Honeywell 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

assets and changes the requirements for derecognizing financial assets. The guidance is effective for fiscal years

beginning after November 15, 2009. The implementation of this standard will not have a material impact on our

consolidated financial position and results of operations.

In June 2009, the FASB issued an amendment to the accounting and disclosure requirements for the

consolidation of variable interest entities. The guidance affects the overall consolidation analysis and requires

enhanced disclosures on involvement with variable interest entities. The guidance is effective for fiscal years

beginning after November 15, 2009. The implementation of this standard will not have a material impact on our

consolidated financial position and results of operations.

In October 2009, the FASB issued amendments to the accounting and disclosure for revenue recognition.

These amendments, effective for fiscal years beginning on or after June 15, 2010 (early adoption is permitted),

modify the criteria for recognizing revenue in multiple element arrangements and the scope of what constitutes a

non-software deliverable. The Company has elected to early adopt this guidance, on a prospective basis for

applicable transactions originating or materially modified after January 1, 2010. The implementation of this

amended accounting guidance is not expected to have a material impact on our consolidated financial position

and results of operations.

Note 2—Acquisitions and Divestitures

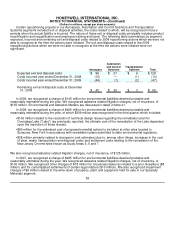

We acquired businesses for an aggregate cost of $468, $2,181 and $1,190 million in 2009, 2008 and 2007,

respectively. For all of our acquisitions the acquired businesses were recorded at their estimated fair values at

the dates of acquisition. Significant acquisitions made in these years are discussed below.

In August 2009, the Company completed the acquisition of the RMG Group (RMG Regel + Messtechnik

GmbH), a natural gas measuring and control products, services and integrated solutions company, for a

purchase price of approximately $416 million, net of cash acquired. The purchase price for the acquisition was

allocated to the tangible and identifiable intangible assets acquired and liabilities assumed based on their

estimated fair values at the acquisition date. The Company has assigned $174 million to identifiable intangible

assets, predominantly customer relationships, existing technology and trademarks. These intangible assets are

being amortized over their estimated lives using straight-line and accelerated amortization methods. The excess

of the purchase price over the estimated fair values of net assets acquired (approximating $225 million), was

recorded as goodwill. This goodwill is non- deductible for tax purposes. This acquisition was accounted for by the

acquisition method, and, accordingly, results of operations are included in the consolidated financial statements

from the date of acquisition. The results from the acquisition date through December 31, 2009 are included in the

Automation and Control Solutions segment and were not material to the consolidated financial statements. As of

December 31, 2009, the purchase accounting for the RMG Group is still subject to adjustment primarily for useful

lives of intangible assets, amounts allocated to intangible assets and goodwill, and for certain pre- acquisition

contingencies.

In May 2008, the Company completed the acquisition of Safety Products Holding, Inc, which through its

subsidiary Norcross Safety Products L.L.C. (Norcross) is a leading manufacturer of personal protective

equipment. The purchase price, net of cash acquired, was approximately $1.2 billion and was allocated to

tangible and identifiable intangible assets acquired and liabilities assumed based on their estimated fair values at

the acquisition date.

60