencies. Interest and other debt expense, net, decreased $182 million. This decrease is due to the Company's refinancing of notes payable to Altria Group, Inc. and the use of free cash flow to pay down debt. The Company's reported effective income tax rate... -

Page 32

Operating Results by Reportable Segment Kraft North America Commercial For the Years Ended December 31, 2004 2003 2002 (in millions) Volume (in pounds): U.S. Beverages ...U.S. Cheese, Canada & North America Foodservice U.S. Convenient Meals ...U.S. Grocery ...U.S. Snacks & Cereals ... ... ... ... ... -

Page 33

... business in 2004 and higher shipments to national accounts. Cheese volume also increased, benefiting from increased promotional spending. Net revenues increased $704 million (10.5%), due primarily to higher volume/mix ($272 million), higher pricing, net of higher promotional reinvestment spending... -

Page 34

...a food factory ($107 million). The following discusses operating results within each of Kraft North America Commercial's reportable segments. U.S. Beverages. Volume increased 7.8%, due primarily to higher shipments of ready-to-drink beverages, which were aided by new product introductions. In coffee... -

Page 35

..., driven by new beverage product introductions. Net revenues increased $317 million (5.0%), due to favorable currency ($162 million), higher volume/mix ($119 million) and higher pricing ($36 million, including the impact of increased promotional spending). Operating companies income increased... -

Page 36

... discussion compares Kraft International Commercial's operating results for 2004 with 2003. Volume decreased 1.1%, due primarily to the impact of the divestiture of a rice business and a branded fresh cheese business in Europe in 2003, as well as price competition and trade inventory reductions in... -

Page 37

... operating results within each of Kraft International Commercial's reportable segments. Europe, Middle East & Africa. Volume decreased 1.3%, due primarily to the divestiture of a rice business and a branded fresh cheese business in Europe in 2003, price competition in France and trade inventory... -

Page 38

... quarter of 2002, and new product introductions. These gains were partially offset by the impact of the summer heat wave across Europe on the chocolate and coffee businesses, price competition in Germany and France, and the divestiture of a rice business and a branded fresh cheese business in Europe... -

Page 39

... capital, partially offset by increased pension contributions. Net Cash Used in Investing Activities One element of the growth strategy of the Company is to strengthen its brand portfolios through disciplined programs of selective acquisitions and divestitures. The Company is constantly reviewing... -

Page 40

... 2004, the Company issued $750 million of 5-year notes bearing interest at 4.125%. The net proceeds of the offering were used to refinance maturing debt. The Company has a Form S-3 shelf registration statement on file with the Securities and Exchange Commission (''SEC'') under which the Company... -

Page 41

for up to one additional year. At December 31, 2004, credit lines for the Company and the related activity were as follows (in billions of dollars): December 31, 2004 Commercial Paper Amount Drawn Outstanding Type Credit Lines 364-day (expires July 2005) ...Multi-year (expires July 2006) ... $2.5... -

Page 42

..., future contractual obligations and payment of its anticipated quarterly dividends. Equity and Dividends In December 2003, Kraft's Board of Directors approved the repurchase from time to time of up to $700 million of Kraft's Class A common stock. On December 14, 2004, Kraft completed the program... -

Page 43

... lower number of shares outstanding as a result of Class A share repurchases. During the third quarter of 2004, Kraft's Board of Directors approved a 13.9% increase in the current quarterly dividend rate to $0.205 per share on its Class A and Class B common stock. As a result, the present annualized... -

Page 44

.... The VAR computation includes the Company's debt; short-term investments; foreign currency forwards, swaps and options; and commodity futures, forwards and options. Anticipated transactions, foreign currency trade payables and receivables, and net investments in foreign subsidiaries, which the... -

Page 45

...a discussion of new accounting standards. Contingencies See Note 18 to the consolidated financial statements for a discussion of contingencies. Item 7A. Quantitative and Qualitative Disclosures About Market Risk. See the paragraphs captioned ''Market Risk'' and ''Value at Risk'' in Item 7 above. 44 -

Page 46

... of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America. The Company's internal control over financial reporting includes those written policies and procedures that: • pertain to the maintenance of records... -

Page 47

... on the effectiveness of the Company's internal control over financial reporting based on our audit. We conducted our audit of internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we... -

Page 48

... of the company's assets that could have a material effect on the financial statements. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject... -

Page 49

...Accrued postretirement health care costs Other liabilities ... Total liabilities ...Contingencies (Note 18) SHAREHOLDERS' EQUITY Class A common stock, no par value (555,000,000 shares issued in 2004 and 2003) Class B common stock, no par value (1,180,000,000 shares issued and outstanding in 2004 and... -

Page 50

KRAFT FOODS INC. and SUBSIDIARIES CONSOLIDATED STATEMENTS of EARNINGS for the years ended December 31, (in millions of dollars, except per share data) 2004 2003 2002 Net revenues ...Cost of sales ...Gross profit ...Marketing, administration and research costs Integration costs and a loss on sale of... -

Page 51

KRAFT FOODS INC. and SUBSIDIARIES CONSOLIDATED STATEMENTS of SHAREHOLDERS' EQUITY (in millions of dollars, except per share data) Accumulated Other Comprehensive Earnings (Losses) Class A and B Additional Earnings Currency Common Paid-In Reinvested in Translation Stock Capital the Business ... -

Page 52

...Inventories ...Accounts payable ...Income taxes ...Amounts due to Altria Group, Inc. and affiliates ...Other working capital items ...Change in pension assets and postretirement liabilities, net ...Other ...Net cash provided by operating activities ...CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES... -

Page 53

... Cheese, Canada & North America Foodservice; U.S. Convenient Meals; U.S. Grocery; U.S. Snacks & Cereals; Europe, Middle East & Africa; and Latin America & Asia Pacific. The new segment structure in North America reflects a shift of certain divisions and brands between segments to more closely align... -

Page 54

... fair value. During 2004, the Company completed its annual review of goodwill and intangible assets. This review resulted in a $29 million non-cash pre-tax charge related to an intangible asset impairment for a small confectionery business in the United States and certain brands in Mexico. A portion... -

Page 55

.... Such accruals are adjusted as new information develops or circumstances change. While it is not possible to quantify with certainty the potential impact of actions regarding environmental remediation and compliance efforts that the Company may undertake in the future, in the opinion of management... -

Page 56

... for income taxes. Based on the Company's current estimate, this benefit is calculated to be approximately $70 million, $100 million and $240 million for the years ended December 31, 2004, 2003 and 2002, respectively. The Company makes payments to, or is reimbursed by, Altria Group, Inc. for the tax... -

Page 57

..., plant and equipment on the consolidated balance sheets and amortized on a straight-line basis over the estimated useful lives of the software, which do not exceed five years. Stock-based compensation: The Company accounts for employee stock compensation plans in accordance with the intrinsic value... -

Page 58

... for outstanding stock option awards for the years ended December 31, 2004, 2003 and 2002 (in millions, except per share data): 2004 2003 2002 Net earnings, as reported ...Deduct: Total stock-based employee compensation expense determined under fair value method for all stock option awards, net of... -

Page 59

... Charges: During 2004, the Company completed its annual review of goodwill and intangible assets. This review resulted in a $29 million non-cash pre-tax charge related to an intangible asset impairment for a small confectionery business in the United States and certain brands in Mexico. A portion of... -

Page 60

... Party Transactions: Altria Group, Inc.'s subsidiary, Altria Corporate Services, Inc., provides the Company with various services, including planning, legal, treasury, accounting, auditing, insurance, human resources, office of the secretary, corporate affairs, information technology, aviation... -

Page 61

...aircraft management, pilot services, maintenance and other aviation services for the Company. During 2004, Altria Corporate Services, Inc. provided to the Company certain financial services, including payroll and accounts payable processing, at a cost of approximately $25 million, which was included... -

Page 62

... December 31, 2004, were as follows (in millions): Inventories ...Property, plant and equipment, net ...Goodwill ...Other intangible assets, net ...Impairment loss on assets of discontinued operations held for sale . Other: During 2004, the Company sold a Brazilian snack nuts business and trademarks... -

Page 63

...a provision allowing the Company to extend the maturity of outstanding borrowings for up to one additional year. At December 31, 2004, credit lines for the Company and the related activity were as follows (in billions of dollars): Credit Lines Amount Drawn Commercial Paper Outstanding Type 364-day... -

Page 64

international businesses. Borrowings on these lines amounted to approximately $150 million and $220 million at December 31, 2004 and 2003, respectively. Note 9. Long-Term Debt: At December 31, 2004 and 2003, the Company's long-term debt consisted of the following: 2004 2003 (in millions) Short-... -

Page 65

...Kraft completed a $500 million Class A common stock repurchase program, acquiring 15,308,458 Class A shares at an average price of $32.66 per share. In addition, 1.18 billion Class B common shares were issued and outstanding at December 31, 2004 and 2003. Altria Group, Inc. holds 276.5 million Class... -

Page 66

... of the Company's Class A common stock may be issued under the 2001 Plan. In addition, the Company may grant up to 500,000 shares of Class A common stock to members of the Board of Directors who are not full-time employees of the Company or Altria Group, Inc., or their subsidiaries, under the Kraft... -

Page 67

... exercise price of $35.69 per share at December 31, 2002. Had compensation cost for stock option awards under the Kraft plans and Altria Group, Inc. plans been determined by using the fair value at the grant date, the Company's net earnings and basic and diluted EPS would have been $2,658 million... -

Page 68

... Years Ended December 31, 2004 2003 2002 (in millions) Earnings from continuing operations ...(Loss) earnings from discontinued operations ...Net earnings ...Weighted average shares for basic EPS ...Plus incremental shares from assumed conversions: Restricted stock and stock rights ...Stock options... -

Page 69

... Production Activities Provided by the American Jobs Creation Act of 2004'' (''FSP 109-1''). FSP 109-1 requires companies to account for this deduction as a ''special deduction'' rather than a rate reduction, in accordance with SFAS No. 109, and therefore, the Company will recognize these benefits... -

Page 70

... managed principally by product category. Kraft International Commercial's operations are organized and managed by geographic location. During January 2004, the Company announced a new global organizational structure, which resulted in new segments. During the fourth quarter of 2004, following the... -

Page 71

... December 31, 2004 2003 2002 (in millions) Earnings from continuing operations before income taxes and minority interest: Operating companies income: U.S. Beverages ...U.S. Cheese, Canada & North America Foodservice ...U.S. Convenient Meals ...U.S. Grocery ...U.S. Snacks & Cereals ...Europe, Middle... -

Page 72

... into sector components, were as follows for the years ended December 31, 2004, 2003 and 2002: For the Year Ended December 31, 2004 Kraft North Kraft America International Commercial Commercial (in millions) Total Consumer Sector: Snacks ...Beverages ...Cheese ...Grocery ...Convenient Meals... -

Page 73

... a food factory. These items were included in the operating companies income of the following segments: For the Years Ended December 31, 2003 2002 (in millions) U.S. Beverages ...U.S. Cheese, Canada & North America Foodservice U.S. Convenient Meals ...U.S. Grocery ...U.S. Snacks & Cereals ...Latin... -

Page 74

...the Years Ended December 31, 2004 2003 2002 (in millions) Capital expenditures from continuing operations: U.S. Beverages ...U.S. Cheese, Canada & North America Foodservice U.S. Convenient Meals ...U.S. Grocery ...U.S. Snacks & Cereals ...Europe, Middle East & Africa ...Latin America & Asia Pacific... -

Page 75

... provide health care and other benefits to substantially all retired employees. Health care benefits for retirees outside the United States and Canada are generally covered through local government plans. The plan assets and benefit obligations of the Company's U.S. and Canadian pension plans are... -

Page 76

Pension Plans Obligations and Funded Status The benefit obligations, plan assets and funded status of the Company's pension plans at December 31, 2004 and 2003, were as follows: U.S. Plans Non-U.S. Plans 2004 2003 2004 2003 (in millions) Benefit obligation at January 1 Service cost ...Interest cost... -

Page 77

... to determine the Company's benefit obligations under the plans at December 31: U.S. Plans 2004 2003 Non-U.S. Plans 2004 2003 Discount rate ...Rate of compensation increase ...Components of Net Periodic Benefit Cost 5.75% 6.25% 5.18% 4.00 4.00 3.11 5.41% 3.11 Net periodic pension cost (income... -

Page 78

... long-term investment performance, current asset allocation and estimates of future long-term returns by asset class. The Company has reduced this assumption to 8% in determining its U.S. plans pension expense for 2005. In 2005, the discount rate used to determine the Company's net pension cost for... -

Page 79

... current service, if the benefit provided is at least actuarially equivalent to Medicare Part D. The Company adopted FSP 106-2 in the third quarter of 2004. The impact of adoption for 2004 was a reduction of pre-tax net postretirement health care costs and an increase in net earnings of $24 million... -

Page 80

... discount rate used to determine the Company's net postretirement cost will be 5.75% and the health care cost trend rate will be 8.00% for its U.S. plans and 9.50% for its Canadian plans. The Company's postretirement health care plans are not funded. The changes in the accumulated benefit obligation... -

Page 81

... was determined using an assumed ultimate annual turnover rate of 0.3% in 2004 and 2003, assumed compensation cost increases of 4.0% in 2004 and 2003, and assumed benefits as defined in the respective plans. Postemployment costs arising from actions that offer employees benefits in excess of those... -

Page 82

Note 16. Additional Information: For the Years Ended December 31, 2004 2003 2002 (in millions) The amounts shown below are for continuing operations. Research and development expense ...Advertising expense ...Interest and other debt expense, net: Interest (income) expense, Altria Group, Inc. and ... -

Page 83

...underlying hedged transactions are reported on the Company's consolidated statement of earnings. The Company is exposed to price risk related to forecasted purchases of certain commodities used as raw materials by its businesses. Accordingly, the Company uses commodity forward contracts as cash flow... -

Page 84

... Note 19. Quarterly Financial Data (Unaudited): 2004 Quarters First Second Third Fourth (in millions, except per share data) Net revenues ...Gross profit ...Earnings from continuing operations ...Earnings (loss) from discontinued operations ...Net earnings ...Weighted average shares for diluted EPS... -

Page 85

... the total for the year. During 2004 and 2003, the Company recorded the following pre-tax charges or (gains) in earnings from continuing operations: First 2004 Quarters Second Third (in millions) Fourth Asset impairment and exit costs ...Losses (gains) on sales of businesses ... $ 291 $ 129 $ 44... -

Page 86

... of the Company's Chief Executive Officer and Chief Financial Officer, any change in the Company's internal control over financial reporting and determined that there has been no change in the Company's internal control over financial reporting during the quarter ended December 31, 2004 that has... -

Page 87

... Commercial Executive Vice President, Global Human Resources Group Vice President and President, U.S. Beverages Sector Executive Vice President, General Counsel and Corporate Secretary Group Vice President and President, Asia Pacific Region Executive Vice President, Global Strategy and Business... -

Page 88

... to: Corporate Secretary, Kraft Foods Inc., Three Lakes Drive, Northfield, IL 60093. In addition, the Company has adopted corporate governance guidelines and charters for its Audit Committee, Compensation Committee and Nominating and Governance Committee, as well as a code of business conduct and... -

Page 89

... Company's equity compensation plans at December 31, 2004 were as follows: Equity Compensation Plan Information Number of Shares to be Issued Upon Exercise of Outstanding Options and Vesting of Restricted Stock Number of Shares Remaining Available for Future Issuance under Equity Compensation Plans... -

Page 90

...10.7 Kraft Foods Inc. Supplemental Benefits Plan I (including First Amendment adding Supplement A)(6) 10.8 Kraft Foods Inc. Supplemental Benefits Plan II(6) 10.9 Form of Employee Grantor Trust Enrollment Agreement (8)(12) 10.10 The Altria Group, Inc. 1992 Incentive Compensation and Stock Option Plan... -

Page 91

...31.1 31.2 32.1 32.2 The Altria Group, Inc. 1997 Performance Incentive Plan (10)(12) The Altria Group, Inc. 2000 Performance Incentive Plan (11)(12) 2001 Kraft Foods Inc. Compensation Plan for Non-Employee Directors (Deferred Compensation)(13) Five-Year Revolving Credit Agreement dated as of July... -

Page 92

... (SEC File No. 1-8940). (12) Compensation plans maintained by Altria Group, Inc. and its subsidiaries in which officers of the Registrant have historically participated. (13) Incorporated by reference to the Registrant's Annual Report on Form 10-K for the year ended December 31, 2001 (SEC File No... -

Page 93

... undersigned, thereunto duly authorized. KRAFT FOODS INC. By: /s/ JAMES P. DOLLIVE (James P . Dollive, Executive Vice President and Chief Financial Officer) Date: March 11, 2005 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following... -

Page 94

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ON FINANCIAL STATEMENT SCHEDULE To the Board of Directors and Shareholders of Kraft Foods Inc.: Our audits of the consolidated financial statements, of management's assessment of the Company's internal control over financial reporting and of the... -

Page 95

KRAFT FOODS INC. AND SUBSIDIARIES VALUATION AND QUALIFYING ACCOUNTS For the Years Ended December 31, 2004, 2003 and 2002 (in millions) Col. A Col. B Balance at Beginning of Period Col. C Additions Charged to Charged to Costs and Other Expenses Accounts... discounts ...Allowance for doubtful accounts ...