Honeywell 2009 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

investments in real estate funds. Other types of investments include investments in private equity and hedge

funds that follow several different strategies. Our non-U.S. investment policies are different for each country, but

the long-term investment objectives remain the same.

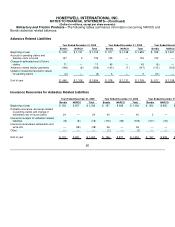

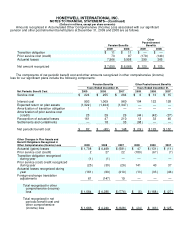

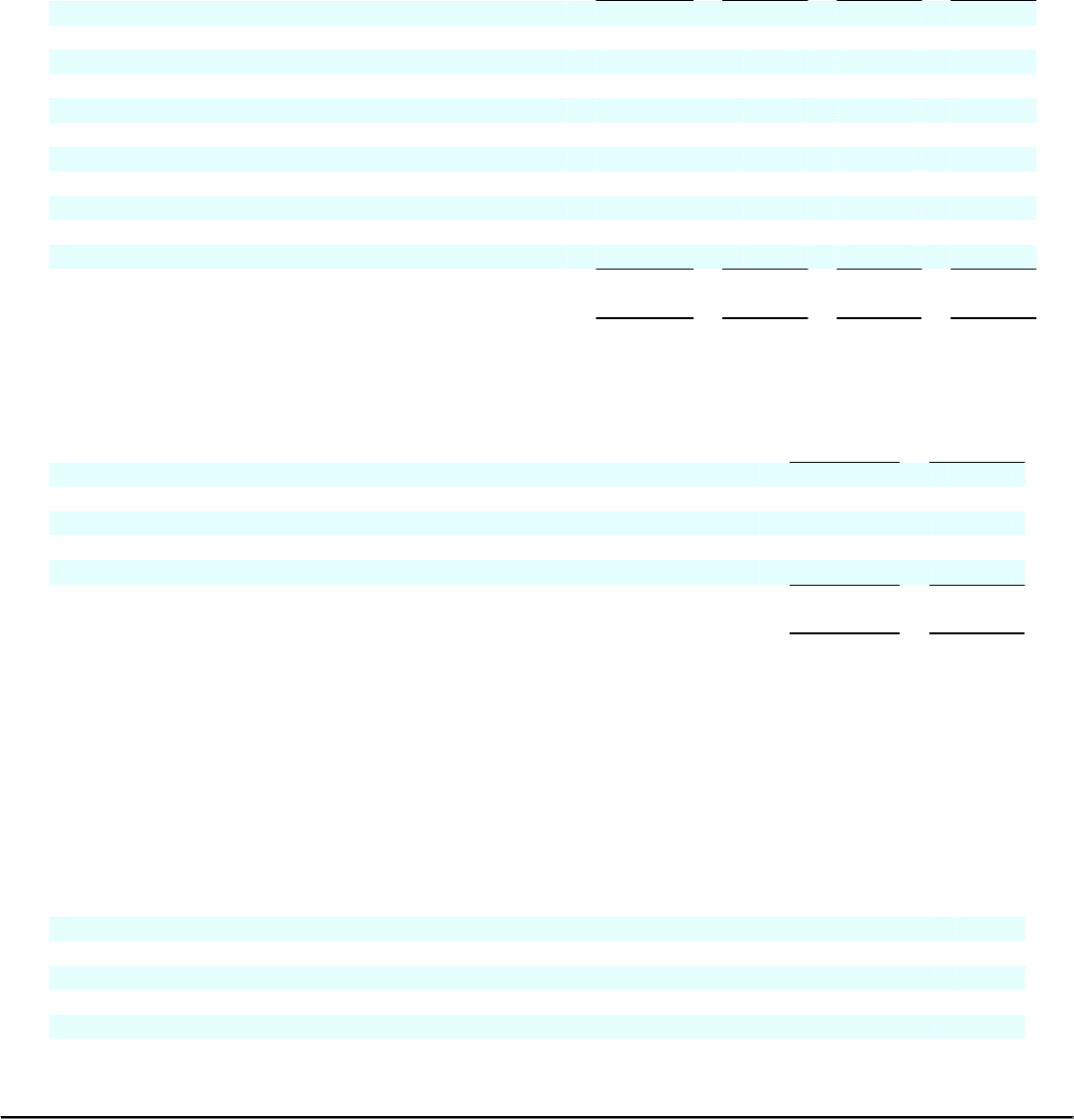

Our U.S. pension plans assets were $10.3 and $8.7 billion and our non-U.S. pension plans assets were $3.5

and $2.8 billion at December 31, 2009 and 2008, respectively. The fair values of our pension plans assets at

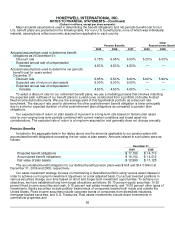

December 31, 2009 by asset category are as follows:

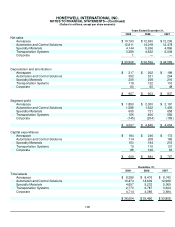

Total Level 1 Level 2 Level 3

Equity securities:

U.S. companies $ 5,181 $ 5,099 $ 82 $ —

Non-U.S. companies 3,324 2,269 1,055 —

Fixed income securities:

Short-term investments 439 439 — —

Government securities 955 258 697 —

Corporate securities 1,281 — 1,281 —

Mortgage/Asset-Backed securities 357 — 357 —

Insurance contracts 216 — 216 —

Real estate investments 786 48 — 738

Other 1,226 — — 1,226

$ 13,765 $ 8,113 $ 3,688 $ 1,964

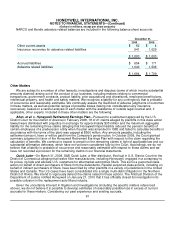

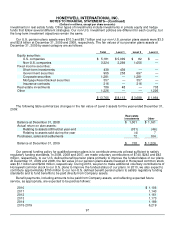

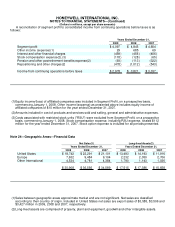

The following table summarizes changes in the fair value of Level 3 assets for the year ended December 31,

2009:

Real estate

investments Other

Balance at December 31, 2008 $ 1,001 $ 1,161

Actual return on plan assets:

Relating to assets still held at year-end (331) (46)

Relating to assets sold during the year (4) 7

Purchases, sales and settlements 72 104

Balance at December 31, 2009 $ 738 $ 1,226

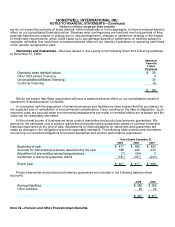

Our general funding policy for qualified pension plans is to contribute amounts at least sufficient to satisfy

regulatory funding standards. In 2009, 2008 and 2007, we made voluntary contributions of $740, $242 and $42

million, respectively, to our U.S. defined benefit pension plans primarily to improve the funded status of our plans.

At December 31, 2009 and 2008, the fair value of our pension plans assets invested in Honeywell common stock

was $1.1 billion and $204 million, respectively. During 2010, we plan to make additional voluntary contributions of

Honeywell common stock to our U.S. plans to improve the funded status of our plans. In 2010, we also expect to

contribute approximately $150 million to our non-U.S. defined benefit pension plans to satisfy regulatory funding

standards and to fund benefits to be paid directly from Company assets.

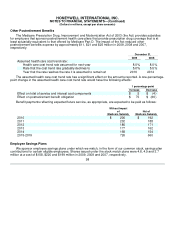

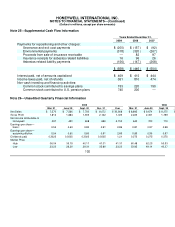

Benefit payments, including amounts to be paid from Company assets, and reflecting expected future

service, as appropriate, are expected to be paid as follows:

2010 $ 1,106

2011 1,143

2012 1,161

2013 1,173

2014 1,189

2015-2019 6,219

97