Honeywell 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

remaining intangible assets are being amortized over their estimated life of 8-15 years using straight-line and

accelerated amortization methods. The value assigned to the trademarks of approximately $27 million is

classified as an indefinite lived intangible. The excess of the purchase price over the estimated fair values of net

assets acquired approximating $167 million, was recorded as goodwill. This goodwill is non-deductible for tax

purposes. This acquisition was accounted for by the purchase method, and, accordingly, results of operations are

included in the consolidated financial statements from the date of acquisition. The results from the acquisition

date through December 31, 2007 are included in the Automation and Control Solutions segment and were not

material to the consolidated financial statements.

In connection with all acquisitions in 2009, 2008 and 2007, the amounts recorded for transaction costs and

the costs of integrating the acquired businesses into Honeywell were not material.

The pro forma results for 2009, 2008 and 2007, assuming these acquisitions had been made at the

beginning of the year, would not be materially different from consolidated reported results.

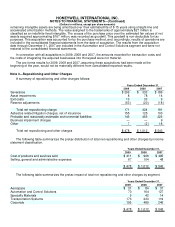

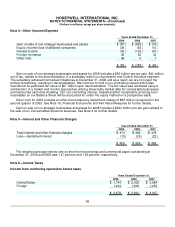

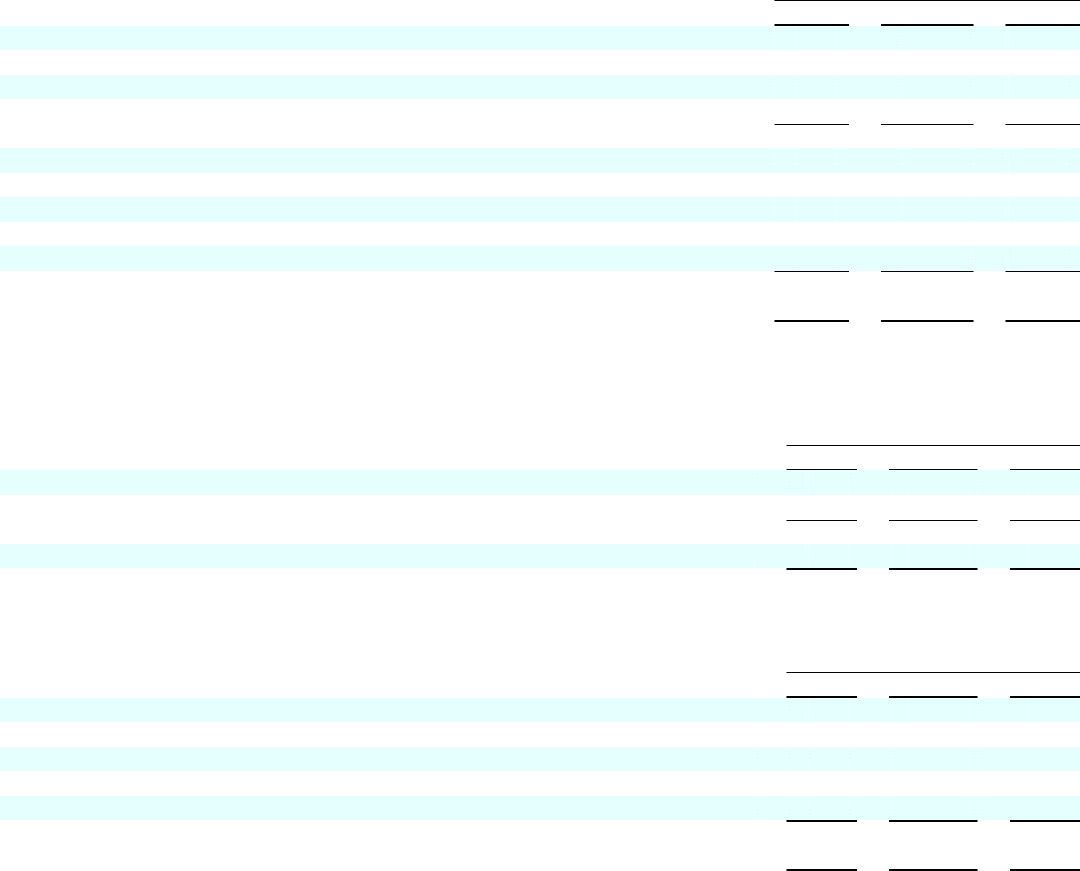

Note 3—Repositioning and Other Charges

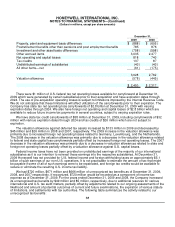

A summary of repositioning and other charges follows:

Years Ended December 31,

2009 2008 2007

Severance $ 206 $ 333 $ 186

Asset impairments 8 78 14

Exit costs 10 33 9

Reserve adjustments (53) (20) (18)

Total net repositioning charge 171 424 191

Asbestos related litigation charges, net of insurance 155 125 100

Probable and reasonably estimable environmental liabilities 145 465 225

Business impairment charges — — 9

Other 7 (2) 18

Total net repositioning and other charges $ 478 $ 1,012 $ 543

The following table summarizes the pretax distribution of total net repositioning and other charges by income

statement classification.

Years Ended December 31,

2009 2008 2007

Cost of products and services sold $ 411 $ 908 $ 495

Selling, general and administrative expenses 67 104 48

$ 478 $ 1,012 $ 543

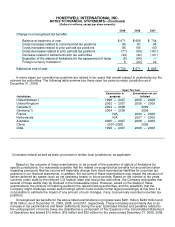

The following table summarizes the pretax impact of total net repositioning and other charges by segment.

Years Ended December 31,

2009 2008 2007

Aerospace $ 31 $ 84 $ 37

Automation and Control Solutions 70 164 127

Specialty Materials 9 42 14

Transportation Systems 173 233 119

Corporate 195 489 246

$ 478 $ 1,012 $ 543